Urban Outfitters (URBN) Gains 24.2% in 6 Months: Here's Why

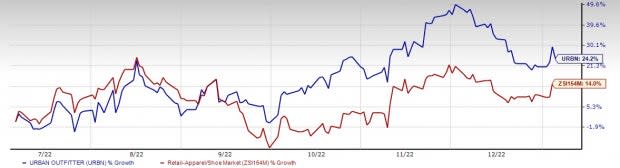

Urban Outfitters, Inc. URBN seems a promising bet, thanks to its solid growth strategies and sound fundamentals. Management has been strengthening its direct-to-consumer business, enhancing productivity across the existing channels and optimizing inventory levels. URBN’s strategic growth initiative, FP Movement and store-growth endeavors are also impressive. Markedly, shares of this Philadelphia, PA-based player have gained 24.2% outperforming its industry’s 14% rise over the past six months.

Additionally, analysts look optimistic about this Zacks Rank #2 (Buy) stock. For fiscal 2023, the Zacks Consensus Estimate for URBN’s sales is currently pegged at $4.77 billion, suggesting 4.8% growth from the year-ago period’s corresponding figure. For fiscal 2024, the consensus estimate for sales and earnings per share (EPS) presently stands at $4.91 billion and $2.23, respectively, indicating an increase of 3% and 27.9% each from the comparable previous fiscal year’s actuals.

Strategic Discussion

Being a multi-brand and multi-channel retailer, Urban Outfitters offers a flexible merchandising strategy. The company also has a significant domestic and international presence with rapidly expanding e-commerce activities. In addition, the company’s FP Movement and AnthroLiving initiatives hold promise. Management had earlier said that AnthroLiving has the potential to become at least a $1-billion business with the size of Anthro's apparel business.

Regarding the FP Movement, management believes that this initiative will lure a wider customer base to its Free People brand. Having a differentiated position in the fitness and wellness space, the FP Movement offers a major growth opportunity and is expected to boost Free People’s brand revenues. Impressively, the FP brand witnessed an outstanding fiscal third quarter, generating 28% retail segment growth.

Image Source: Zacks Investment Research

In addition, management remains optimistic about the prospects of Nuuly. Nuuly comprises the Nuuly Rent and Nuuly Thrift brands. During the fiscal third quarter, Nuuly contributed $35.3 million to net sales, reflecting an increase from $12.7 million recorded in the earlier fiscal year’s comparable period, backed by a sharp rise in subscribers. On a quarter-over-quarter basis, active subscribers increased 37%, outpacing the 100,000 sub milestone in early October. Currently, the number of active subscribers is in excess of 120,000. This is likely to keep fueling the company’s overall sales.

What Else?

Urban Outfitters reported third-quarter fiscal 2023 results, wherein the top line beat the Zacks Consensus Estimate and grew from the year-ago fiscal quarter’s tally. Net sales for the three months ending Oct 31, fiscal 2023, rose 3.9% from the same-period level of fiscal 2022 to $1,175.3 million. Brandwise, net sales were up 12.2% from the comparable period’s level in fiscal 2022 to $484.2 million at Anthropologie Group and 5.9% to $280.7 million at Free People. Nuuly contributed $35.3 million to net sales, reflecting an increase from $12.7 million recorded in the earlier fiscal year’s comparable period. Menus & Venues’ net sales amounted to $7.7 million, up 18.5% from the level recorded in the prior fiscal year’s corresponding period.

Based on the sales expectations, management anticipates the company’s Retail segment comp sales to come in low single-digit positive for the fiscal fourth quarter. Growth in the Retail and Nuuly segments is likely to be somewhat offset by reduced sales in the Wholesale segment.

Solid Picks in Retail

We highlighted three top-ranked stocks, namely Tecnoglass TGLS, Chico's FAS CHS and Boot Barn BOOT.

Tecnoglass manufactures and sells architectural glass and windows and aluminum products for the residential and commercial construction industries. TGLS currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and EPS suggests growth of 11.2% and 9%, respectively, from the year-ago reported figures. TGLS has a trailing four-quarter earnings surprise of 26.9%, on average.

Chico's FAS, an omnichannel specialty retailer, currently sports a Zacks Rank of 1. CHS has a trailing four-quarter earnings surprise of 87.5%, on average.

The Zacks Consensus Estimate for Chico's FAS’s current financial-year sales and EPS suggests growth of 19.6% and 127.5%, respectively, from the year-ago reported figures.

Boot Barn, a fashion retailer of apparel and accessories, currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 11.7%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 11.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Chico's FAS, Inc. (CHS) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report