Staples Dividend Stocks Investors Love

Consumer defensive companies tend to be non-cyclical, which means their products and services are in constant demand irrespective of the economic cycle. Consumption also tends to sit at a relatively steady level, regardless of price. Therefore, these companies provide a strong reliable stream of constant income which is a great diversifier during economic downturns. As a long term investor, I favour these consumer staples stocks with great dividend payments that continues to add value to my portfolio.

Village Super Market, Inc. (NASDAQ:VLGE.A)

VLGE.A has an alluring dividend yield of 4.32% and the company has a payout ratio of 65.81% . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from $0.56 to $1. Village Super Market seems reasonably priced when looking at its PE ratio (15.2). The industry average suggests that US Consumer Retailing companies are more expensive on average 20.1.

SpartanNash Company (NASDAQ:SPTN)

SPTN has a good-sized dividend yield of 2.54% and a reasonably sustainable dividend payout ratio , with analysts expecting this ratio to be 38.25% in the next three years. The company’s DPS have increased from $0.2 to $0.66 over the last 10 years. It should comfort existing and potential future shareholders to know that SPTN hasn’t missed a payment during this time.

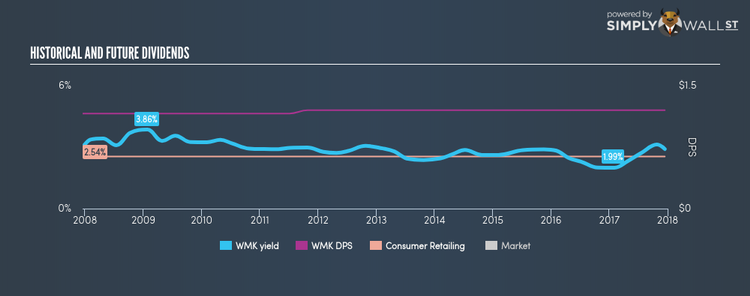

Weis Markets, Inc. (NYSE:WMK)

WMK has a good-sized dividend yield of 2.91% and their payout ratio stands at 42.53% . WMK’s last dividend payment was $1.2, up from it’s payment 10 years ago of $1.16. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Weis Markets’s earnings growth over the past 12 months has exceeded the us consumer retailing industry, with the company reporting an EPS growth of 18.41% while the industry totaled 2.95%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.