Prem Watsa Tightens Grip on Atlas Through Company Reorganization

Prem Watsa (Trades, Portfolio), the founder of Fairfax Financial Holdings Ltd. (TSX:FFH), disclosed this week that he gained shares of Atlas Corp. (NYSE:ATCO) according to GuruFocus Real-Time Picks, a Premium feature.

In 1985, Watsa met Francis Chou (Trades, Portfolio) and asked him how Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) CEO Warren Buffett (Trades, Portfolio) made his money. Chou responded with "insurance float." As a result, Watsa models his investment strategy in a similar manner to Buffett, earning him the moniker: "Canada's Warren Buffett."

As of December 2019, the $2.03 billion equity portfolio, which is composed of 41 stocks, has 55.24% weight in the industrials sector, the largest sector in terms of portfolio weight. Technology and real estate represent 16.63% and 14.70% of the equity portfolio.

Transaction background and details

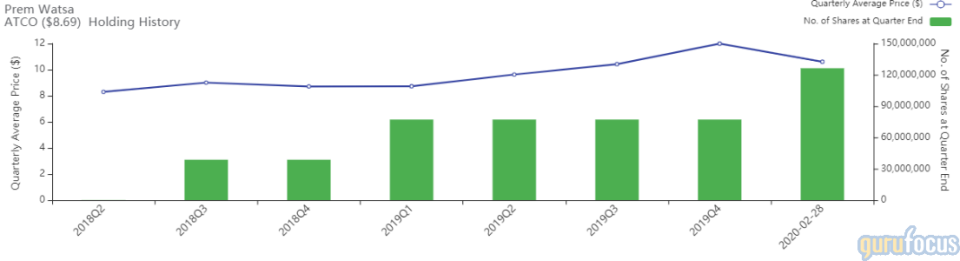

Watsa reported 126,251,819 shares of Atlas, up 49,096,819 shares or 63.63% from the previous-quarter holding of 77,155,000 shares.

On Nov. 22, Seaspan announced that is board of directors had approved a company reorganization, in which the Hong Kong-based company would become a subsidiary of a new holding company, Atlas. Seaspan also announced it entered a definitive agreement to acquire APR Energy Ltd. Fairfax is one of several sellers for the transaction, which completed on Feb. 27. Seaspan shareholders approved the reorganization with a 99% approval rating among those voting. Under the transaction, Seaspan shareholders received one common share of Atlas for each common share of Seaspan. Fairfax also received warrants to purchase Atlas shares in exchange for warrants to purchase Seaspan shares as part of the company reorganization.

Watsa commented in his 2019 annual report that he expects the holding company to continue driving shareholder value over the long term under the leadership of Chairman David Sokol and CEO Bing Chen. The Fairfax leader added that Sokol led Mid-American Energy Holdings Co., a Berkshire subsidiary, to compounded earnings growth of over 20% over a 20-year period.

Company financial overview

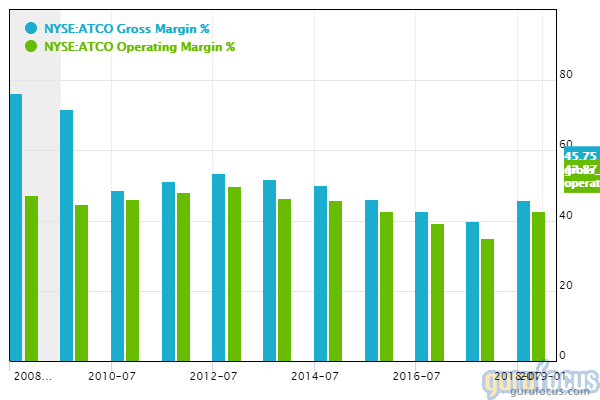

GuruFocus ranks Atlas' profitability 6 out of 10: Operating margins are outperforming 71.68% of global competitors despite gross margins contracting over the past five years. However, Atlas' financial strength ranks a low 3 out of 10 on the back of debt ratios underperforming over 65% of global competitors and a weak Altman Z-score of 0.52.

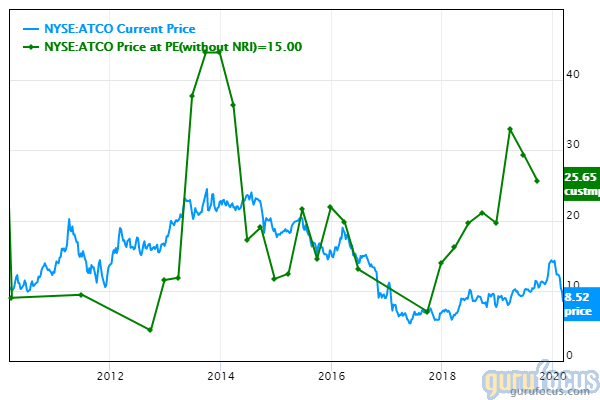

Despite low financial strength, Atlas' valuation ranks 9 out of 10 on several signs of undervaluation, which include a price-earnings ratio that outperforms 81.89% of global asset management companies and a price-book ratio near a 52-week low of 0.53.

See also

Jim Simons (Trades, Portfolio)' Renaissance Technologies also has a holding in Atlas.

Watsa's top five holdings as of December 2019 are Atlas, BlackBerry Ltd. (NYSE:BB), Kennedy-Wilson Holdings Inc. (NYSE:KW), Resolute Forest Products Inc. (NYSE:RFP) and CenturyLink Inc. (NYSE:CTL).

Disclosure: No positions.

Read more here:

Charles de Vaulx's 6 New Positions for the 4th Quarter

4 High-Quality Tech Companies as Coronavirus Fears Smash Markets Worldwide

3 Five-Star Companies at Historically Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.