Ralph Lauren (RL) Q3 Earnings Beat Estimates, Revenues Lag

Ralph Lauren Corporation RL has reported third-quarter fiscal 2021 results, wherein the bottom line surpassed the Zacks Consensus Estimate, while sales lagged the same. Moreover, earnings and sales declined year over year, driven by the COVID-led business disruptions.

In the past three months, shares of this Zacks Rank #1 (Strong Buy) company have gained 50.5% compared with the industry’s growth of 12.6%.

Q3 in Detail

Ralph Lauren reported adjusted earnings per share of $1.67 in the fiscal third quarter, surpassing the Zacks Consensus Estimate of $1.62. However, the bottom line declined 41.6% from $2.86 reported in the prior-year quarter.

Net revenues declined 18.2% year over year to $1,432.8 million and missed the Zacks Consensus Estimate of $1,456.3 million. On a constant-currency basis, revenues were down 20% from the prior-year quarter. Soft revenues mainly resulted from lower sales across the North America and Europe segments, stemming from disruptions related to COVID-19, offset by gains in the Asia business. Meanwhile, the top line reflected gains of 170 basis points (bps) from favorable currency.

Apart from these, the strong momentum in digital business continued, recording double-digit growth in digital revenues across all regions. Notably, digital sales improved more than 70% in Europe and Asia, while it was up 10% in North America.

Segment Details

North America: During the fiscal third quarter, the segment’s revenues declined 21% from the year-ago quarter to $715 million. The retail channel in the region witnessed a 21% decline in comparable store sales (comps), including a 30% decrease in brick-and-mortar stores, partly offset by a 9% rise in digital commerce. Revenues from the North America wholesale business plunged 22% from the prior-year period.

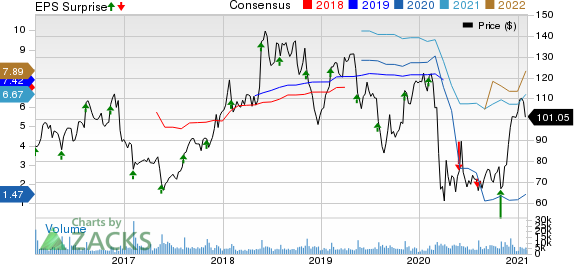

Ralph Lauren Corporation Price, Consensus and EPS Surprise

Ralph Lauren Corporation price-consensus-eps-surprise-chart | Ralph Lauren Corporation Quote

Europe: The segment’s revenues fell 28% year over year to $316 million, with a 32% decline in currency-neutral revenues. Comps at retail stores in Europe declined 38% due to a 51% decrease in brick-and-mortar stores, somewhat offset by 68% growth in digital sales. Revenues for the segment’s wholesale business were down 17% on a reported basis and 22% at constant currency.

Asia: The segment’s revenues advanced 14% year over year to $330 million on a reported basis and 9% on a currency-neutral basis. Comps in Asia were up 3%, backed by a 1% rise in brick-and-mortar stores and a 54% increase in the digital business.

Margins

Ralph Lauren's adjusted gross profit margin expanded 320 bps to 65.4%, driven by positive regional and channel mix shifts along with enhanced AUR in all regions. On a constant-currency basis, gross margin improved 290 bps.

Adjusted operating expenses declined 11% from the year-ago period to $747 million in the fiscal third quarter. The decline can be attributable to savings from compensation-related expenses, rent and occupancy, and other discretionary expenses. Adjusted operating expenses, as a percentage of sales, increased 400 bps to 52.2%.

Further, the company reported an adjusted operating income of $190 million, down 22.7% year over year. Meanwhile, adjusted operating margin contracted 70 bps to 13.3% in the quarter under review.

Financials

Ralph Lauren ended the quarter with cash and short-term investments of $2,787.2 million, total debt of $1,631.9 million, and total shareholders’ equity of $2,692 million. Inventory at the end of the fiscal third quarter dropped 4.3% from the year-ago quarter to $866 million.

Store Update

As of Dec 26, 2020, Ralph Lauren had 548 directly-operated stores and 660 concession shops globally. The directly-operated stores included 146 Ralph Lauren, 73 Club Monaco and 329 Polo factory stores. Additionally, the company operated 286 licensed stores globally.

Strategic Realignment Plan

As part of the Fiscal 2021 Strategic Realignment Plan, management announced intention to reduce headcount by the end of fiscal 2021, the transition of the Chaps brand to a fully-licensed model and close its Polo store on Regent Street in London.

As part of the same, the company has planned additional realignment actions for its real estate footprint. It plans to further consolidate its global corporate offices to better align with its current organizational profile. It has also renegotiated lease terms across its global retail store fleet, resulting in multi-year savings. Further, the company identified about 10 stores for potential closures in fiscal 2022. It also expects to consolidate its existing North America distribution centers to drive greater efficiencies, improve sustainability and enhance the customer experience.

The realignment initiatives are now collectively expected to attract pre-tax charges of $300-$350 million. Moreover, these actions are estimated to generate gross annualized pre-tax expense savings of $200-$240 million, after the completion of sustainability by the end of fiscal 2022. The company expects to reinvest a portion of these savings into its business.

Outlook

Management expects COVID-19 impacts and uncertainties to continue in the fourth quarter and fiscal 2021.

For the fiscal fourth quarter, it anticipates a sales decline of mid- to high-single digits from the prior-year quarter. However, this will likely reflect a sequential improvement from the first three quarters of fiscal 2021. The company predicts gross margin expansion to continue in the fiscal fourth quarter, although at a moderate rate than the first three quarters of fiscal 2021. Operating expenses are expected to increase year over year in low single-digits. However, excluding marketing investments, operating expenses are estimated to decline year over year in low-single digits.

Moreover, the company predicts capital expenditure of $130-$140 million for fiscal 2021 compared with $170-$200 million stated at the beginning of fiscal 2021. Moreover, it plans to reinstate its quarterly dividend in the first half of fiscal 2022.

Other Stocks to Consider

Crocs, Inc. CROX, a Zacks Rank #1 stock at present, has an impressive long-term earnings growth rate of 15%. You can see the complete list of today’s Zacks #1 Rank stocks here.

PVH Corp. PVH has a long-term earnings growth rate of 18% and it currently sports a Zacks Rank #1.

Steven Madden, Ltd. SHOO has a long-term earnings growth rate of 15% and it presently flaunts a Zacks Rank #1.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research