Why we're trapped in stock market purgatory

David Nelson, CFA, is the Chief Strategist of Belpointe Asset Management

Caught in a world between heaven and hell, investors have struggled with a market that’s always a headline or tweet away from a 500-point down day. As simple as it sounds, heaven is defined as the S&P 500 breaking above the downtrend drawn from the all-time high of 2873. For the moment, investors have decided hell is any break below the 200-day moving average. Several times this year traders have stepped in to lift the index from the edge of the abyss.

With rates rising, valuations may not be compelling but nor are they alarming either. (Read last week’s post” The Wall”) We’re on the tail end of one of the best earning’s seasons in 7 years so it raises the question, “What will it take to put the SPX (S&P 500) back on I-95 North?

A little over 4 months into 2018, stocks are pretty much where we started the year. It feels worse than it is because we’re down over (-7%) from the highs of January. Staggering earning’s growth on the heels of a massive tax cut could easily be dismissed but this quarter delivered on the top line as well. There are any number of things that can be done to manipulate earnings but revenue growth? Either you have it or you don’t.

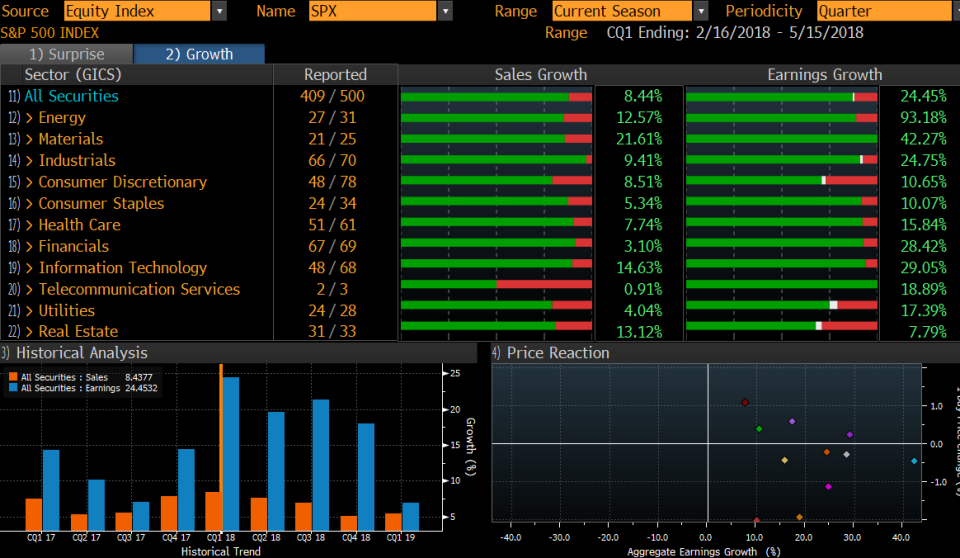

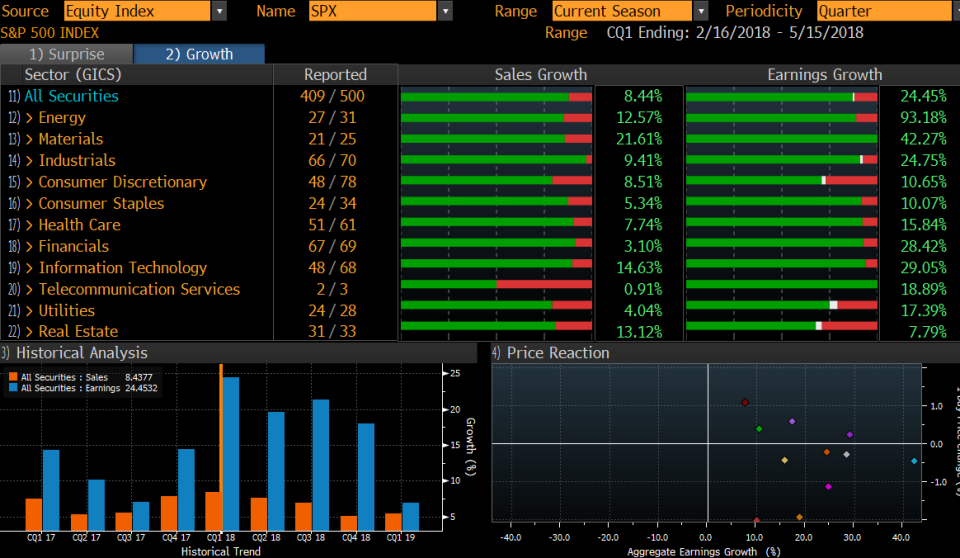

Earnings & Sales Growth — It doesn’t get much better than this

409 of the S&P 500 have reported, so the bulk of the season is over. All in, despite all this good news, the average post report price reaction was to the downside. Some of the best upside moves came from companies like Apple (AAPL) where expectations had been dramatically cut and sentiment was low heading into the report.

Avoiding a Trade War

With the season close to the end, what will be the next catalyst that can break the deadlock? Investors hoping for a quick resolution to a potential trade war with China will be disappointed. It took us 30 years to get into this mess and given we are dealing with a Chinese leader who is likely there until the day he dies, a quick fix is almost out of the question.

There are valid arguments on both sides of the debate, but I think most of us can agree the theft of intellectual property is a non-starter. It’s the crown jewels. They’re stealing our future. China is hoping we will defend the status quo unwilling to risk a negative outcome, a strategy that has paid off brilliantly for decades.

The U.S. delegation just returned from meetings with their counterparts in Beijing. Not many details from either side but at this point it seems they may have only resolved the shape of the table.

What about Jobs & the Fed?

Friday’s job growth was a little soft but as Joel Naroff of Naroff Economic Advisors points out in his latest update “while the total was below forecasts, when you add in the upward revisions to February and March, you come out right at consensus.”

Wages continue to move higher but hardly alarming — and despite calls the Fed is looking to accelerate the pace of rate hikes, I still stand by my previous call the hawkish rhetoric will soon morph into something more benign. While they may not openly address my concerns, a yield curve that continues to flatten and the market wealth effect loom as important issues weighing on any Fed decision.

Emerging Markets & EM Debt rolling while U.S. Dollar rises

The rising dollar isn’t just a negative for U.S. large-cap multi-nationals. If it continues to rise unabated, emerging markets and EM credit will continue to struggle as it becomes more expensive for overseas borrowers to service their debt.

As you can see there’s no shortage of bricks for the wall of worry, but it’s frankly been that way throughout what is admittedly one of the longest bull markets ever.

The lack of a meaningful breakout in either direction continues to frustrate both bulls and bears both convinced victory is just around the corner. While the traders continue to react to every headline and tweet. the better move may be to drill down into the fundamentals that drive the stocks in your favorite index. In the end stocks follow earnings — and for the moment that train still is on the track.