UnitedHealth's (UNH) Earnings in Q2 Beat on Lower Payouts

UnitedHealth Group Inc.’s UNH second-quarter 2020 earnings of $7.12 per share surpassed the Zacks Consensus Estimate by 37.45%. This also compares favorably with earnings of $3.60 per share a year ago.

Better-than-expected earnings were driven lower by an unprecedented, temporary deferral of care in the company’s risk-based businesses, as hospital elective payouts were put on hold due to the coronavirus outbreak.

Led by an earnings beat, shares of the company inched up 0.9% in pre-market trading.

UnitedHealth’s revenues of $62.1 billion missed the Zacks Consensus Estimate by 2.7%. However, the top line improved 2.5% year over year, aided by broad-based revenue growth at Optum and UnitedHealthcare.

Medical care ratio of 70.2% improved 1290 basis points year over year, mainly owing to the temporary deferral of care amid the pandemic.

The operating cost ratio of 16.1% increased 220 basis points due to the health insurance tax, COVID-19 response efforts and business mix.

Total operating cost of $52.9 billion was down 5.3% year over year, mainly on account of lower medical costs.

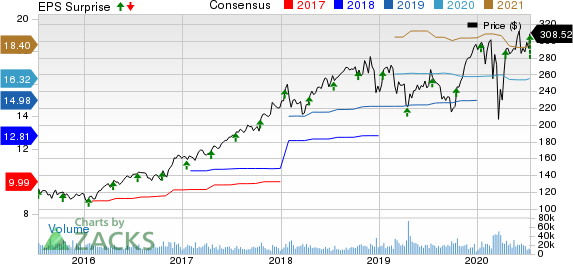

UnitedHealth Group Incorporated Price, Consensus and EPS Surprise

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

Strong Segmental Performances

In the reported quarter, the company’s health benefits segment, UnitedHealthcare, generated revenues worth $49.1 billion, up 1% year over year. Revenue growth was attributable to strong Medicare Advantage and dual special needs plans, partly offset by a decline in commercial enrollment.

The company’s business groups, namely Medicare and Retirement plus Community and State contributed to growth, partly offset by lower contribution from Employer and individual and Global segments. Earnings from operations worth $7 billion were up from $2.6 billion last year, backed by the temporary impact of deferred care, net of COVID-19 treatment costs and the initial impact of a decelerating economy.

Revenues from another segment, Optum, improved 16.8% year over year to $32.7 billion, reflecting robust contributions from the sub-segments of OptumHealth (up 27.8%), OptumInsight (12.6%) and OptumRx (up 13%). Earnings from operations rose 6.3% year over year to $2.2 billion.

The segment gained from the company’s efforts in different areas, which included extending geographic presence and adding distinctive capabilities through strategic acquisitions in infusion services (Diplomat Pharmacy), post-acute care (NaviHealth) and digital behavioral health (AbleTo); launching the Boulder Community Health partnership; providing testing services in California, Indiana and Florida and introducing digital-at-home and rare-disease pharmacy programs.

Decline in Membership Enrollment

The company served 48.4 million people in the quarter, down 2.2% year over year, thanks to lower member enrollment in the Commercial and International business.

During the first six months of 2020, cash flow from operations of $12.94 billion surged 42.1% year over year.

Mixed Capital Position

Cash and short-term investments as of June 30, 2020 were $25.59 billion, up 79.7% from the level as of Dec 31, 2019.

Long-term debt of $39.9 billion at June-end was up 8.4% from the level at 2019 end.

2020 Guidance Intact

The company reaffirmed its earlier-issued earnings outlook for 2020 including net earnings of $15.45-$15.75 per share and adjusted net earnings of $16.25-$16.55. Further revisions for earnings will depend on how the COVID-19 pandemic unleashes it effect on the company’s business.

Zacks Rank

UnitedHealth has a Zacks Rank #2 (Buy), currently.

Upcoming Releases

Some stocks worth considering from the same sector with the perfect combination of elements — a positive Earnings ESP and a Zacks Rank #1(Strong Buy), 2 (Buy) or 3 (Hold) — to surpass on earnings this time around are Centene Corp. CNC , Molina Healthcare, Inc. MOH and Anthem. Inc. ANTM. You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.