Republic First Bancorp (NASDAQ:FRBK) Shareholders Booked A 66% Gain In The Last Year

Republic First Bancorp, Inc. (NASDAQ:FRBK) shareholders have seen the share price descend 12% over the month. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 66%.

View our latest analysis for Republic First Bancorp

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Republic First Bancorp grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 33% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

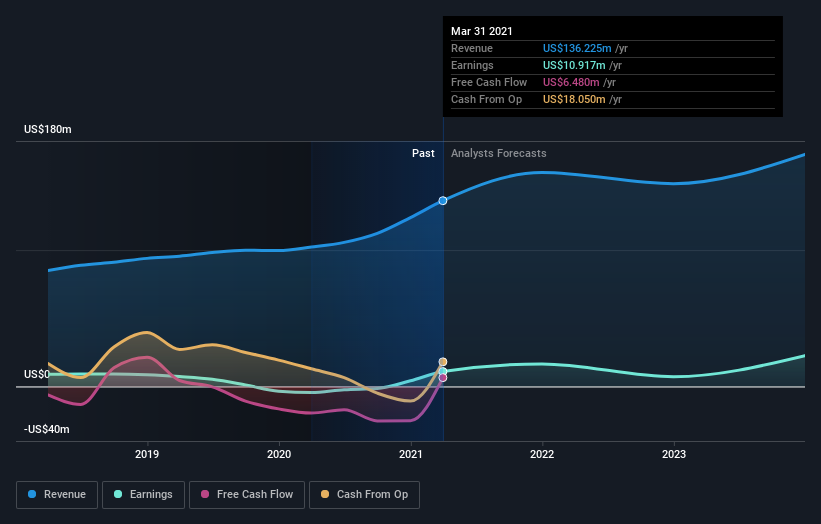

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Republic First Bancorp in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Republic First Bancorp shareholders have received a total shareholder return of 66% over one year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Republic First Bancorp better, we need to consider many other factors. Even so, be aware that Republic First Bancorp is showing 2 warning signs in our investment analysis , you should know about...

Republic First Bancorp is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.