VBI Vaccine (VBIV) Inks Deal With Agenus for Brain Cancer Study

VBI Vaccines VBIV stock increased almost 7% on Oct 12 after the company announced a collaboration with Agenus Inc AGEN to evaluate its cancer vaccine immunotherapeutic, VBI-1901 in combination with Agenus’ anti-PD-1 therapy balstilimab for primary glioblastoma (GBM)

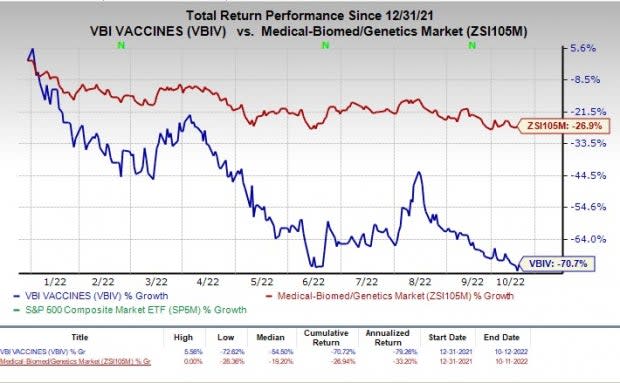

Shares of VBI Vaccines have declined 70.7% in the year-to-date period compared with the industry’s fall of 26.9%.

Image Source: Zacks Investment Research

Shares of Agenus have declined 21.1% compared with the industry’s fall of 26.9% this year.

Image Source: Zacks Investment Research

GBM is among the most common and aggressive malignant primary brain tumors in humans but it still has limited treatment options.

The study, which is a part of INSIGhT adaptive platform, is expected to evaluate the efficacy of VBI-1901 in combination with balstilimab in frontline GBM patients following primary tumor resection and radiotherapy. The combination study is expected to start by the end of 2022.

As part of the agreement, VBI will be responsible for the operational execution of the combination study, while Agenus will focus on drug supply and provide scientific support.

VBI Vaccines’ VBI-1901 is a cancer vaccine immunotherapeutic used to treat multiple solid tumors, including GBM. The candidate is currently being evaluated in an ongoing phase II study in recurrent GBM patients. In the latest data reported from the study, once recurrent GBM patient remains on protocol beyond two and a half years with a sustained 93% tumor reduction relative to baseline.

Based on the latest data, VBI Vaccines also intends to initiate a randomized controlled extension study evaluating VBI-1901 in recurrent GBM patients in the fourth quarter of 2022.

Agenus’ balstilimab is a programmed death receptor-1 (PD-1) monoclonal antibody that blocks the PD-1 protein, an important barrier that prevents T-cells from attacking cancer. Agenus had submitted a biologics license application (BLA) for balstilimab as a monotherapy for treating cervical cancer. However, the company decided to withdraw the BLA for balstilimab in October 2021, following the FDA approval for Merck’s Keytruda (pembrolizumab) for the same indication. Balstilimab is currently being studied in combination with Agenus’ other pipeline candidates for treating other cancer indications.

VBI Vaccines, Inc. Price

VBI Vaccines, Inc. price | VBI Vaccines, Inc. Quote

Agenus Inc. Price

Agenus Inc. price | Agenus Inc. Quote

Zacks Rank and Stocks to Consider

VBI Vaccines currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector include Immunocore IMCR, carrying a Zacks Rank #1 (Strong Buy), Acadia Pharmaceuticals ACAD, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Immunocore’s loss per share estimates for 2022 narrowed down from $1.48 to $1.46 in the past 30 days. The same for 2023 has widened from $1.63 to $1.65 in the same time frame.

Earnings of Immunocore missed estimates in three of the trailing four quarters, while beating the same in the reaming occasion. The average earnings surprise for IMCR is 33.28%.

Acadia’s loss per share estimates for 2022 have narrowed from $1.30 to $1.29 in the past 30 days. The loss per share for 2023 has narrowed from 67 cents to 60 cents in the same time frame.

Earnings of Acadia beat estimates in two of the trailing four quarters, while missing the same on the remaining two occasions. The average negative earnings surprise for STSA is 6.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agenus Inc. (AGEN) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

VBI Vaccines, Inc. (VBIV) : Free Stock Analysis Report

Immunocore Holdings PLC Sponsored ADR (IMCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research