RLI Earnings Beat Estimates, Revenues Improve Y/Y in Q2

RLI Corp.’s RLI second-quarter 2018 operating earnings of 60 cents per share beat the Zacks Consensus Estimate by 9.1%. However, the bottom line slipped 1.6% year over year.

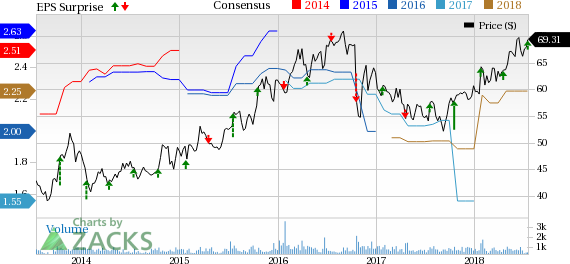

RLI Corp. Price, Consensus and EPS Surprise

RLI Corp. Price, Consensus and EPS Surprise | RLI Corp. Quote

Net income improved 25.4% year over year to 74 cents per share.

The company witnessed profitable underwriting results along with improved net investment income in the reported quarter. Also, the property and casualty (P&C) insurer displayed premium growth across all its segments.

Operational Performance

Operating revenues for the reported quarter totaled $211.1 million, up 6.8% year over year owing to higher net premiums earned as well as net investment income. Also, the top line outpaced the Zacks Consensus Estimate of $208 million by 1.5%.

Gross premiums written improved nearly 12% year over year to $269.8 million on the back of a solid performance by all the segments — Casualty, Property and Surety.

Total expenses increased 10.6% year over year to $186.9 million due to higher loss and settlement expenses, policy acquisition costs, insurance operating as well as general corporate expenses.

The company reported underwriting income of $14.1 million, which declined 28.4% year over year. Combined ratio deteriorated 350 basis points year over year to 92.8%.

The property and casualty (P&C) insurer’s net investment income improved nearly 10.1% year over year to $14.6 million. Total return from the investment portfolio was 0.8%.

Financial Update

The company exited the second quarter with total investments and cash of $2.2 billion, up 1.3% from the year-end 2017.

Book value was $19.17 per share as of Jun 30, 2018, down 0.8% from the tally as of Dec 31, 2017.

Long-term debt was $149 million, which inched up 0.1% from the figure at 2017-end level.

Statutory surplus grew 7.3% year over year to $927.9 million.

Net cash flow from operations surged 33.6% to $84.6 million in the quarter under review.

Dividend Payout

On Jun 20, 2018, the company paid out a cash dividend of 22 cents per share, up 4.8% from the year-ago quarter’s payment. Over the past five years, the P&C insurer’s total cumulative dividends amounted to more than $613 million.

Zacks Rank

RLI Corp. carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry having reported second-quarter earnings so far, the bottom line of The Progressive Corporation PGR, MGIC Investment Corporation MTG and Fidelity National Financial, Inc. FNF beat the respective Zacks Consensus Estimate.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research