SEHK Top Dividend Stocks – China CITIC Bank And More

Dividend stocks such as China CITIC Bank and Bank of Communications can help diversify the constant stream of cash flows generated by your portfolio. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

China CITIC Bank Corporation Limited (SEHK:998)

China CITIC Bank Corporation Limited provides various banking products and services in the People’s Republic of China, Hong Kong, and internationally. Started in 1987, and currently headed by CEO Deshun Sun, the company now has 51,608 employees and with the market cap of HKD HK$403.54B, it falls under the large-cap category.

998 has a good dividend yield of 3.31% and the company currently pays out 26.09% of its profits as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. China CITIC Bank is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 55.38% over the next three years. More detail on China CITIC Bank here.

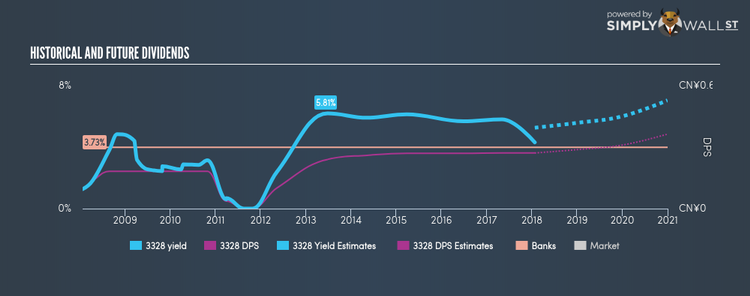

Bank of Communications Co., Ltd. (SEHK:3328)

Bank of Communications Co., Ltd. provides various commercial and retail banking products and services primarily in China. Formed in 1908, and currently lead by Chun Peng, the company now has 93,999 employees and with the stock’s market cap sitting at HKD HK$569.75B, it comes under the large-cap group.

3328 has a large dividend yield of 4.04% and is paying out 30.36% of profits as dividends . Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from ¥0.09 to ¥0.27 over the past 10 years. Dig deeper into Bank of Communications here.

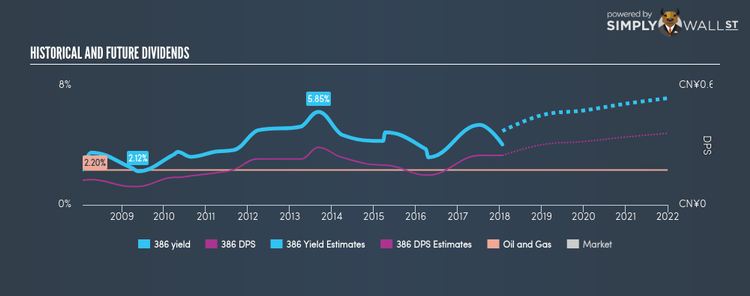

China Petroleum & Chemical Corporation (SEHK:386)

China Petroleum & Chemical Corporation, an energy and chemical company, engages in the oil and gas, and chemical operations and businesses in the People’s Republic of China and internationally. Started in 2000, and currently lead by Houliang Dai, the company now has 451,611 employees and with the company’s market cap sitting at HKD HK$988.40B, it falls under the large-cap stocks category.

386 has a sizeable dividend yield of 3.80% and their payout ratio stands at 58.53% . Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from ¥0.12 to ¥0.25 over the past 10 years. Continue research on China Petroleum & Chemical here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.