UK house prices rise at fastest pace in 18 months

House prices in the UK are rising at their fastest pace in 18 months, in another sign the ‘Boris bounce’ has increased confidence in the UK economy.

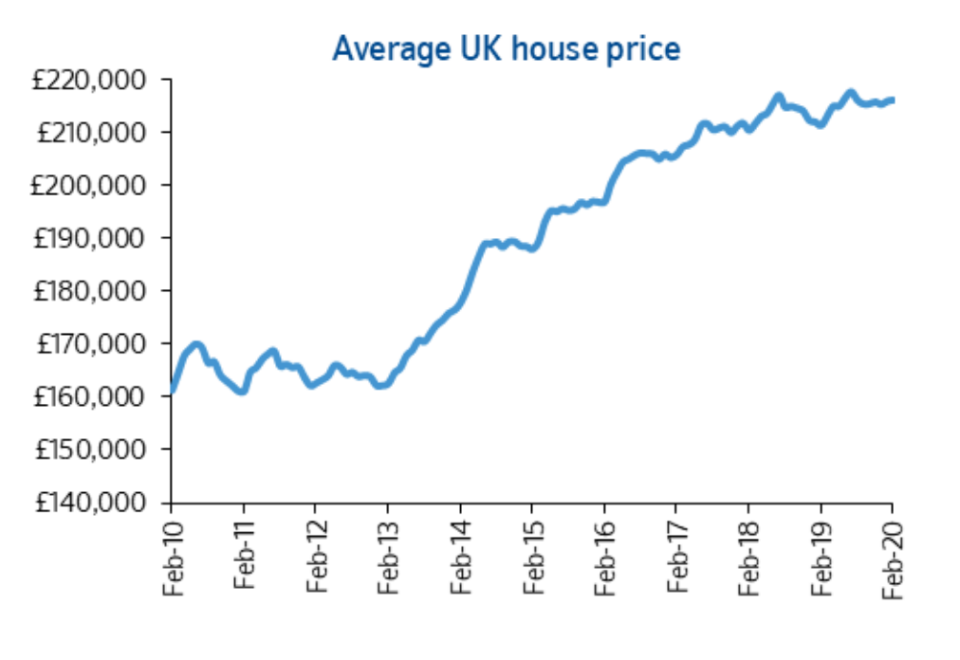

Average prices leapt 2.3% in the year to February, figures from Nationwide’s closely watched house price index suggest.

The average home bought on a mortgage from the lender cost just over £216,000 ($280,968) last month, up from £211,300 a year earlier.

It marked a significant rise in the pace of growth on January, when prices were up 1.9% year-on-year.

Read more: Houses cost millennials 14 times more than baby boomers

Robert Gardner, Nationwide's chief economist, said record employment and low borrowing costs are sustaining the property market despite the sluggish wider economy, according to Gardner.

He said prime minister Boris Johnson’s decision election victory last year may have “provided a boost to buyer sentiment.”

Many surveys and retail sales figures show a wider lift to business and consumer confidence and spending in recent months since the election.

But Gardner said “significant uncertainties” could still prove a drag on growth this year, with Nationwide expecting prices to remain broadly flat in 2020.

He pointed to a “challenging” global economic backdrop, the coronavirus outbreak and Britain’s global trade negotiations.

Read more: Landlord numbers fall to seven-year low after government clampdown

Jonathan Hopper, CEO of Garrington Property Finders, said the latest figures indicated the “Boris bounce is clearly no blip.”

“The flock of New Year househunters has been swelled by thousands of would-be buyers who sat on their hands last year while the Brexit drama played out.

“Sellers too are coming out of the woodwork, meaning the market is seeing a simultaneous boost in both demand and supply,” he noted.