Uber Technologies Stock Targeted for Bearish Options Trade

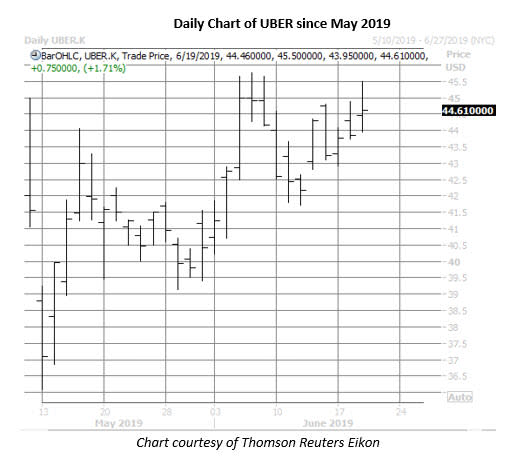

Uber Technologies Inc (NYSE:UBER) stock is trading up 1.7% at $44.61 this afternoon, heading for its third straight win. However, this rally ran out of steam earlier at $45 -- site of the ride-sharing service's initial public offering (IPO) -- and one options trader today appears to be positioning for a sharper retreat from here in the near term.

UBER options volume is accelerated today, with 36,000 calls and 13,500 puts on the tape, 1.3 times the expected intraday amount. The weekly 6/28 44-strike put is one of Uber's most active options at last check, due to two large sweeps totaling 2,255 contracts that were likely bought to open earlier. By doing so, the put buyer expects the stock to swing below $44 by expiration at the close next Friday, June 28.

This put buying runs counter to the broader trend seen in Uber's options pits. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), speculative players have bought to open 58,793 calls in the past two weeks, compared to 12,933 puts.

This optimism is seen among analysts, too, even though Uber Technologies has struggled on the charts. More specifically, the stock opened for trading on May 10 at $42 -- below Uber's IPO price -- and dropped to a record low of $36.08 on May 13. While the shares rallied all the way up to $45 earlier this month, the key level has served as staunch resistance.