Technology “bubble” fears don’t hold up

By: Russ Koesterich

Harvest Exchange

June 13, 2018

Technology “bubble” fears don’t hold up

Upon hearing of his obituary, Mark Twain famously quipped, “The reports of my death are greatly exaggerated.” A similar rebuke could be used for those claiming that technology stocks are back in bubble territory.

While technology stocks are having another stellar year in an otherwise languid market, their outperformance has been driven primarily through stellar earnings, not obscene multiple expansion. Since the start of 2010, the trailing price-to-earnings ratio (P/E) for the S&P 500 Technology Sector Index has risen approximately 20%, only slightly faster than the 14% for the S&P 500 Index. A quick look at top-line valuations confirms that 2018 is not the late ’90s redux.

1.Absolute sector valuation is below average.

At 23 times trailing earnings, the sector is trading at a discount to the long-term average of 28. To be fair, the long-term average is distorted by the bubble years, when the sector traded as high as 70 times earnings. Using the median, a statistical measure less influenced by outliers, suggests that today’s valuation is right in line with the long-term norm.

2.Relative value also looks reasonable.

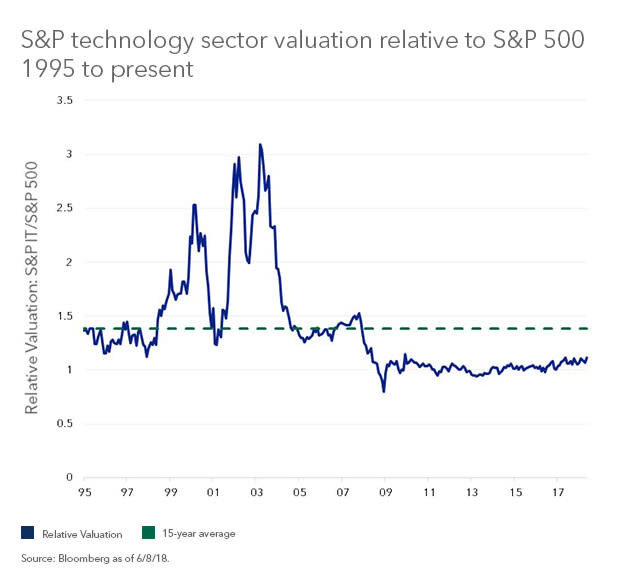

The technology sector trades at an 11% premium to the broader market. While this is up from a couple of years ago when the sector traded at a small discount, the current premium appears very reasonable in light of recent history. Again, excluding the bubble years, the current relative valuation is actually a bit below the 15-year average (see Chart 1). Using cash-flow rather than earnings provides a similar picture: On a P/CF basis the sector is trading at about an 18% premium to the market, below the historical median of 30%.

3.The sector remains very profitable.

With a return-on-equity of 20%, the sector remains profitable relative to both its history as well as the broader market. The current return on equity is six percentage points above the broader market. This compares favorably to the long-term median of around four percentage points.

Vulnerable to disruption

To be clear, every technology company remains vulnerable to being disrupted by a slightly more clever version of itself. A sobering reminder of this reality: On the eve of the financial crisis, Nokia’s smartphone market share was approximately 45%, the iPhone was less than one year old and Facebook was barely out of the dorm room. Pessimists will see this as a sign that the sector’s premium is unwarranted given the accelerating pace of innovation.

Read more from Russ K.

Although the pessimists have a point, the overall sector continues to be extraordinarily profitable, and, despite rumors to the contrary, reasonably valued. In an environment in which every company, in and outside tech, is vulnerable to being blindsided by an unheard of competitor or innovation, the tech sector is still delivering. It is worth a modest premium.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2018 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. ©2018 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. 524898

RSS Import: Original Source

Originally Published at: Technology “bubble” fears don’t hold up