Rarely Undervalued Mastercard Looks Compelling After Selloff

Mastercard Inc. (NYSE:MA), the second-largest player in the U.S. electronic payments space, closed Mondays trading session 20% below its 52-week and split-adjusted all-time high of $401.50. The stock has traded down nearly 12% in the last five days alone. This decline comes despite posting excellent results in its most recent quarter as the recovery from Covid-19 continues to take place.

The stock may have fallen into bear market territory, but Mastercard now has a valuation nearly on par with its long-term average when using next years earnings estimates. Shares are also trading well below certain intrinsic value estimates, suggesting that investors buying today could see solid returns in what has become a beaten down stock.

Lets look closer at the company to see why I think shares are undervalued and appealing at the current price.

Quarterly earnings highlights

Mastercard reported third-quarter earnings results on Oct. 28. Revenue was higher by 30% to $5 billion, coming in $36 million ahead of Wall Street analysts estimates. Adjusted net income of $2.3 billion, or $2.37 per share, compared very favorably to adjusted net income of $1.6 billion, or $1.60 per share, in the prior year. Adjusted earnings per share was also 18 cents better than expected.

Gross dollar volumes improved 20% to $1.99 trillion. Both the U.S. and the rest of the world grew 20% from the prior year.

On a currency neutral basis, cross-border volume fees and volume were up 59% and 52%, respectively, from the prior year. Switched transactions improved 25%, purchase volumes increased 23% and cards in use were up a high single digit amount.

Offsetting these gains was a 30% increase in rebates and incentives, which was caused by the higher volumes and transactions as well as new and renewed agreements.

On a currency neutral basis, adjusted operating expenses grew 23% due to higher strategic investments. The adjusted operating margin was up 200 basis points to 56.7%.

Mastercard repurchased 4.3 million shares of stock during the quarter at an average price of $372. The company has almost $5 billion, or 1.5% of its market capitalization, remaining under its current repurchase authorization. The company paid out $434 million of dividends while generating $2.3 billion of free cash flow for the period.

The company ended the third quarter with total assets of $34.9 billion, current assets of $15.1 billion and cash and equivalents of $6.8 billion. This compares to total liabilities of $28.6 billion and current liabilities of $11.6 billion. Mastercard has total debt of $13.9 billion, of which just $650 million is due within the next year.

According to analysts surveyed by Yahoo Finance, Mastercard is expected to earn $8.26 per share in 2021, which would be a 28.5% increase from 2020 and the companys best year ever. Those same analysts expect that earnings per share are expected to grow nearly 28% from this years estimate to $10.54 in 2022.

Takeaways

Mastercard was negatively impacted by the pandemic last year, as spending fell significantly. The third quarter of 2020 was the companys second weakest quarter, so revenue and adjusted earnings per share beating estimates wasnt difficult.

However, Mastercard outperformed the same period of 2019 by a sizeable margin. Revenue, adjusted earnings per share and adjusted net income improved 11%, 10.2% and 4.5%, respectively, from the third quarter of that year. After weathering the storm last year, Mastercard looks to be in better shape than it was before the pandemic.

Good signs can be seen throughout the most recent quarter, but cross-border transactions, which often are more profitable for the company, were particularly strong. On a local currency basis, cross-border volumes for the quarter were up 52% year-over-year. Looking back further to when the Covid-19 pandemic was not yet a headwind, July, August and September cross-border volumes were 91%, 100% and 101%, respectively, of the comparable period of 2019.

This strength continued into the beginning of the fourth quarter. Cross border volumes were up 55% for the first three weeks of October compared to last year and cross-border volume as a percentage of 2019 was 105%. Again, this shows that the company is seeing results that are at or above figures seen prior to the pandemic.

Valuation analysis

Shares of Mastercard are lower by 11.6% in just the last five trading sessions, driven by a stream of news headlines on increasing competition in the online payments space. Buy now, pay later is becoming increasingly popular among younger generations as a replacement for credit cards. Amazon.com, Inc. (NASDAQ:AMZN) also recently announced that it would stop accepting Visa Inc. (NYSE:V) credit cards in the UK. The two companies are in a dispute over how much Visa is charging for cross border transactions.

Somewhat strangely, Mastercard is down more in the near term than Visa, which has lost almost 8% over the same period.. The decline in shares of Mastercard have presented an opportunity as the valuation has become slightly less rich. Shares ended Mondays trading session at $321.30. Using earnings per share estimates for the year, Mastercard has a forward price-earnings ratio of 38.9.

According to Value Line, the stock has an average price-earnings ratio of 28 over the last decade. Shares are still trading at a meaningful premium to this average even after the selloff.

However, using analysts' estimates for 2021, the forward price-earnings ratio comes down to a much more reasonable 30.4. This is still above the long-term average, but only by a small amount.

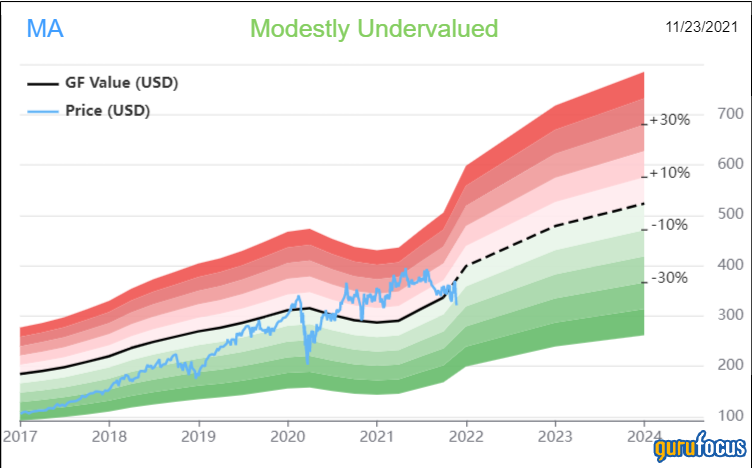

Where the valuation really looks appealing is when using the GuruFocus Value chart:

Mastercard has a GF Value of $372.74, implying a price-to-GF-Value ratio of 0.86. Shares would record a 16% advance were they to trade with the GF Value. Mastercard receives a rating of modestly undervalued from GuruFocus as a result. Looking at the chart, we can see that the stock hasnt been this undervalued since the beginning of the pandemic.

Final thoughts

Mastercard shares have reached bear market territory recently, driven by a steep decline in a matter of trading sessions. Part of this decline is likely attributed to a disagreement between Amazon and the companys peer Visa. So far, this disagreement over fees hasnt impacted Mastercards business.

Regardless, I think the selloff looks to be overdone when considering the companys business performance. The most recent quarterly report showed strong gains from the prior year. Compared to 2019, results look better on most metrics.

Mastercard, which has rarely been considered a value stock, looks almost fairly priced when using next years earnings estimates compared to its 10-year average earnings multiple. Using the GuruFocus Value chart, shares even look to be undervalued by a mid-teens percentage.

The companys business performance, secure place as a leader in the electronic payment space and valuation suggest that Mastercard is available at a rare undervalued level now that it is 20% off of its all-time high.

This article first appeared on GuruFocus.