Trending: Venezuelan Economy in Meltdown Amid Political Strife

Venezuela’s economy may have fallen completely into disarray, but markets are looking for a political resolution that would open the doors for various investments.

President Trump’s State of the Union address had a positive impact on infrastructure companies as he urged lawmakers to further fund infrastructure projects. Regional banks SunTrust and BB&T are poised to merge in what would become the largest bank deal in a decade. Nickel prices seesawed on fears regarding knock-on effects from the Brazilian mining disaster at the end of January, while the list closes with the U.S. dollar as investors ponder the effects of the U.S.-China trade talks and the dovish tilt from the Federal Reserve.

Check out our previous trends’ edition at Trending: Chinese Stimulus Pledge Provides Impetus for African Economies

Politicians Worldwide Push for an End to the Venezuelan Saga

The cash-strapped South American nation is facing global pressure to put an end to its internal political feud that has brought the economy to its knees. Interest in Venezuela has doubled over the last week as both President Nicolas Maduro and the leader of the opposition Juan Guaido seek to forge alliances that would secure control of the country.

Oil is undoubtedly the most important asset the nation has at its disposal. News of a U.S. fund set by the Venezuelan opposition with the aim of receiving the proceeds of oil sales surfaced last week. The fund would receive the income accrued by state-run oil firm PDVSA’s U.S. unit Citgo Petroleum Corp. The opposition is reportedly advanced in its plans of establishing this financial vehicle and its leaders have already talked to PDVSA’s international partners, who have expressed a willingness to keep operating in Venezuela. About 7 million barrels of crude are presently parked at the U.S. Gulf Coast waiting for instructions as U.S. sanctions on Venezuelan oil came into effect at the end of January.

The Maduro Administration is using gold mines to fund the nation’s most basic consumer goods. The gold extracted from southern jungles is sent to Turkish refineries and the proceeds are used to buy essential goods like food and hygiene products. Trade between the two countries has grown eightfold in 2018, while Venezuelan gold shipments to Turkey have reached $900 million for the same year. Venezuela’s central bank sold vast amounts of gold, which brought national gold reserves to their lowest levels in 75 years. The U.S. has issued a national ban on Venezuelan gold purchases and pressured the U.K. to refrain from releasing $1.2 billion in gold reserves the Latin American country has stored in the Bank of England.

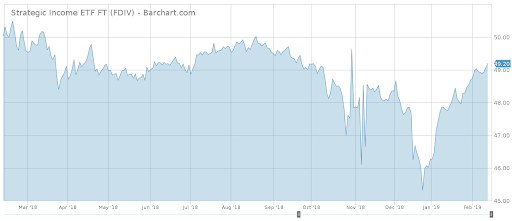

Investors have their options reduced to only a few ETFs when it comes to Venezuela, First Trust Strategic Income ETF (FDIV B) being the most exposed to the Latin American economy. The ETF has rebounded of late and currently holds a year-to-date performance of 6.86%.

Sign up for ETFdb.com Pro and get access to real-time ratings on over 1,900 U.S.-listed ETFs.

Trump Calls for Rebuild of U.S. “Crumbling” Infrastructure

President Donald Trump addressed the nation last week and called for a bipartisan push for a bill that would boost infrastructure spending. As a result, investors have taken interest in infrastructure products, upping traffic nearly 80% over the last week.

The American head of state is trying to fulfill his campaign promise of $1.5 billion in infrastructure spending over a ten-year period, although his efforts have been met with resistance by Congress so far. House Transportation and Infrastructure Chair Peter DeFazio acknowledged last week that efforts must be made for some 140,000 American bridges and nearly half of its highways. Democrats proposed, back in 2017, a plan to raise $500 billion by issuing 30-year bonds and using revenue from indexing fuel taxes to rise with inflation. Analysts also pointed to rail and freight rail, a sector that has grown substantially over the last years while mainly relying on private investments.

On the international front, the latest report from Deloitte Access Economics revealed a peak for infrastructure spending this year in Australia. The findings point to a peak of $40 billion for 2019, followed by a slowdown as major projects like the $8.3 billion Sydney Metro Northwest or the $3 billion NorthConnex are set to wrap up in the upcoming months. The current surge could last a while longer as a result of upcoming projects, upward cost revisions, changes in the scope of current projects or delays to development timelines.

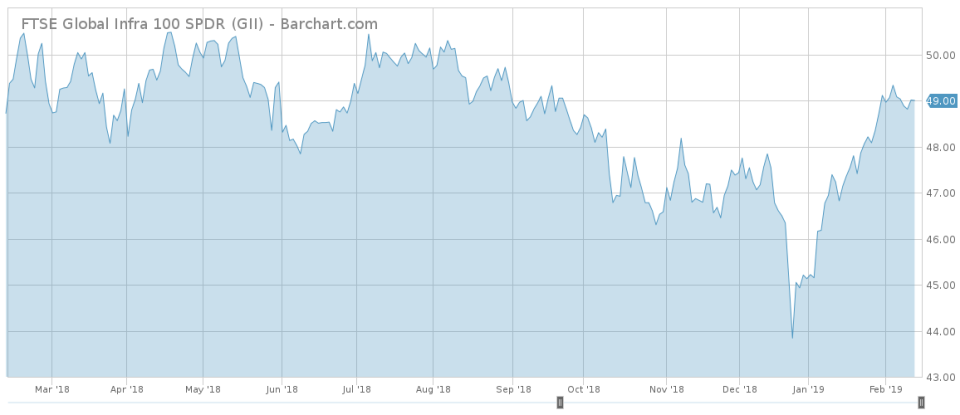

SPDR S&P Global Infrastructure ETF (GII B-), the second-largest product in the sector, offers exposure to both the U.S. and Australia. The ETF’s top holding, Melbourne-based Transurban Group, is involved in the 16.8 billion WestConnex project – the largest road infrastructure project currently underway in Australia, which is nearly 50% completed. The ETF rose 8.4% since the start of the year.

Use our Head-to-Head Comparison tool to compare two ETFs such as (GII B-) and (FDIV B) on a variety of criteria such as performance, AUM, trading volume and expenses.

Regional Banks Merge in Massive Deal

Regional banks jumped last week as the largest bank transaction in 10 years was announced. Viewership in the sector rose 74% as investors turned their attention to the banking scene.

BB&T (BBT) and SunTrust (STI), the third and fourth holdings of iShares U.S. Regional Banks ETF (IAT A-), said they have agreed to merge in a $66 billion deal. The all-stock merger is set to create the sixth-largest bank in the U.S., with roughly $442 billion in assets, $301 billion in loans and $324 billion in deposits.

Analysts argued that the resulting entity would breach the $250 billion in assets threshold and thus gain access to greater scale, improved cost efficiency and superior geographical reach. A possible rollback in financial regulation would open the floodgates to more bank acquisitions amid a renewed wave of consolidation.

Chemical Bank and TCF Bank took the same route last month when they announced a deal that is set to forge a $45 billion bank that would operate in nine states.

iShares U.S. Regional Banks ETF (IAT A-) has soared over the last month-and-a-half and now sits 17.35% above the level at which it started trading in 2019. However, a flattening yield curve and the low U.S. interest rates have been headwinds for financials, causing a drop for the ETF of 9.8% over the last 12 months.

Nickel Drives up the Metals Sector

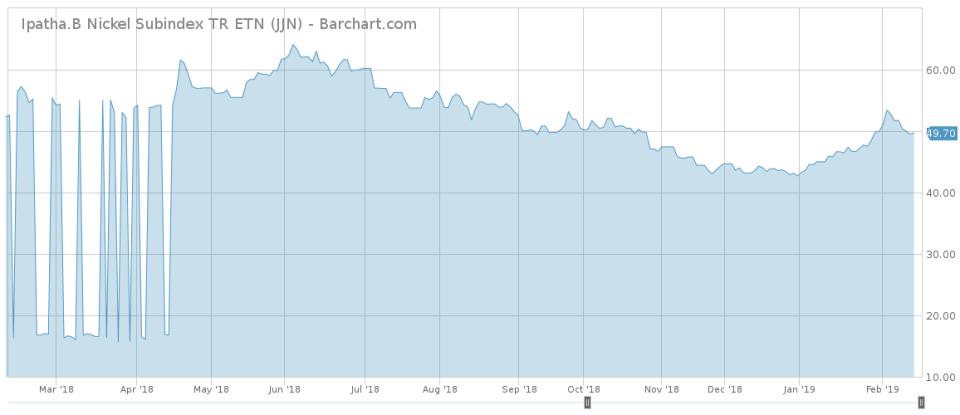

The metals sector has had a wild ride over the last few days as the Brazilian Brumadinho mining disaster was expected to take a toll on mining giant Vale. Traffic in metals rose by 34% as investors witnessed nickel’s surge to a five-month high of $13,35 per tonne on the London Metal Exchange.

Following the devastating tailings collapse in Vale’s Brumadinho iron ore mine, the company is expected to face regulatory scrutiny surrounding all of its tailings dams in Brazil, adding to the already complicated situation of Onca Puma mine. Brazilian authorities ordered a halt in activity at Vale’s Onca Puma smelter in November on environmental grounds. Onca Puma produced 25,000 tonnes of nickel in ferronickel in 2018.

Brazil may even ban all 88 tailings dams similar to the recently collapsed one at Brumadinho, according to talks held at Brazil’s National Mining Agency. London-based miner Anglo American also operates two ferronickel plants in Brazil and had a combined production of 42,000 tonnes in 2018.

iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN C+) surged accordingly over the last few days and holds a year-to-date performance of 15.2%.

U.S. Dollar

The greenback cooled after staging the longest rally in two years as investor sentiment drove up riskier bets. The U.S. dollar saw its traffic up 14% over the last week as officials on both sides of the Pacific engaged in discussions with the aim of reaching a lasting trade deal.

Global risks dwindled as a result of top U.S. officials arriving in Beijing on Tuesday for high-level talks. The eight-day rally came in spite of a dovish stance from the Federal Reserve at the latest meeting. Investors have proven cautious about taking risk with their portfolios during January as policymakers said that they would be “patient” before deciding on further rate hikes while maintaining a large balance sheet for the foreseeable future.

Invesco DB US Dollar Index Bullish Fund (UUP A) is trading 10.50% higher than a year ago as political tensions and financial strains in rival currencies like the euro and the British pound remain prevalent.

For a deeper analysis on individual ETF investments such as (IAT A-) or (UUP A), use our ETF Analyzer tool:https://etfdb.com/etf-analyzer/. You can select ETFs by Category or Type as well as add individual ticker symbols to compare performance, expenses and dividend yield, among other metrics.

The Bottom Line

The Maduro Administration is fighting for survival by relying on proceeds from the sale of gold reserves in an attempt to secure support from allies and counter the opposition’s move on the oil front. The U.S. president called for a fix to the nation’s decaying infrastructure, but congressional approval may prove difficult as funding issues divide the two parties. The largest bank merger in a decade pushed regional banks into this week’s list, while metals grew on supply worries. Lastly, the greenback staged an impressive rally since the start of February as trade tensions and Brexit angst engulfed markets.

For more ETF news and analysis, subscribe to our free newsletter.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.