Schneider (SNDR) Rides on Cash Position & Segmental Revenues

We have recently updated a report on Schneider National, Inc. SNDR.

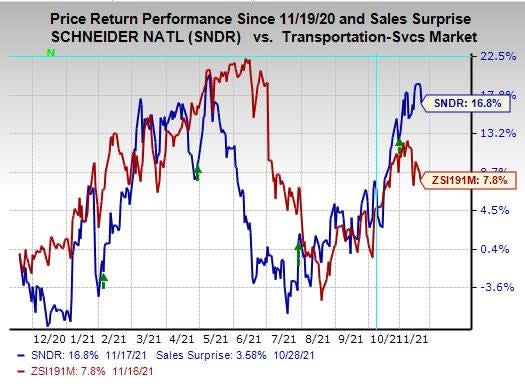

Long-term expected earnings per share (three to five years) growth rate for Schneider is pegged at 17.9%. The stock has gained 16.8% in the past year compared with a 7.8% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Strong performance in the Intermodal and Logistics segments are driving Schneider National’s top line, up 23% year over year in the first nine months of 2021. The Intermodal segment (revenues rose 17% in the first nine months of 2021) is benefiting from yield management, revenue per order and increased volumes, mainly in the Eastern rail network. The Logistics unit (revenues surged 67.1% year over year) is thriving on the back of favorable constructive market conditions, increased spot mix and other factors.

Following strong third-quarter results and expectations of favorable market conditions, the company raised its adjusted EPS guidance for 2021 to $2.13-$2.17 compared with $1.85-$1.95 expected previously.

The company has a sound liquidity position. Its cash and equivalents at the end of the third quarter totaled $550 million, higher than the current debt and finance lease obligations of $101 million. The company’s current ratio (a measure of liquidity) was at 2.03 at the end of third-quarter 2021, higher than the 1.94 recorded at the end of second-quarter 2021. A current ratio that is greater than 1.5 is usually considered suitable for a company.

Despite recent improvements, Schneider National’s third-quarter operations were hurt by increased rail costs, lower Truckload network fleet count, lower miles per tractor, lower utilization and higher driver and related costs. In the event of these headwinds dampening results in the coming quarters, the stock might be severely hurt.

Zacks Rank & Other Stocks to Consider

Schneider currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some better-ranked stocks in the broader Zacks Transportation sector are Knight-Swift Transportation Holdings Inc. KNX, Landstar System, Inc. LSTR and C.H. Robinson Worldwide, Inc. CHRW.

Long-term expected earnings per share (three to five years) growth rate for Knight-Swift is pegged at 15%. KNX is benefitting from an improvement in the adjusted operating ratio. Notably, adjusted operating ratio improved to 82.8% in the first nine months of 2021 compared with 86.6% reported in the first nine months of 2020. In third-quarter 2021, the metric improved to 81.3% from 83.9%, a year ago.

This uptick in adjusted operating ratios is primarily driven by an increase in revenues in the Trucking, Logistics and Intermodal segments. Notably, the lower the value of the metric, the better. The stock price has surged 39.4% from the past year. Knight-Swift sports a Zacks Rank #1.

Long-term expected earnings per share (three to five years) growth rate for Landstar is pegged at 12%. LSTR is benefitting from gradual recovery in the economy, freight market conditions in the United States.

LSTR’s top and the bottom line increased substantially in each quarter from third-quarter 2020’s levels, owing to robust revenues generated from the primary segment — truck transportation. The stock has rallied 34.6% in the past year. Landstar carries a Zacks Rank #2 (Buy).

Long-term expected earnings per share (three to five years) growth rate for C.H. Robinson is pegged at 9%. CHRW benefits from higher pricing and volumes across most of its service lines. Total revenues jumped 42.4% year over year in the first nine months of 2021, with higher revenues across all segments.

CHRW’s measures to reward its shareholders are encouraging. Driven by the tailwinds, the stock increased negligibly in the past month. C.H. Robinson carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

KnightSwift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.