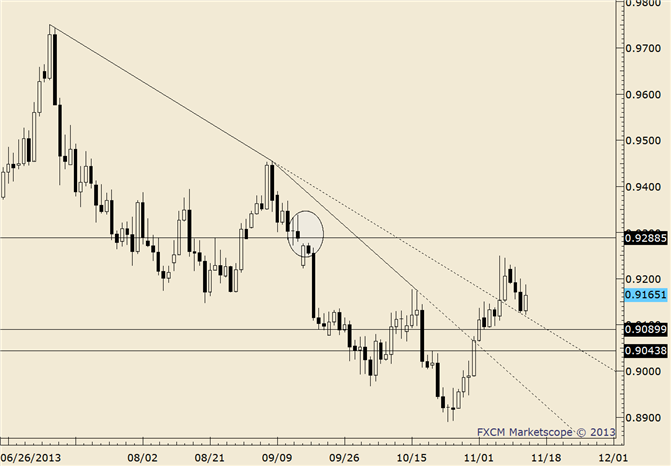

USD/CHF .9640 is a Level to Watch for a Near Term Low

60Minute

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

FOREXAnalysis: An inverse head and shoulders pattern that began exactly 8 months ago (9/14/12) was confirmed Tuesday in the USDCHF. The target from the pattern is 1.0111. In the ‘year of the breakout’, ignore such patterns at your own risk. Wrote Wednesday that “channel resistance won today but look for support at the broken upward sloping channel line and neckline (both in blue).” The neckline served as support Thursday and price is putting corrective channel resistance to the test. A break above the channel would indicate that the rally is accelerating from that point to much higher levels…and eliminate a corrective interpretation of the advance from .9021. The blue channel is a microcosm of the black channel. Any setbacks are viewed as opportunities to buy against .9520. If price fails to hold .9640, then a drop below .9577 could complete a flat correction.

FOREXTrading Strategy: Have been increasing longs on near term bullish patterns. Looking for support at .9640. Am bullish above .9520 with .9900 target and 1.0100.

LEVELS: .9520 .9577 .9642 .9722 .9760 .9898

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.