RenaissanceRe's (RNR) Q3 Earnings Beat Estimates, Rise Y/Y

RenaissanceRe Holdings Ltd.’s RNR third-quarter 2018 operating earnings per share of 52 cents beat the Zacks Consensus Estimate by a whopping 420%. Moreover, the bottom line reversed the year-ago period’s loss of $13.74. This upside was backed by positive net and operating income.

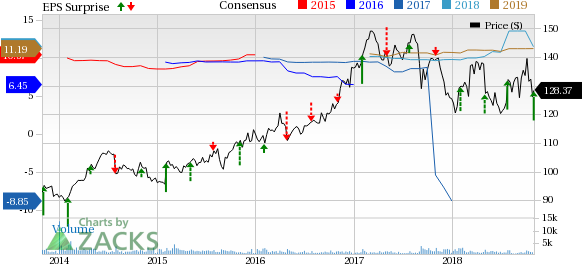

RenaissanceRe Holdings Ltd. Price, Consensus and EPS Surprise

RenaissanceRe Holdings Ltd. Price, Consensus and EPS Surprise | RenaissanceRe Holdings Ltd. Quote

The quarter under review witnessed many large catastrophic events, positive net and operating income along with growth in tangible book value per share along with other accumulated dividends.

Quarterly Operational Update

RenaissanceRe’s third-quarter operating revenues of $613 million surpassed the Zacks Consensus Estimate by 0.6%. The top line even improved 3.7% year over year, driven by higher net investment income.

Gross premiums written dipped 2.3% year over year to $626 million due to lower premiums in the Property segments. However, the downside was partially offset by the increase in premiums in the Casualty and Specialty segment.

Net investment income is $80.6 million for the reported quarter, skyrocketing 100.5% year over year.

RenaissanceRe’s total expenses were $579.4 million, down 57.3% year over year due to lower net claims and claim expenses.

Underwriting loss of $29 million was narrower than the year-ago quarter’s loss of $793.2 million.

Combined ratio was 105.5% for the third quarter compared with the year-ago quarter’s tally of 244.8%.

Quarterly Segment Update

Property Segment

Gross premiums written were $301.4 million, down 7.4% year over year, led by a decrease in premium written in catastrophe class of business.

Underwriting loss of $43.9 million due to catastrophe events that occurred in the third quarter compared favorably with the underwriting loss of $750.2 million in the prior-year period. Combined ratio of 115% improved from 322.7% a year earlier.

Casualty and Specialty Segment

Gross premiums written were $324.3 million, up 3% from the prior-year quarter, driven by continued and selective growth from new business opportunities within a few classes of business.

Underwriting income of $14.9 million declined 65.4% from the year-ago quarter’s income of $43.1 million.

Combined ratio of 93.8% improved from 120.4% by 2660 basis points in the third quarter of 2017. This upside was particularly driven by a 23.5% decrease in the net claims and claim expense ratio as a result of significant net claims and claim expenses from 2017’s third-quarter Large Loss Events.

Financial Position

As of Sep 30, 2018, total assets of RenaissanceRe were $17 billion, up 13% from 2017-end level.

The company had total debt of $990 million as of Sep 30 2018, up 0.1% from the 2017-end level.

Cash and cash equivalents were $453 million, down 66.7% from 2017 end.

Book Value per share of $105.21 inched up 0.6% year over year.

Return on equity for the quarter under review is 3.1%.

Zacks Rank

RenaissanceRe carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry having reported third-quarter earnings so far, the bottom line of The Progressive Corporation PGR and MGIC Investment Corporation MTG outpaced the respective Zacks Consensus Estimate while the metric of RLI Corp. RLI missed the same.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

See them today for free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.