Prologis (PLD) Tops Q4 FFO Estimates on Occupancy, Rent Growth

Prologis, Inc. PLD has reported fourth-quarter 2021 core funds from operations (FFO) per share of $1.12, beating the Zacks Consensus Estimate of $1.10. It also compares favorably with the year-ago quarter’s figure of 95 cents.

The results reflect low vacancies and solid increases in rental revenues. Further, this industrial REIT has issued its 2022 outlook.

Prologis generated rental revenues of $1.07 billion, up from the prior-year quarter’s $987.8 million. The Zacks Consensus Estimate for the same was pegged at $1.06 billion. Total revenues were $1.28 billion, up from the year-ago quarter’s $1.11 billion.

Per Hamid R. Moghadam, chairman and chief executive officer of the company, "Demand for our 1 billion square foot global portfolio shows no signs of slowing and we are positioned ideally to meet our customers' most critical real estate needs."

For 2021, the company reported core FFO per share of $4.15, up 9.2% from $3.80 in the prior year and also beat the Zacks Consensus Estimate of $4.12. Rental revenues of $4.15 billion increased 9.4% year over year.

Quarter in Detail

The average occupancy level in Prologis’ owned and managed portfolio was 97.4% in the fourth quarter, expanding 80 basis points (bps) from the third quarter of 2021. Moreover, the company’s owned and managed portfolio was 98.2% leased as of Dec 31, 2021.

In the quarter under review, 55.1 million square feet of leases commenced in the company’s owned and managed portfolio, with 44.3 million square feet in the operating portfolio and 10.8 million square feet in the development portfolio. The retention level was 75.8% in the quarter.

Prologis’ share of net effective rent change was 33.0% in the October-December quarter, up 510 bps sequentially. Cash rent change was 19.6%. Cash same-store net operating income (NOI) grew 7.5%, driven by the U.S. business at 8.1% and the International business at 5.3%.

The company’s share of building acquisitions amounted to $329 million, with a weighted average stabilized cap rate of 4.3% in the reported quarter. Development stabilization aggregated $1.05 billion, while development starts totaled $992 million, with 39.0% being build to suit. PLD’s total dispositions and contributions were $1.74 billion, with a weighted average stabilized cap rate (excluding land and other real estate) of 4.1%.

Liquidity

Prologis exited the fourth quarter of 2021 with cash and cash equivalents of $556.1 million. Its liquidity amounted to $5.0 billion in cash and availability on its credit facilities.

Debt, as a percentage of total market capitalization, was 13.5%. The company's weighted average interest rate on its share of the total debt was 1.7%, with a weighted average term of 10.0 years. The combined investment capacity of Prologis and its open-ended ventures, in line with their current ratings, is roughly $15.5 billion. The company and its co-investment ventures issued $2.9 billion of debt in the fourth quarter at a weighted average interest rate of 1.1%.

Outlook

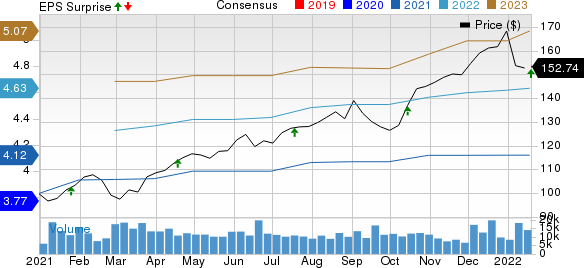

Prologis provided its 2022 core FFO per share guidance in the range of $5.00-$5.10. This is ahead of the current Zacks Consensus Estimate, which is pegged at $4.63.

The company expects average occupancy of 96.5-97.5%. Cash same-store NOI (Prologis share) is projected in the range of 6-7%.

Prologis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prologis, Inc. Price, Consensus and EPS Surprise

Prologis, Inc. price-consensus-eps-surprise-chart | Prologis, Inc. Quote

It’s time to look forward to the earnings releases of REITs, including Boston Properties, Inc. BXP, Crown Castle International Corp. CCI and SL Green Realty Corp. SLG.

Boston Properties is scheduled to report its numbers on Jan 25, while Crown Castle and SL Green are slated to release fourth-quarter 2021 results on Jan 26.

The Zacks Consensus Estimate for Boston Properties’ fourth-quarter 2021 FFO per share is pegged at $1.52, suggesting a year-over-year increase of 10.95%. BXP currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for Crown Castle’s fourth-quarter 2021 FFO per share stands at $1.71, indicating a year-over-year decline of 26.6%. CCI currently has a Zacks Rank of 2 (Buy).

The Zacks Consensus Estimate for SL Green’s fourth-quarter 2021 FFO per share is pegged at $1.53, implying a year-over-year decrease of 1.92%. SLG currently carries a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research