Vipshop: Should You Buy the Post-Earnings Pop?

- By Nicholas Kitonyi

Shares of Chinese online discount retailer Vipshop Holdings Ltd. (NYSE:VIPS) popped 5% after posting strong third-quarter results before the opening bell on Friday.

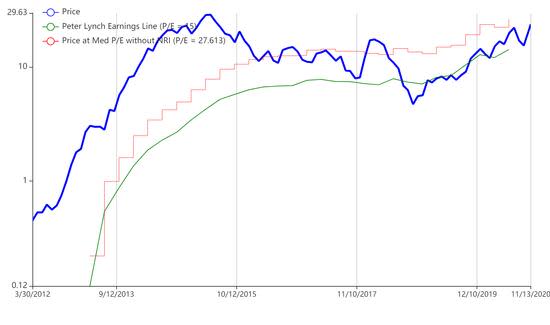

Shares of the Guangzhou-based company are now up more than 50% over the last five weeks and 55% this year. The recent surge in price values the stock above the Peter Lynch earnings line, which suggests it could be overvalued.

However, when we factor in expected growth, there could be some room left to run going into the tail-end of the year.

Highlights from recent quarterly results

In the company's most recent quarterly results, Vipshop's earnings per share soared 20% to 30 cents, which beat analysts' expectations of 26 cents. The company's top line also posted a significant year-over-year growth of 24.42% to $3.41 billion, again outperforming the consensus estimate of $3.26 billion.

The company expects to post revenue in the range of $4.96 billion to $5.18 billion in the fourth quarter. If it meets this projection, then it will represent a significant increase from the prior-year quarter. The company is on track to post double-digit, year-over-year top-line growth for the full year.

Vipshop operates in the online retail market, which, unlike several other industries, was more resistant to the adverse effects of the Covid-19 lockdowns.

Valuation

From a valuation perspective, Vipshop trades at a price-earnings ratio of about 25.94, which compares positively to the price-earnings ratio of fellow Chinese online retailer JD.com Inc.'s (NASDAQ:JD) multiple of 42.22. On the other hand, NetEase Inc. (NASDAQ:NTES) has an earnings multiple of 79.75.

When we factor in expected earnings growth for the next 12 months, shares of Vipshop trade at a forward price-earnings ratio of about 15.70. JD.com's forward price-earnings ratio is 38.61, while NetEase's equivalent is 19.01. On the other hand, China's largest interactive e-commerce platform, Pinduoduo Inc. (NASDAQ:PDD) trades at a forward price-earnings ratio of 163.93.

Comparatively, Vipshop appears to be cheaply valued relative to its closest peers. However, the stock's trailing price-earnings ratio of over 25 puts its current market value above the Peter Lynch earnings line. This indicates overvaluation.

But looking further forward, Vipshop appears set to continue growing earnings at least for the next 12 months. This could be the reason behind its current premium valuation, which still looks cheap relative to industry peers.

The company also operates in an industry that tends to attract high valuation multiples. This offers further justification for the high price-earnings ratio.

Disclosure: No positions in the stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.