Tidewater Midstream and Infrastructure Ltd. Just Missed Earnings; Here's What Analysts Are Forecasting Now

One of the biggest stories of last week was how Tidewater Midstream and Infrastructure Ltd. (TSE:TWM) shares plunged 31% in the week since its latest yearly results, closing yesterday at CA$0.55. Revenues of CA$692m beat expectations by 6.6%. Unfortunately statutory earnings per share (EPS) fell well short of the mark, turning in a loss of CA$0.04 compared to previous analyst expectations of a profit. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Tidewater Midstream and Infrastructure

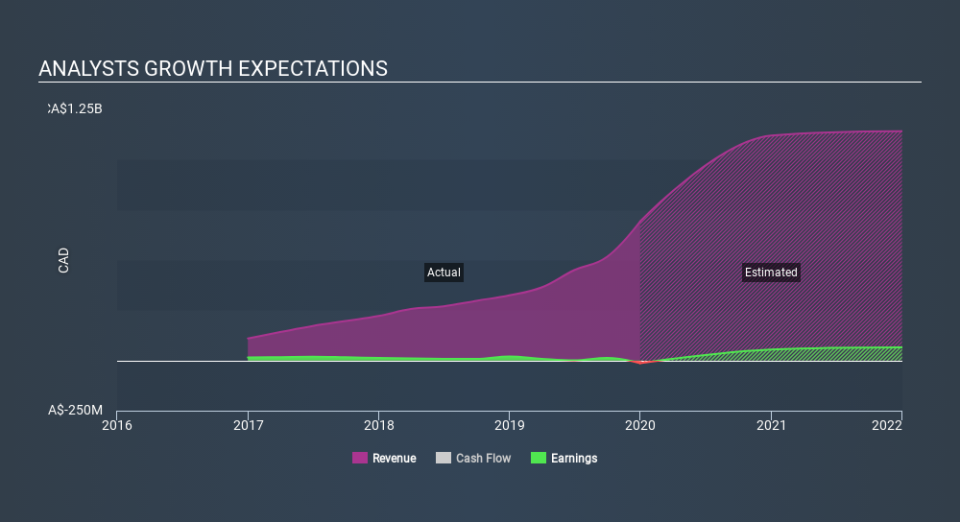

Taking into account the latest results, the current consensus from Tidewater Midstream and Infrastructure's seven analysts is for revenues of CA$1.12b in 2020, which would reflect a huge 62% increase on its sales over the past 12 months. Tidewater Midstream and Infrastructure is also expected to turn profitable, with statutory earnings of CA$0.16 per share. In the lead-up to this report, analysts had been modelling revenues of CA$1.14b and earnings per share (EPS) of CA$0.16 in 2020. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

With no major changes to earnings forecasts, the consensus price target fell 19% to CA$1.51, suggesting that analysts might have previously been hoping for an earnings upgrade. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Tidewater Midstream and Infrastructure, with the most bullish analyst valuing it at CA$2.25 and the most bearish at CA$0.85 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

It can also be useful to step back and take a broader view of how analyst forecasts compare to Tidewater Midstream and Infrastructure's performance in recent years. Next year brings more of the same, according to analysts, with revenue forecast to grow 62%, in line with its 52% annual growth over the past three years. Compare this with the wider market, which analyst estimates (in aggregate) suggest will see revenues grow 2.3% next year. So although Tidewater Midstream and Infrastructure is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider market.

The Bottom Line

The most obvious conclusion from these results is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. Happily, there were no major changes to revenue forecasts, with analysts still expecting the business to grow faster than the wider market. Analysts also downgraded their price target, suggesting that the latest news has led analysts to become more pessimistic about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Tidewater Midstream and Infrastructure analysts - going out to 2021, and you can see them free on our platform here.

It might also be worth considering whether Tidewater Midstream and Infrastructure's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.