Strong Auto Sales Send Related ETFs Higher

Domestic automakers last week reported double-digit sales gains in October year-over-year, sending returns for related ETFs above 30 percent on the year.

Last week, General Motors said it delivered 226,402 vehicles in the U.S. in October, up 16 percent versus a year ago, and retail sales were also up 16 percent. Ford reported U.S. total sales of 191,985 vehicles, an increase of 14 percent from last October, and its best October retail sales since 2004. Also, Chrysler Group reported U.S. sales of 140,083 cars, an 11 percent increase compared with sales in October 2012, and the group’s best October sales since 2007.

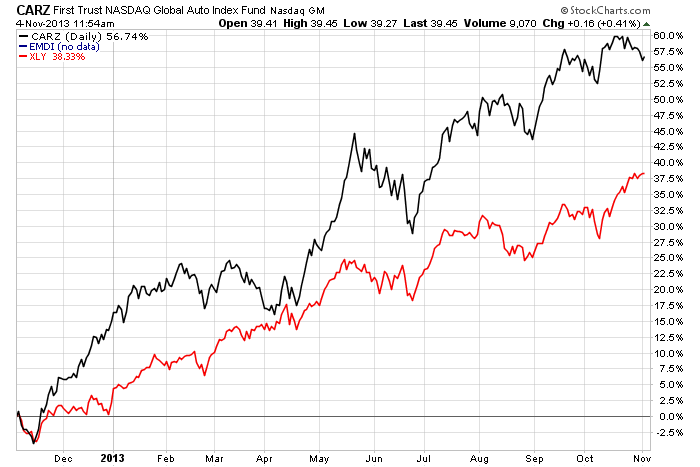

As a result, the $55.4 million First Trust Nasdaq Global Auto Index Fund (CARZ | C-37) has risen 37.15 percent year-to-date while raking in $41.46 million. The fund’s top three holdings currently include Daimler (8.50 percent), Honda (7.91 percent) and Toyota Motor (7.89 percent).

Other related ETFs that have exposure to the auto sector to a lesser extent have also fared well this year. The $6.9 billion Consumer Discretionary Select Sector SPDR Fund (XLY | A-89), includes Ford as one of its top holdings at 3.45 percent, and makes the auto and auto components sectors a combined 9.28 percent of its overall portfolio.

XLY is up 34.89 percent year-to-date and has netted $1.79 billion in inflows.

Also, the $5.6 million iShares MSCI Emerging Markets Consumer Discretionary Sector ETF (EMDI | C-44), which has a 42.60 percent allocation to the auto and auto parts sectors, is up 8.57 percent YTD. EMDI has netted $2.8 million inflows YTD.

The fund’s top holding is Hyundai, which also reported “the best October in company history,” with sales for the month at 53,555 units, up 7 percent versus the same period in 2012.

Chart courtesy of StockCharts.com

Improvement for automakers is part of broader—albeit modest—momentum for the U.S. manufacturing sector in October. The sector grew at its slowest rate for a year in October, according to the final Markit U.S. Manufacturing Purchasing Managers’ Index , which came in at 51.8, down from 52.8 in September, but above the earlier flash estimate of 51.1.

However, the auto sector could be poised for further growth ahead, thanks in part to the Federal Reserve’s so-called quantitative easing measures that have fueled investors’ appetite for riskier assets, and that should also benefit cyclical growth stocks such as autos.

Steady economic improvement, job growth, low interest rates, attractive new vehicles, stable gas prices and an aging auto population have driven auto sales higher in October, according to Efraim Levy, an auto analyst for S&P Capital IQ.

“Those are key factors that have been driving new sales higher, and I expect them to continue to drive sales higher through next year,” said Levy.

Levy added that he’s not too worried about the Federal Reserve’s tapering effect on the auto industry because small interest rate increases for auto purchases have “less of an impact than buying a house.”