Silicon Laboratories (NASDAQ:SLAB) lifts 4.1% this week, taking five-year gains to 80%

Silicon Laboratories Inc. (NASDAQ:SLAB) shareholders have seen the share price descend 11% over the month. While that's not great, the returns over five years have been decent. It's good to see the share price is up 80% in that time, better than its market return of 68%. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 16% drop, in the last year.

The past week has proven to be lucrative for Silicon Laboratories investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Silicon Laboratories

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that Silicon Laboratories has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So we might find other metrics can better explain the share price movements.

It is not great to see that revenue has dropped by 4.6% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

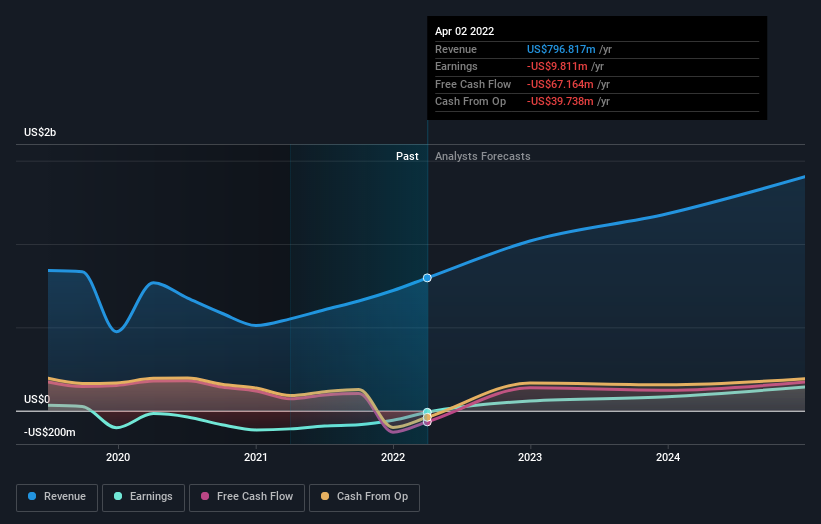

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Silicon Laboratories is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Silicon Laboratories shareholders are down 16% over twelve months, which isn't far from the market return of -17%. The silver lining is that longer term investors would have made a total return of 12% per year over half a decade. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. Before spending more time on Silicon Laboratories it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here