Steven Cohen Boosts Stake in Hyatt Hotels

- By James Li

Steven Cohen (Trades, Portfolio), founder of Point72 Asset Management, disclosed Monday he added an additional 357,386 shares of Hyatt Hotels Corp. (NYSE:H) to his portfolio for $78.56 per share, according to GuruFocus real-time picks.

Warning! GuruFocus has detected 3 Warning Sign with H. Click here to check it out.

The intrinsic value of H

Trade background

Cohen initiated a 2,048,826-share stake in Hyatt during fourth-quarter 2017, when the stock averaged $67.57. The manager boosted the position 17.44% with Monday's trade.

Company reported strong fourth-quarter earnings and offers good growth potential

Hyatt, a major luxury hotel owner, said full-year comparable revenues per available room increased 3.3% worldwide, fueled by "a record-setting" 71 new hotels added to the network according to CEO Mark Hoplamazian. The company reported net income of $249 million during fiscal 2017, up 22.3% from fiscal 2016.

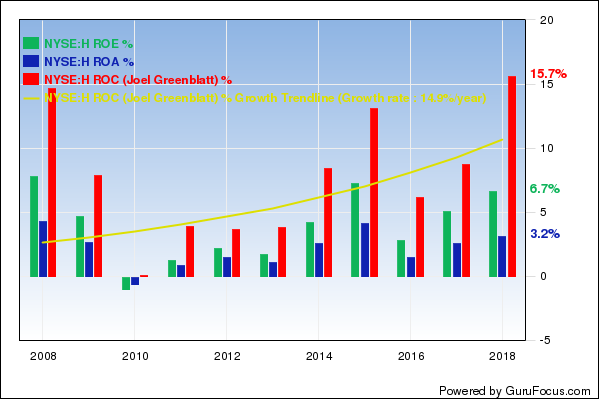

Hoplamazian said comparable revenues per available room are expected to increase between 1% and 3% in fiscal 2018 compared to fiscal 2017. The company's profitability ranks a solid 8 out of 10, driven primarily by a perfect Piotroski F-score of 9 and above-average returns on equity and capital.

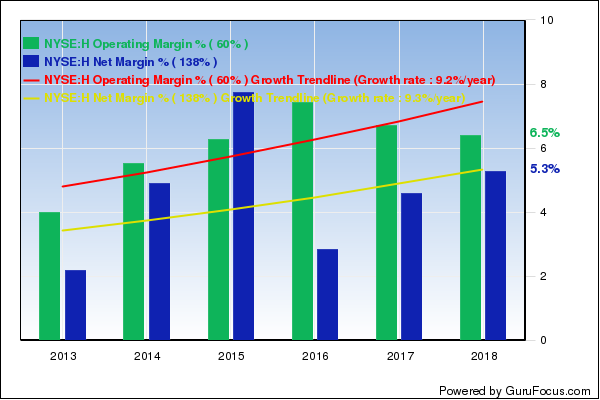

Hyatt's operating margins expanded approximately 9.20% per year over the past five years even though margins underperform approximately 53% of global competitors. Companies with expanding operating margins offer strong growth potential according to Berkshire Hathaway Inc. (BRK-A)(BRK-B) co-managers Warren Buffett (Trades, Portfolio) and Charlie Munger (Trades, Portfolio).

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with H. Click here to check it out.

The intrinsic value of H