Top 5 Buys of the Royce International Premier Fund in the 2nd Quarter

The Royce International Premier Fund (Trades, Portfolio), part of Chuck Royce (Trades, Portfolio)'s Royce and Associates, disclosed last week that its top five buys during the second quarter included a new holding in Totvs SA (BSP:TOTS3) and position boosts in four existing holdings: IRESS Ltd. (ASX:IRE), Ossur hf (OCSE:OSSR), Loomis AB (OSTO:LOOMIS) and dorma+kaba Holding AG (XSWX:DOKA).

According to the fund's website, fund manager Mark Rayner says that the Premier Fund seeks to build a portfolio of high-quality, world-class businesses that "can generate plentiful free cash, and have a genuine and defensive moat." The fund focuses on premier non-U.S. companies that have notable strengths in industry structure, competitive positioning, operational efficiency, financial track record and corporate governance.

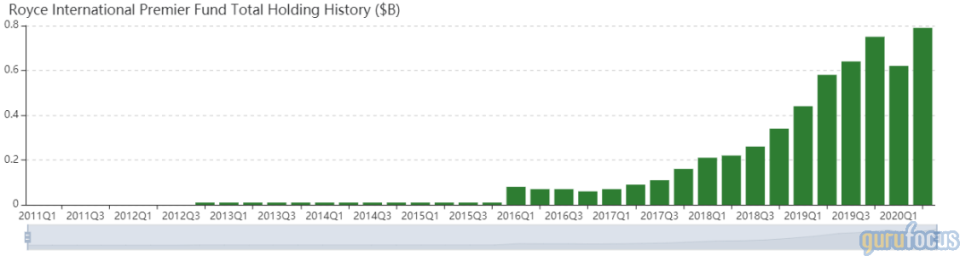

As of the quarter's end, the fund's $794 million equity portfolio contains 58 stocks with a turnover of 8% for the quarter. The top four sectors in terms of portfolio weight are industrials, technology, materials and health care, with weights of 38.96%, 21.94%, 12.55% and 10.86%, respectively.

Totvs SA

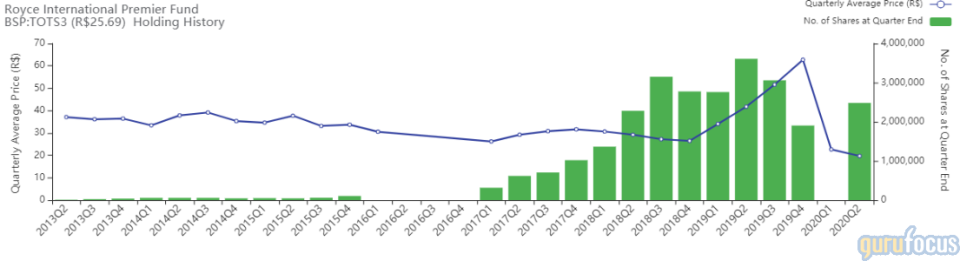

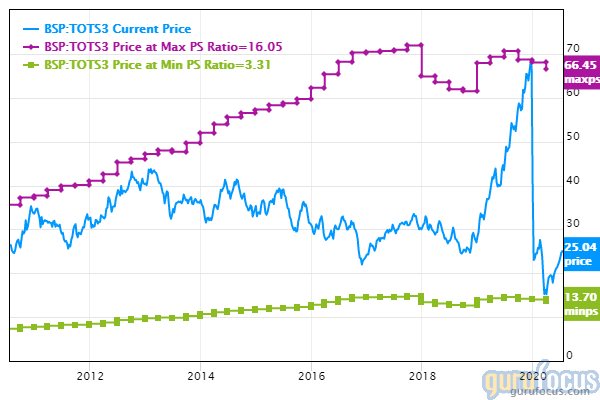

The fund purchased 2.481 million shares of Totvs SA, giving the position 1.33% weight in the equity portfolio. Shares averaged 19.72 Reals ($3.68) during the second quarter.

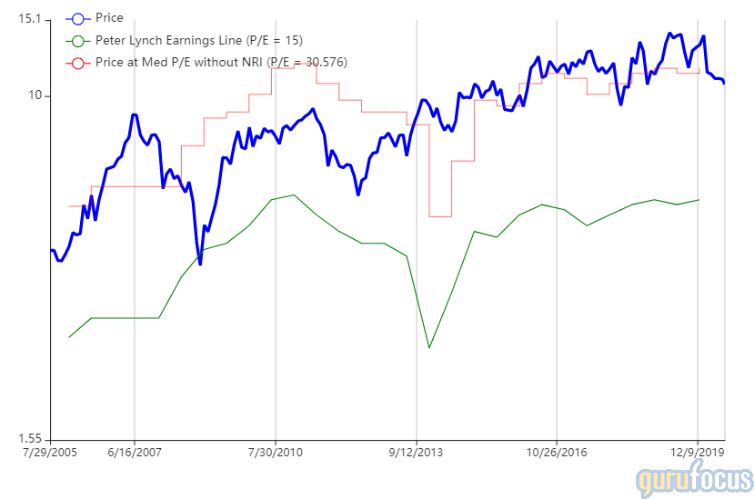

The Brazilian software company provides information technology solutions to small and medium enterprises in the education, government, health care and retail end markets. GuruFocus ranks the company's financial strength and profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8, a strong Altman Z-score of 9.59 and an operating margin that is outperforming over 80% of global competitors.

Totvs' valuation ranks 8 out of 10 on the back of price valuations near 10-year lows, despite underperforming over 70% of global competitors.

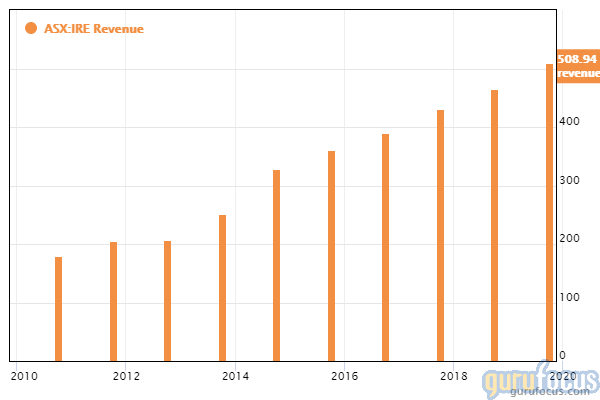

IRESS

The fund added 1,202,700 shares of IRESS, increasing the position 177.34% and impacting the equity portfolio 1.15%. Shares averaged 10.81 Australian dollars ($7.57) during the second quarter.

The Melbourne, Australia-based software company provides technological solutions for the financial markets and wealth management sectors. GuruFocus ranks IRESS' profitability 8 out of 10 on several positive investing signs, which include consistent revenue growth and profit margins that are outperforming over 83% of global competitors.

Ossur

The fund added 848,300 shares of Ossur, increasing the position 135.47% and impacting the equity portfolio 0.71%. Shares averaged 45.34 Icelandic krona (32 cents) during the second quarter.

Ossur designs and manufactures non-invasive orthopedic products through two business segments: bracing/support and prosthetics. GuruFocus ranks the Iceland-based company's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins that are outperforming over 73% of global competitors.

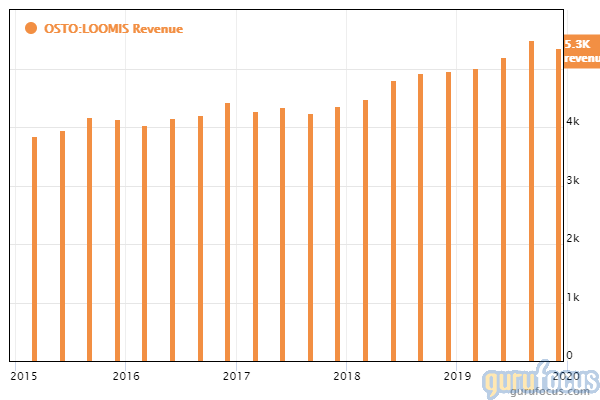

Loomis

The fund purchased 145,600 shares of Loomis, increasing the position 28.64% and impacting the equity portfolio 0.44%. Shares averaged 233.69 Swedish krona ($26.01) during the second quarter.

Loomis provides cash handling services like cash in transit and cash management. GuruFocus ranks the Stockholm-based company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a 3.5-star business predictability rank and an operating margin that has increased approximately 3.70% per year on average over the past five years and is outperforming over 74% of global competitors.

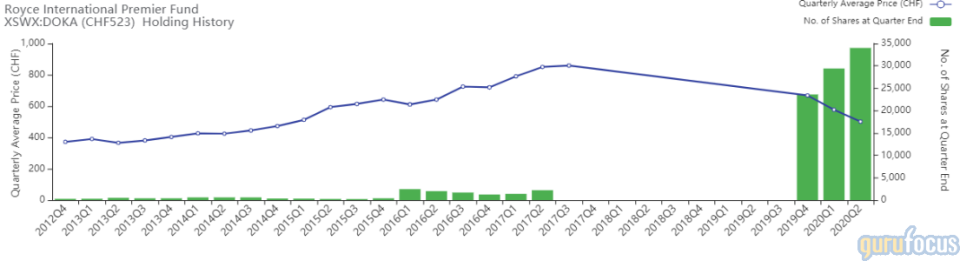

Dorma+Kaba

The fund added 4,600 shares of Dorma+Kaba, increasing the position 15.65% and imapacting the equity portfolio 0.32%. Shares averaged 500.77 francs ($533.05) during the second quarter.

GuruFocus ranks the Swiss security and protection service company's profitability 8 out of 10 on the back of profit margins and returns outperforming over 90% of global competitors.

Disclosure: No positions.

Read more here:

Yacktman Fund Buys 2, Slims 4 Positions in 2nd Quarter

T Rowe Price Equity Income Fund's Top 5 Buys in the 2nd Quarter

4 Farm and Construction Machinery Companies With High Financial Strength

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.