Ron Baron Buys America Movil, Boosts Marriott Vacations

- By Tiziano Frateschi

Ron Baron (Trades, Portfolio)'s Baron Funds bought shares of the following stocks during the second quarter.

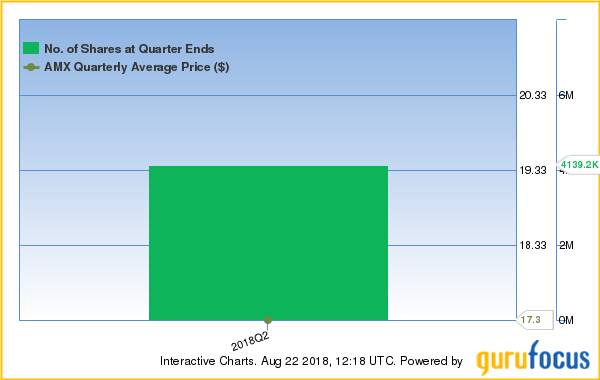

The firm established a new position in America Movil SAB de CV (AMX), buying 4,139,193 shares. The trade had an impact of 0.3% on the portfolio.

Warning! GuruFocus has detected 3 Warning Signs with AMX. Click here to check it out.

The intrinsic value of AMX

The telecommunications company has a market cap of $57.2 billion and an enterprise value of $89.33 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 21.09% and return on assets of 3.96% are outperforming 56% of companies in the Global Telecom Services industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.30.

The company's largest shareholder among the gurus is Ken Fisher (Trades, Portfolio) with 43% of outstanding shares, followed by Baron with 0.13% and Charles Brandes (Trades, Portfolio) with 0.03%.

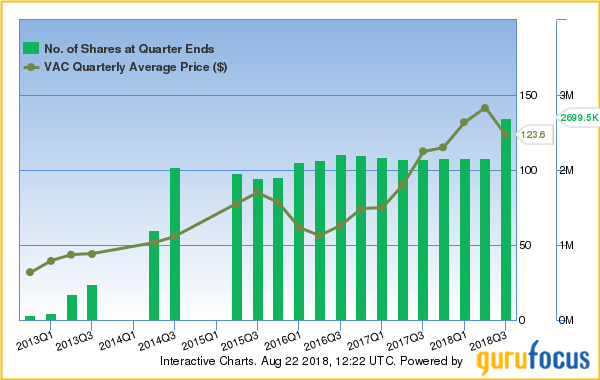

The firm added 24.96% to its Marriott Vacations Worldwide Corp. (VAC) position. The trade had an impact of 0.27% on the portfolio.

The timeshare operator has a market cap of $3.36 billion and an enterprise value of $4.14 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 19.19% and return on assets of 6.99% are outperforming 75% of companies in the Global Resorts and Casinos industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.41 is below the industry median of 0.71.

Another notable guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.47% of outstanding shares, followed by Leucadia National (Trades, Portfolio) with 0.19% and Paul Tudor Jones (Trades, Portfolio) with 0.02%.

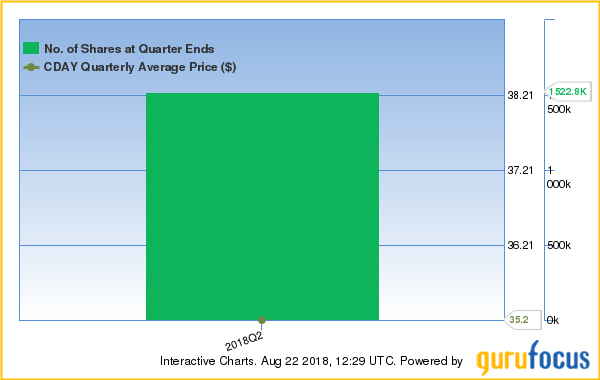

Baron Funds bought 1,522,790 shares of Ceridian HCM Holding Inc. (CDAY). The trade had a 0.22% impact on the portfolio.

The company, which provides human resources software and services, has a market cap of $4.78 billion and an enterprise value of $1.93 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of -0.89% and return on assets of -0.14% are underperforming 68% of companies in the Global Software - Application industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 3.75 is below the industry median of 4.22.

Leon Cooperman (Trades, Portfolio) is another notable guru shareholder of the company with 0.21% of outstanding shares, followed by Chase Coleman (Trades, Portfolio) with 0.12% and George Soros (Trades, Portfolio) with 0.05%.

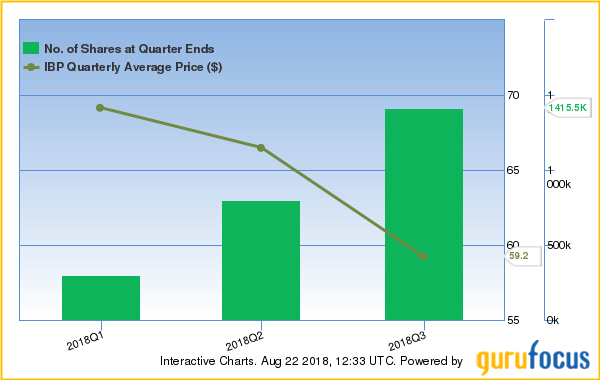

The firm boosted its Installed Building Products Inc. (IBP) holding by 76.94%, expanding the portfolio 0.15%.

The company is an insulation installer serving the residential new construction market. It has a market cap of $1.52 billion and an enterprise value of $1.82 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 22.61% and return on assets of 6.10% are outperforming 67% of companies in the Global Building Materials industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.35 is below the industry median of 0.37.

The company's largest shareholder among the gurus is Baron with 4.48% of outstanding shares, followed by Fisher with 0.21%.

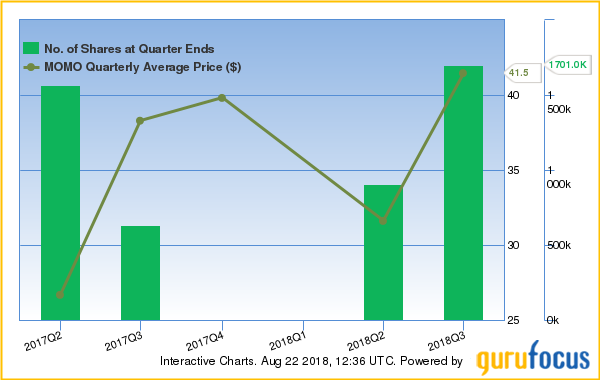

The Momo Inc. (MOMO) position was boosted 87.24%, impacting the portfolio by 0.15%.

The company, which provides mobile-based social networking services, has a market cap of $8.14 billion and an enterprise value of $7.24 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 39.20% and return on assets of 31.96% are outperforming 96% of companies in the Global Internet Content and Information industry. Its financial strength is rated 9 out of 10. It has no debt.

With 2.24% of outstanding shares, Simons is the company's largest guru shareholder, followed by Louis Moore Bacon (Trades, Portfolio) with 0.48% and Steven Cohen (Trades, Portfolio) with 0.24%.

The Wix.com Ltd. (WIX) holding was expanded 17.65%. The trade had an impact of 0.14%.

The company, which provides a cloud-based web development platform, has a market cap of $4.79 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -149.89% and return on assets of -11.56% are underperforming 100% of companies in the Global Internet Content and Information industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 1.35 is below the industry median of 7.46.

Another notable guru shareholder of the company is Simons with 3.07% of outstanding shares.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with AMX. Click here to check it out.

The intrinsic value of AMX