Take-Two Interactive Software, Inc. (NASDAQ:TTWO): What's The Analyst Consensus Outlook?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

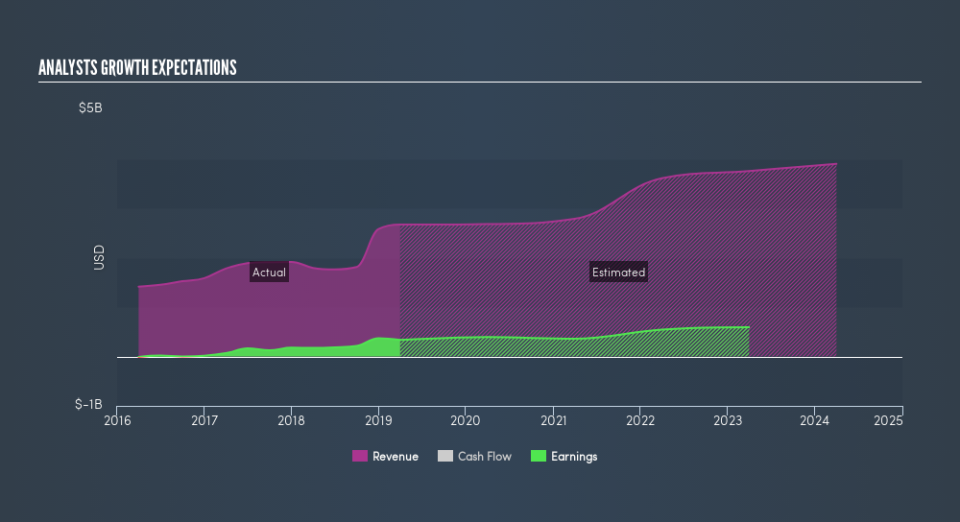

Take-Two Interactive Software, Inc.'s (NASDAQ:TTWO) latest earnings announcement in March 2019 indicated that the business experienced a strong tailwind, leading to a high double-digit earnings growth of 93%. Below is a brief commentary on my key takeaways on how market analysts predict Take-Two Interactive Software's earnings growth outlook over the next couple of years and whether the future looks even brighter than the past. Note that I will be looking at net income excluding extraordinary items to get a better understanding of the underlying drivers of earnings.

See our latest analysis for Take-Two Interactive Software

Analysts' expectations for next year seems positive, with earnings growing by a robust 17%. However, earnings is expected to fall in the following year before rising again to US$543m in 2022.

Although it is useful to be aware of the growth rate each year relative to today’s level, it may be more insightful to evaluate the rate at which the company is moving on average every year. The pro of this technique is that it ignores near term flucuations and accounts for the overarching direction of Take-Two Interactive Software's earnings trajectory over time, be more volatile. To calculate this rate, I've inserted a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is 13%. This means that, we can anticipate Take-Two Interactive Software will grow its earnings by 13% every year for the next few years.

Next Steps:

For Take-Two Interactive Software, I've compiled three key aspects you should further examine:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Valuation: What is TTWO worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether TTWO is currently mispriced by the market.

Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of TTWO? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.