Tractor Supply (TSCO) Rises on Q1 Earnings Beat, Upbeat View

Tractor Supply Company TSCO has reported first-quarter 2021 results, wherein the top and bottom lines improved year over year and surpassed the Zacks Consensus Estimate. Citing favorable trends in the first quarter, the company raised its view for 2021.

Tractor Supply’s earnings were $1.55 per share, which surpassed the Zacks Consensus Estimate of 99 cents. Moreover, the bottom line improved 118.3% from the prior-year quarter.

Net sales increased 42.5% year over year to $ 2,792.3 million and beat the Zacks Consensus Estimate of $2,465.8 million. The improvement was driven by an increase in comparable store sales (comps) of 38.6%, led by growth of 17.6% in comparable average ticket and a 21% rise in comparable average transaction count.

Comps growth was backed by strength in demand for seasonal categories as well as everyday merchandise, including consumable, usable and edible products. Moreover, the company witnessed strong comp growth of at least 30% across all geographic regions. Additionally, Tractor Supply witnessed triple-digit percentage sales growth in the e-commerce business. This marked the fourth consecutive quarter of triple-digit growth in e-commerce sales.

Driven by the strong results and upbeat view for 2021, shares of the company rose 3.6% in the pre-market trading session on Apr 22. Notably, shares of this Zacks Rank #2 (Buy) company have gained 15.4% in the past three months compared with the industry’s 2% growth.

Margins & Costs

Gross profit rose 48.8% year over year to $983.8 million, while gross margin expanded 148 basis points (bps) to 35.2%. Gross margin gained from lower depth and frequency of sales promotions, and lower clearance activity and favorable product mix, offset by higher transportation costs as a percent of net sales.

Adjusted selling, general and administrative (SG&A) expenses, including depreciation and amortization, as a percentage of sales, declined 103 bps to 27%. The decline was driven by leverage in occupancy and other costs on a rise in comps. This was partly offset by incremental costs related to the pandemic and higher incentive compensation. In dollar terms, adjusted SG&A expenses, including depreciation and amortization, rose 37.3% to $753.2 million.

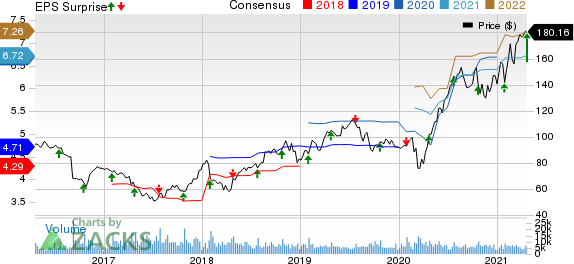

Tractor Supply Company Price, Consensus and EPS Surprise

Tractor Supply Company price-consensus-eps-surprise-chart | Tractor Supply Company Quote

Driven by higher sales and gross margin, operating income rose 104.9% to $230.5 million in the first quarter. Operating margin expanded 251 bps to 8.26%.

Financial Position

Tractor Supply ended the first quarter with cash and cash equivalents of $1,149.9 million, long-term debt of $984.8 million, and total stockholders’ equity of $1,852.3 million. Further, it has no amount drawn on its $500-million revolving credit facility as of Mar 27, 2021.

In first-quarter 2021, the company incurred a capital expenditure of $100.7 million and generated cash flow from operating activities of $177.1 million.

Moreover, Tractor Supply returned $314 million to shareholders in the first quarter, including $253.4 million to repurchase 1.6 million shares and $60.6 million for the payment of quarterly cash dividends.

For 2021, it expects to incur a capital expenditure of $450-$550 million. It anticipates share repurchases of $700-$800 million for 2021.

Store Update

In the quarter under review, Tractor Supply opened 21 Tractor Supply stores and two Petsense stores. However, it closed seven Petsense stores in the first quarter of 2021. As of Mar 27, 2021, the company operated 1,944 Tractor Supply stores across 49 states and 177 Petsense stores in 23 states.

Management remains on track with its store-opening initiatives. It plans to open 80 Tractor Supply stores and 10 Petsense stores in 2021. Also, it expects 150-200 Side Lot transformations and 150-200 Project Fusion store remodels of existing Tractor Supply stores as part of its Life Out Here Strategy.

2021 Outlook

Tractor Supply continues to remain uncertain regarding the magnitude of the pandemic’s impact on its 2021 performance. Nevertheless, it raised its guidance for 2021 based on the strong first-quarter performance and current trends.

The company now expects net sales of $11.4-$11.7 billion for 2021 compared with $10.7-11 billion mentioned earlier. Comps are likely to increase 5-8% compared with the previously mentioned 2% decline to 1% growth. Operating margin is now anticipated to be 9.4-9.7% versus 9.3-9.6% stated earlier.

Moreover, net income is now expected to be $820-$860 million for 2021. Earlier, the company predicted a net income of $750-$800 million. Earnings per share are now expected to be $7.05-$7.40 compared with $6.50-$6.90 mentioned earlier.

The company’s guidance assumes an effective tax rate of 22.1-22.4% for 2021 versus 22.5-22.8% stated earlier.

3 Other Retail Stocks to Watch Out

Abercrombie & Fitch Company ANF, which currently sports a Zacks Rank #1 (Strong Buy), has an expected long-term earnings growth rate of 18%. You can see the complete list of today’s Zacks #1 Rank stocks here.

L Brands, Inc. LB, also a Zacks Rank #1 stock, has an expected long-term earnings growth rate of 13%.

Petco Health and Wellness Company, Inc. WOOF presently has an expected long-term earnings growth rate of 42.7% and a Zacks Rank #2.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Petco Health and Wellness Company, Inc. (WOOF) : Free Stock Analysis Report

L Brands, Inc. (LB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research