QLGN: Secures Worldwide Rights to G4-Selective Cancer Therapeutics…

NASDAQ:QLGN

READ THE FULL QLGN RESEARCH REPORT

Business Update

Licenses G4-Selective Transcription Inhibitors to Develop as Cancer Therapeutics

In January 2022, Qualigen Therapeutics, Inc. (NASDAQ:QLGN) announced an exclusive worldwide in-license of a genomic quadruplex (G4)-selective transcription inhibitor drug program from University College London. The lead compound, QN-302, will be developed for the treatment of pancreatic ductal adenocarcinoma (PDAC). Qualigen has engaged Professor Stephen Neidle, who developed QN-302, as a scientific advisor to assist in the development of the compound.

Stretches of nucleic acids with repetitive guanine (G)-rich sequences can form higher order quadruplex arrangements (G4s). G4s can occur in genomic DNA and are widely distributed in a non-random manner in the human genome (Huppert et al., 2005). These complexes are over-represented in numerous cancer-related genes (Siddiqui-Jain et al., 2002). In addition, G4s contribute to the genomic instability of cancer cells and may be involved in the regulation of transcription and replication (Wang et al., 2019; Varshney et al., 2020). Their enhancement in cancer cells is exemplified by one study showing approximately 10,000 G4 structures in an immortalized cell line in contrast to a noncancer cell line that exhibited only approximately 1,500 G4 structures (Hänsel-Hertsch et al., 2016).

G4s can be exploited by cancer therapeutics that stabilize the structures and inhibit various cellular processes. These types of compounds are particularly attractive when targeting “undruggable” proteins such as MYC, which is upregulated in approximately 70% of all cancers and controls the expression of a wide variety of genes associated with proliferation, differentiation, apoptosis, and oncogenesis (Dang, 2012).

In April 2022, Qualigen announced three posters were presented on QN-302 at the 2022 American Association for Cancer Research (AACR) annual meeting. We report on two of the posters below, as the third poster was on structure-based drug design of QN-302 and interested investors can access that poster here. QN-302 is a tetra-substituted naphthalene diimide (ND) derivative that exhibits low nM anti-proliferative activity against a panel of human cancer cell lines (Ahmed et al., 2020). In addition, it was shown to down-regulate a large number of genes including those in the TNF, NK-kappa B, and Wnt signaling pathways. Lastly, protein levels of MAPK11 (which is overexpressed in multiple human cancers) were reduced to undetectable levels following 2x-weekly dosing of QN-302 for 4 weeks in a PDAC xenograft model.

“The potent quadruplex-binding compound QN-302 shows potent anti-proliferative activity in a prostate cancer cell panel and anti-tumor activity in an in vivo model of metastatic prostate cancer” (Williams et al., 2022).

This study was a follow up on earlier results that showed two early-generation ND compounds were active in both androgen-positive and androgen-negative prostate cancer cell lines (Mitchell et al., 2013). This study utilized the PC-3 cell line, which is derived from a metastatic carcinoma following androgen suppression therapy and thus serves as a model for castration-resistant prostate cancer. Abiraterone (Zytiga®) was utilized as a comparator. QN-302 exhibits an IC50 value against the PC-3 cell line of 3 nM while abiraterone has an IC50 of 4820 nM. In the PC-3 xenograft model, QN-302 was administered at 1 mg/kg IV twice weekly while abiraterone was administered at 200 mg/kg PO, both over a 28-day period. The following graph shows that QN-302 produced statistically significant anti-tumor activity (P=0.0008 vs.vehicle) while abiraterone showed anti-tumor activity but at a reduced level compared to QN-302 (P=0.0382 vs. vehicle).

The following table shows IC50 values calculated using the XTT proliferation assay. Four compounds (CM03, QN-302, Abiraterone, Enzalutamide) were evaluated against five prostate cancer cell lines, with results for the PC-3 cell line highlighted in blue. QN-302 exhibits the lowest IC50 value of any of the four compounds against all the cell lines tested.

“The potent quadruplex-binding compound QN-302 shows anti-tumor activity in patient-derived in vivo models of pancreatic cancer” (Neidle et al., 2022).

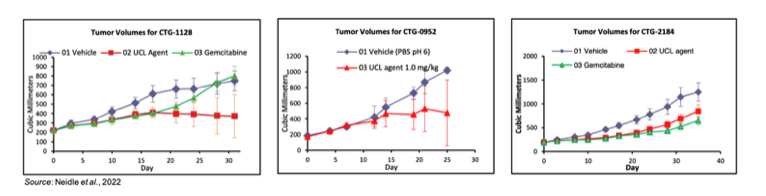

This study examined the anti-tumor activity of QN-302 against six patient-derived xenograft models for human PDAC. Immunocompromised mice were implanted subcutaneously with tumor fragments. After the tumors had reached a size of 150-300 mm3, mice (n=7 per group) were intravenously administered BIWx4 with vehicle, QN-302 (1 mg/kg), or gemcitabine (15 mg/kg). The following charts show potent anti-tumor activity for QN-302 (denoted “UCL Agent”) in three of the six tumor models that were examined. No anti-tumor activity was seen in three other models, however that is likely the result of clonal evolution altering the original patient tumor characteristics. This is exemplified by contrasting gemcitabine responses in the patient and the xenograft model. For example, model CTG-2184 showed susceptibility to gemcitabine in the xenograft model, however the patient that tumor sample was derived from was gemcitabine resistant. Regardless, it is highly encouraging that QN-302 shows activity in a very difficult to treat cancer type.

Update on FastPack System

The company’s FastPack diagnostic system is a proprietary platform that provides rapid and accurate immunoassay testing results. It consists of the FastPack Analyzer and FastPack test pouches that includes a single-use, disposable foil packet containing the FastPack reagent chemistry. The company currently markets nine assays, including tests for prostate cancer, thyroid function, metabolic disorders, and research applications. FastPack products have been placed in approximately 1,000 physician offices worldwide. Since launching in 2001, cumulative sales of FastPack products has exceeded $120 million.

In April 2022, Qualigen announced the resumption as of April 1, 2022 of worldwide distribution and commercial control of FastPack from the previous marketing partner Sekisui Diagnostics. The company will now realize 100% of the revenue from FastPack sales. It is preparing for increased demand now that most COVID-19 restrictions have been lifted and patients are increasingly going to see their healthcare providers, which may lead to increased revenues.

While Qualigen will continue to sell FastPack products, the main focus of the company will be on developing therapeutic candidates that address high unmet medical needs in cancer and infectious diseases.

Financial Update

On April 1, 2022, Qualigen announced financial results for fiscal year 2021, which ended December 31, 2021. The financial results for 2021 are compared to the nine-month transition period ending December 31, 2020. The company reported $5.65 million in revenues for 2021, compared to $2.8 million for the transition period. The increase was primarily due to an increase in diagnostic product sales along with approximately $0.6 million in license revenue from Yi Xin. Net product sales were approximately $5.0 million for 2021, compared to $2.8 million for the transition period. The increase was primarily due to recovery from the effects of the COVID-19 pandemic and the transition period only being nine months compared to a full 12 months for fiscal year 2021.

G&A expenses were $11.7 million for 2021, compared to $7.1 million for the the transition period. The increase was primarily due to increased stock-based compensation, professional fees, insurance expense, and payroll expenses. R&D expenses were $11.7 million for 2021 compared to $3.3 million for the transition period. The increase was primarily due to increased stock-based compensation, increased expenses related to the potential application of QN-165 for the treatment of COVID-19, increased pre-clinical costs associated with QN-247 and RAS, and increased payroll-related expenses.

As of December 31, 2021, Qualigen had approximately $17.5 million in cash and cash equivalents. This was due in part to a registered direct offering in December 2021 in which the company raised $8.82 million in gross proceeds. We estimate the company has sufficient capital to fund operations into mid-2023. As of March 25, 2022, Qualigen had approximately 35.3 million shares outstanding and, when factoring in stock options and warrants, a fully diluted share count of approximately 50.0 million.

Conclusion

The in-licensing of QN-302 is an exciting development for the company and we are looking forward to updates throughout the year as it is advanced through IND-enabling studies. The results presented at AACR are very encouraging, particularly its activity in the PDAC xenograft models. While the timelines for developing QN-302 are aggressive, as of now we anticipate an IND being filed in the first half of 2023. QN-302 is now Qualigen’s lead asset, however the company is continuing to focus resources on QN-247 and RAS-F. In regards to the latter, Qualigen recently extended the research agreement with the University of Louisville to explore additional compounds in the hopes of identifying a lead candidate for IND-enabling studies by the end of 2022. We have incorporated both the December 2021 financing and QN-302 into our model, which now stands at $8.00 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.