Scorned Miner Offers Instant Income Ahead of a Potential Comeback

Many commodity and natural resources stocks have been left behind while the broader market indices make record or multi-year highs. A look at SPDR S&P Metals & Mining (XME) shows the sector ETF is down 18% year to date versus a nearly 15% gain in the S&P 500. However, a minor recovery bounce has taken this group off its recent extreme lows.

One stock in this sector that has seen a sharp decline is Cliffs Natural Resources (CLF), a major supplier of iron ore and metallurgical coal. The stock fell from over $100 a share in 2011 to a 52-week low of $16.74 in April, below the $20 pivot support level dating back to 2009.

CLF then bounced to the $23 level for a 37%-plus rally from its lows. This move back above $20 may confirm that a bottom is finally being put in place for this stock.

If you are comfortable holding on to CLF for a potential recovery, then selling put options could allow you to collect income while you wait to get into the stock at a 20% discount. The high volatility and short amount of time until June options expiration make this a high-probability play.

Cash-Secured Put Selling Strategy

While the typical investor might use a limit order to buy a stock or ETF at a designated price or lower, the options trader can do one better by selling a cash-secured put.

This strategy has the same mathematical risk profile as a covered call. With put selling, there is an obligation to buy the stock at the strike price if it is assigned, allowing you to get into the stock at a discount. In fact, the true entry cost basis is even lower with the subtraction of the premium you earned from selling the puts.

And if the stock is not below the strike price at expiration, then the premium received is all profit. In other words, you're getting paid not to own the stock.

There are two rules traders must follow to be successful at put selling.

Rule One: Only sell puts on stocks you want to own.

The intention of this strategy is to be assigned the stock as a long-term investment (each option contract represents 100 shares). So make sure you have the funds in your account to buy the stock at the options strike price if a sell-off occurs. Paying in full ensures that no additional money is needed to hold the stock for potentially many months or even years until a price recovery occurs.

Rule Two: Sell either of the front two option expiration months to take advantage of time decay.

Collect premium every month on put sales until you are assigned shares at a cost-reduced basis. Every month that you keep the premium is money subtracted from your entry price.

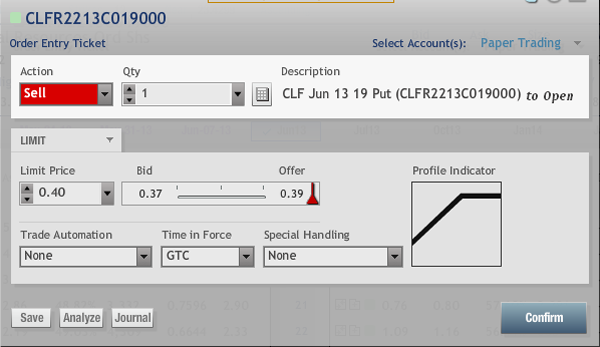

Recommended Trade Setup: Sell to open CLF June 19 Puts at $0.40 or better.

This cash-secured put sale would assign long shares at $18.60 ($19 strike minus $0.40 premium), which is about 20% below CLF's current price, costing you $1,860 per option sold. Remember: Only sell this put if you want to own CLF stock at a discount to the current price. If you are assigned the shares, a July covered call can be sold against the stock to lower your cost basis even further.

If the stock does not fall below the strike price before expiration, then you keep the premium you collected, essentially getting paid not to buy the stock.

Related Articles

This Forgotten Stock Could Kick Off a Big Rally Next Week

Traders Who Ignore the Critics Could See 39% Returns by Year-End

Earn Immediate Income While Waiting for This Under $7 Stock to Rebound