Uber officially files paperwork for IPO, ending months of speculation

Ride sharing behemoth Uber filed paperwork with regulators to go public on Thursday, after rival Lyft became the first to tap the markets in what is shaping up to be a banner year for technology initial public offerings.

On Thursday, Uber’s SEC paperwork revealed it plans to seek a listing on the New York Stock Exchange, under the ticker “UBER” — but did not specify a price range for the shares.

On March 30, Uber’s chief rival, Lyft, went public amid a flurry of investor euphoria— only to sink rapidly below its IPO price to a record low, as bearish sentiment engulfed the shares.

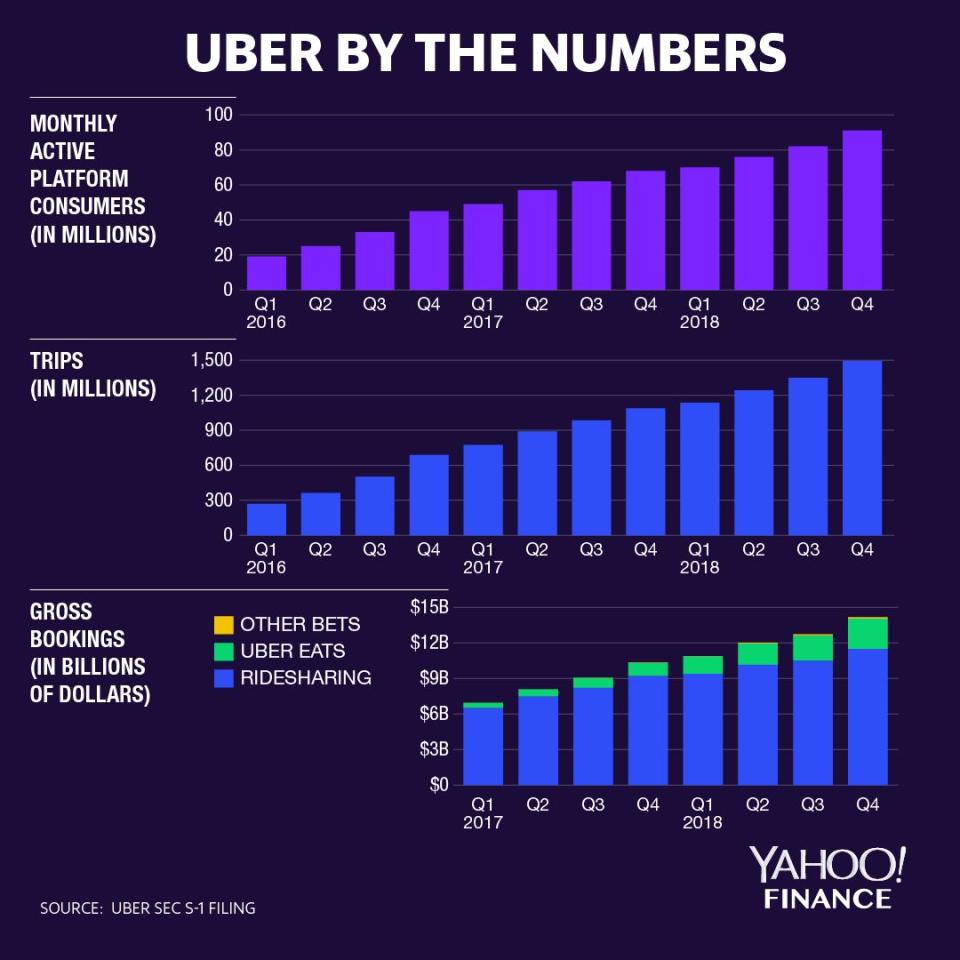

Seeking to allay market concerns that have hammered Lyft’s stock, Uber said it swung to a profit of nearly $1 billion last year, up from a $4 billion loss in the year prior, driven largely by the sale of assets connected to Uber's transactions with Grab and Yandex, and an unrealized gain on investments. The company also said it earned revenue of more than $11 billion during 2018.

Taking a page from Lyft’s book, Uber also said it would use the IPO proceeds to dole out cash “appreciation” awards to its drivers.

Depending on the number of lifetime trips a driver has amassed, the company plans to give them between $100 - $10,000 each. Both Lyft and Uber have been hit by accusations of underpaying and overworking their drivers, and have been the subject of protests in major cities.

Seemingly chastened by Lyft’s experience, Uber is expected to aim for a lower valuation, as well as a more generous initial price.

Uber’s filing ends months of speculation, and makes the company the latest ‘unicorn’ — a private firm worth over $1 billion — to tap the public markets. To date, Uber has raised over $20 billion in private capital.

Both Uber and Lyft have disrupted the way people travel short distances, particularly in big cities with once-thriving cab markets.

However, there are big questions surrounding both companies’ ability to turn a profit, and whether investors will continue to throw cash into enterprises that can’t turn a profit.

“Lyft's IPO was supposed to be a watershed moment for the highly anticipated 2019 tech IPO class,” Wedbush analysts said in a research note on Thursday.

“With Uber, investors will soon have a second option to make a bet on the future of mobility and transportation with the clear market share leader, while competitor focus will likely also zero in on Waymo/Google and even the traditional auto sector which is investing in autonomous vehicles in its own right,” the firm added.

Back in December, the company filed a confidential S-1 with the Securities and Exchange Commission, hinting that it could go public sometime in the first half of 2019.