Skechers' (SKX) Q3 Earnings Miss Estimates, Sales Rise Y/Y

Skechers U.S.A., Inc. SKX reported third-quarter 2021 results with both the top and the bottom line lagging the Zacks Consensus Estimate. However, both metrics improved year over year. This well-known footwear company gained from growth across domestic and international channels, driven by strong wholesale and direct-to-consumer sales.

During the quarter, the company witnessed higher demand for comfort products. The company achieved double-digit growth across all its reportable segments, backed by continued global demand for its Comfort Technology footwear. Moreover, the company’s investments in long-term growth strategies including brands and infrastructural capabilities have been encouraging for a while.

Management remains focused on developing comfort footwear, expanding apparel offering, advancing e-commerce capabilities and tapping opportunities to drive overall sales.

Let’s Analyze the Results

Skechers posted quarterly earnings of 66 cents a share, which increased from 41 cents earned in the year-ago quarter. On an adjusted basis, earnings per share came in at 68 cents. We note that the bottom-line figure came below the Zacks Consensus Estimate of 75 cents.

The company generated sales of $1,551.8 million, falling short of the Zacks Consensus Estimate of $1,636 million after nine straight quarters of beat. The top line jumped 19.2% year over year owing to a 20.1% increase in domestic sales and an 18.6% rise in international sales. On a constant-currency basis, total sales grew 17.1%. Management highlighted that the quarterly revenues represented the company’s second highest sales quarter in history.

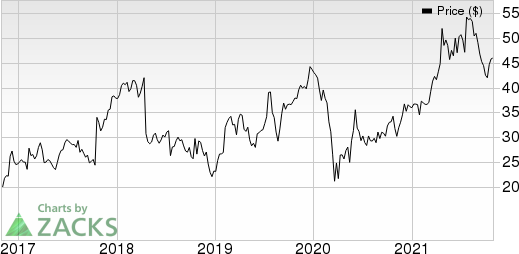

Skechers U.S.A., Inc. Price, Consensus and EPS Surprise

Skechers U.S.A., Inc. price-consensus-eps-surprise-chart | Skechers U.S.A., Inc. Quote

Sales growth in the domestic and international channels was driven by strong wholesale as well as direct-to-consumer businesses, courtesy of the easing of pandemic-led restrictions. International wholesale segment sales rose 10.6% to $711.9 million, aided by strong growth in China, India and Distributor sales, somewhat offset by a decline in the European subsidiaries. Domestic wholesale sales climbed 10.1% to $350.7 million on the back of higher unit sales volume.

The company’s direct-to-consumer sales increased nearly 44% to $488.4 million, backed by growth across the international and domestic retail stores. Increase in the domestic direct-to-consumer business was backed by a 43% gain in the brick-and-mortar stores on higher traffic and normalized operating hours. Direct-to-consumer comparable same store sales jumped 31%, reflecting a rise of 33.7%, domestically and 25.1%, internationally.

Worldwide comparable same-store sales grew 31% including 34% growth, domestically, and 25% growth, internationally. Further, its domestic e-commerce business was mainly affected by limited product availability. The company’s joint venture business grew 5% in the quarter owing to a 10% rise in China along with solid sales in Mexico and Israel.

Looking at Margins

Gross profit increased 23.1% year over year to 769.4 million. Also, gross margin expanded 150 basis points (bps) to 49.6% owing to higher direct-to-consumer gross margin. Higher average selling prices, partly offset by declines in International Wholesale and Domestic Wholesale, resulted in margin expansion in the direct-to-consumer business.

Total operating expenses grew 18% year over year to $630.7 million but contracted 50 bps as a percentage of sales to 40.7%. Selling expenses increased 39% from the year-ago period’s tally to $119.8 million due to increased demand creation spend as the markets reopened globally. Also, general and administrative expenses jumped 13% to $510.9 million.

Earnings from operations came in at $146.2 million that rose significantly from $92.1 million in the prior-year quarter. Also, operating margin expanded 230 bps to 9.4%. Adjusted earnings from operations were $142.6 million in the reported quarter.

Store Update

During the third quarter, the company opened 10 company-owned stores including two in Columbia and one each in Peru, India, Germany and France. It also inaugurated a store in Downtown Los Angeles in a renovated historic building. This outlet marks the company’s first street location in the evolving urban center. Simultaneously, it shuttered one location in the quarter.

Additionally, net 119 third-party Skechers outlets were opened in the reported quarter in 28 countries with a net new 67 in China, 9 in India, 6 in Australia and 4 in New Zealand.

In the fourth quarter to date, it opened three stores including one in Naples, Italy. Management intends to open more shops at 15-20 locations by the end of 2021.

As of Sep 30, 2021, the company had 4,170 stores including 516 company-owned domestic stores, 344 company-owned international locations, 492 joint-venture stores and 2,818 distributor, licensee and franchise stores.

Other Financial Aspects

As of Sep 30, 2021, cash and cash equivalents totaled $952.1 million while short-term investments amounted to $90.6 million. The company ended the quarter with long-term borrowings (excluding current installments) of $282.8 million and shareholders’ equity of $2,841.5 million excluding non-controlling interests of $290.5 million. Further, total inventory was $1,230.3 million.

The company incurred capital expenditures worth $89.4 million during the third quarter. Management anticipates capital expenditures between $80 million and $110 million for the remaining year.

Outlook

Management revised guidance for 2021, given the supply-chain issues witnessed throughout the reported quarter. It believes that these headwinds will continue through the rest of the year and into the first half of 2022.

Skechers envisions fourth-quarter 2021 sales between $1.51 billion and $1.56 billion and earnings in the band of 28-33 cents a share. The Zacks Consensus Estimate for sales and earnings for the fourth quarter is currently pegged at $1.47 billion and 30 cents, respectively.

For the final quarter, it expects gross margins to remain essentially flat with the year-ago period’s level as freight costs will greatly offset the improved pricing.

Skechers projected 2021 sales in the range of $6.15-$6.20 billion versus the earlier anticipation of $6.15-$6.25 billion. The company had reported sales of $4.6 billion in 2020. The Zacks Consensus Estimate for sales in 2021 is currently pegged at $6.20 billion.

For 2021, the company expects earnings per share in the band of $2.45-$2.50, down from the prior view of $2.55-$2.65. The company had reported earnings of 64 cents in 2020. The Zacks Consensus Estimate for 2021 earnings is pegged at $2.58, which is likely to witness downward revisions in the coming days.

Price Performance

Shares of this currently Zacks Rank #4 (Sell) company have lost 14.5% in the past three months compared with the industry's 2.5% dip.

Stocks to Consider

Steven Madden SHOO, currently sporting a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 56.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

G-III Apparel Group GIII, currently carrying a Zacks Rank of 1, has a trailing four-quarter earnings surprise of 180.5%, on average.

Carter’s CRI, currently holding a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 21.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research