Top 3 Growth Stocks For The Month

Why invest in a stock whose growth outlook that lags behind the market? Investors looking for companies with extraordinary future prospects in terms of profitability and returns should look at the following high-growth stocks. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

First Majestic Silver Corp. (TSX:FR)

First Majestic Silver Corp. engages in the acquisition, exploration, development, and production of mineral properties with a focus on silver projects in Mexico. Established in 1979, and run by CEO Keith Neumeyer, the company currently employs 3,580 people and with the company’s market cap sitting at CAD CA$1.66B, it falls under the small-cap category.

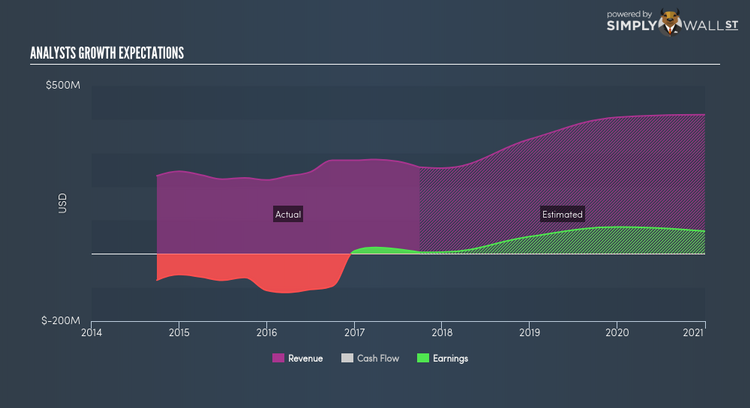

Extreme optimism for FR, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by an equally strong sales growth of 51.26%. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 8.74%. FR ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? Take a look at its other fundamentals here.

Endeavour Silver Corp. (TSX:EDR)

Endeavour Silver Corp., a mid-tier precious metals mining company, engages in evaluation, acquisition, exploration, development, extraction, processing, refining, and reclamation of silver mining properties in Mexico and Chile. Founded in 1981, and currently lead by Bradford Cooke, the company now has 1,475 employees and with the market cap of CAD CA$406.69M, it falls under the small-cap category.

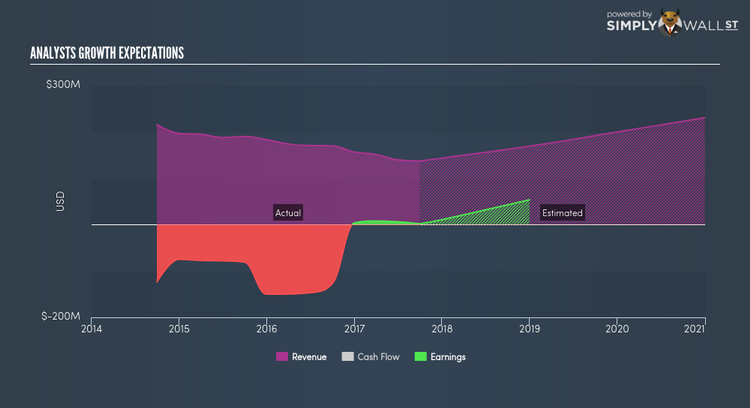

An outstanding doubling of earnings is forecasted for EDR, driven by an underlying sales growth of 39.77% over the next few years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. Furthermore, the high growth of over 100% in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. EDR’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering EDR as a potential investment? Have a browse through its key fundamentals here.

Polaris Infrastructure Inc. (TSX:PIF)

Polaris Infrastructure Inc., a renewable energy company, acquires, explores, develops, and operates geothermal energy projects in Latin America. The company now has 128 employees and with the stock’s market cap sitting at CAD CA$258.02M, it comes under the small-cap group.

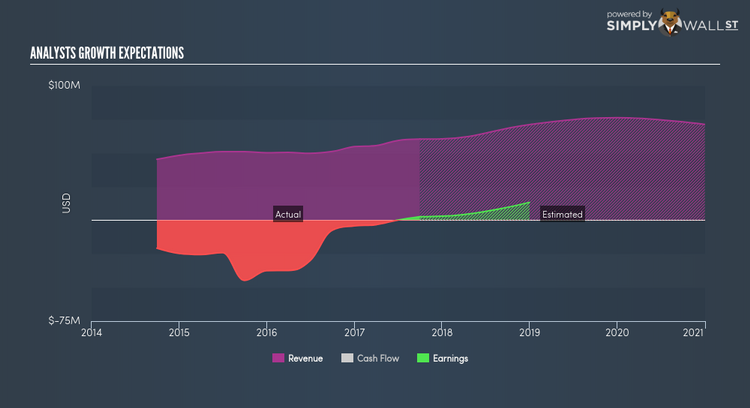

PIF’s projected future profit growth is an exceptional triple-digit, with an underlying 24.29% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of PIF, it does not appear too severe. Moreover, the 27.72% growth in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. PIF’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.