U.S. Silica (SLCA) Tops Earnings and Sales Estimates in Q2

U.S. Silica Holdings, Inc. SLCA reported a net income of $22.9 million or 29 cents per share in second-quarter 2022 compared with $26 million or 34 cents per share in the year-ago quarter.

Barring one-time items, the adjusted earnings were 32 cents, beating the Zacks Consensus Estimate of 19 cents.

U.S. Silica generated revenues of $388.5 million, up 22.4% year over year. The figure surpassed the Zacks Consensus Estimate of $345.9 million.

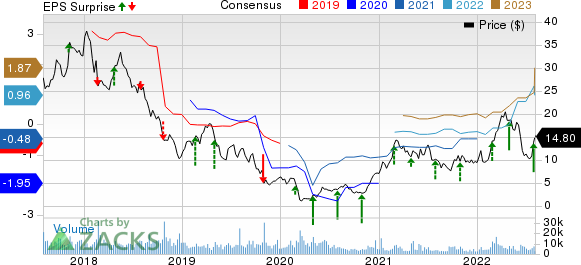

U.S. Silica Holdings, Inc. Price, Consensus and EPS Surprise

U.S. Silica Holdings, Inc. price-consensus-eps-surprise-chart | U.S. Silica Holdings, Inc. Quote

Segment Highlights

Revenues in the Oil & Gas division amounted to $244.2 million in the second quarter, up 26% year over year and 39% sequentially. Overall sales volume increased 17% year over year to 3.53 million tons. The Oil & Gas contribution margin rose 73% sequentially and 129% year over year to $77.4 million or $21.93 per ton.

Revenues in the Industrial & Specialty Products division amounted to $144.3 million in the second quarter, up 16% year over year and 12% sequentially. Overall sales volume increased 4% year over year to 1.124 million tons. The segment’s contribution margin was $45.9 million or $40.85 per ton in the quarter, up 21% sequentially and flat year over year.

Financials

At the end of the quarter, the company’s cash and cash equivalents were $312.4 million, up from $239.4 million as of Dec 31, 2021. Long-term debt was $1,190.3 million compared with $1,193.1 million as of Dec 31, 2021.

Outlook

For the third quarter and second-half 2022, U.S. Silica noted that its two business segments are well-placed for growth in their respective markets. It has a strong portfolio of Industrial and Specialty Products that serve several essential, high-growth and attractive end markets, backed by a strong pipeline of new products under development and pricing increases and surcharges, the company noted.

In the Oil & Gas segment, the company expects a multi-year growth cycle. The strength in WTI crude oil and natural gas prices supports an active well completions environment in 2022 and into 2023.

The company is focused on delivering free cash flow in 2022, deleveraging its balance sheet and plans to be operating cash flow positive in 2022. It forecasts capital expenditures in the range of $40-60 million.

Price Performance

Shares of U.S. Silica have surged 58.5% in the past year against a 28.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

U.S. Silica currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Albemarle Corporation ALB, Cabot Corporation CBT and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle has a projected earnings growth rate of 247% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 7.8% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 22.5%, on average. ALB has gained around 17.9% in a year and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cabot, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 22.5% for the current year. The Zacks Consensus Estimate for CBT's earnings for the current year has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 36.8% over a year.

Sociedad has a projected earnings growth rate of 513.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 57.8% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average being 28.2%. SQM has gained 103.2% in a year. The company sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research