Price & Time: Major Low in the Dollar?

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

Foreign Exchange Price & Time at a Glance:

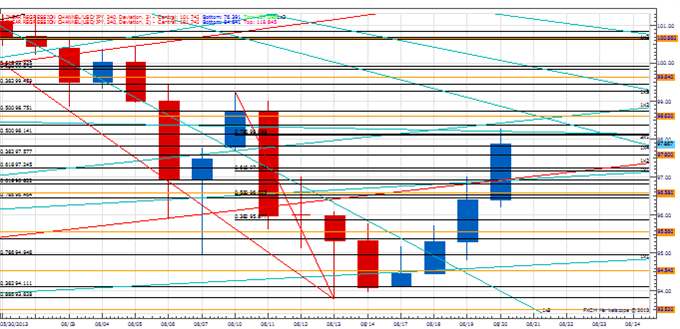

USD/JPY:

Charts Created using Marketscope – Prepared by Kristian Kerr

-USD/JPY has moved steadily higher since finding support during last week’s cyclical turn window at the 88.6% retracement of the April to May advance in the 93.50 area

-Strength through 95.55 has shifted our bias to higher

-Key resistance now looks to be at a convergence of the 5th square root progression of last week’s low and the 50% retracement of the May to June decline in the 98.60/80 area with strength above required to maintain the immediate upside tack

-Near-term focused cycle studies suggest the end of the week is a very minor turn window

-Only a close below the 95.70 2nd square root progression of the month-to-date low at near 95.70 would undermine the burgeoning positive technical structure and turn us negative on the exchange rate

Strategy: Like buying on weakness over the next few days.

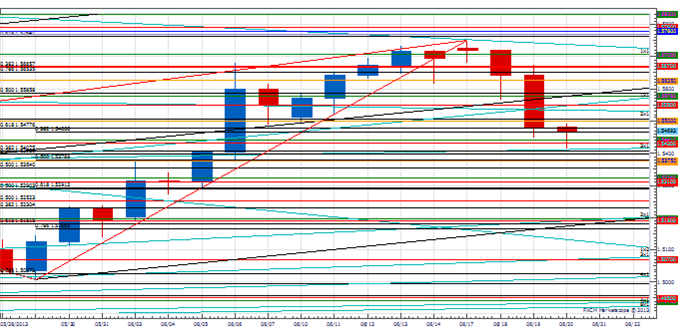

GBP/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-GBP/USD has come under aggressive pressure since failing at the start of the week at the 1x1 Gann angle line of the year-to-date high at 1.5750

-Our bias in now lower in Cable with attention on the convergence of the 3rd square root progression of this week’s high and the 50% retracement May to June advance in the 1.5375 area

-Weakness below this level ideally on a closing basis is required to confirm that a more signficant top is in place and pave the way for more decline in the weeks ahead

-Short-term cycles indicate early next week is a minor turn window in the rate

-The 1.5580 level is immediate resistance, but only strength over 1.5750 undermines the negative technical structure and turns us positive on the Pound

Strategy: Short positions favored while under 1.5750. We like adding on strength.

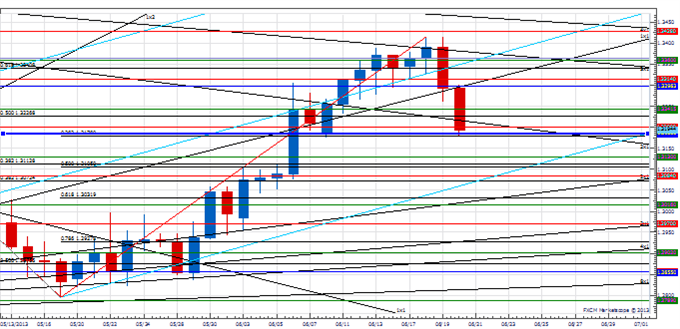

AUD/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-AUD/USD broke below the 61.8% retracement of the late 2010 to 2011 advance to trade to its lowest level in over two and a half years

-Our bias remains lower with focus on the the 13th square root progression of the year-to-date high at .9165

-Weakness below this level needed to set up the next decline towards .9115 and below

-Short-term cycles suggest the end of the week is a minor turn window in the rate

-The .9295 area is now immediate resistance, but only traction over .9425 turns us positive on the Aussie

Strategy: Short positions favored while below .9425

Focus Chart of the Day: EUR/USD

The turn we were anticipating this week in the European currencies looks to be playing out (http://www.dailyfx.com/forex/technical/article/forex_strategy_corner/2013/06/17/PT_euro_top.html). Weakness below the 1.3185 2nd square root progression of the month to date high in the Euro especially on a weekly closing basis will be further evidence that a significant top is indeed in place. Such an occurrence would pave the way for further declines in the weeks ahead for the complex. The action in XAU/USD is not too surprising as the metal nears a critical time period from a cycle perspective over the next few days. Some sort of significant low forming during this turn window is still the favored scenario. The equity market is the odd man out at the moment in terms of cyclical clarity and the picture is bit muddled following the action of the past couple of days. More thoughts on this tomorrow ahead of triple witching.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

Looking for a way to pinpoint sentiment extremes in the Euro in real time? Try the Speculative Sentiment Index.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.