Walgreens Boots Alliance Looks a Bit Under the Weather

Walgreens Boots Alliance Inc.'s (NASDAQ:WBA) stock appears to be a bit under the weather, with its share price dipping as the pandemic continues to wane.

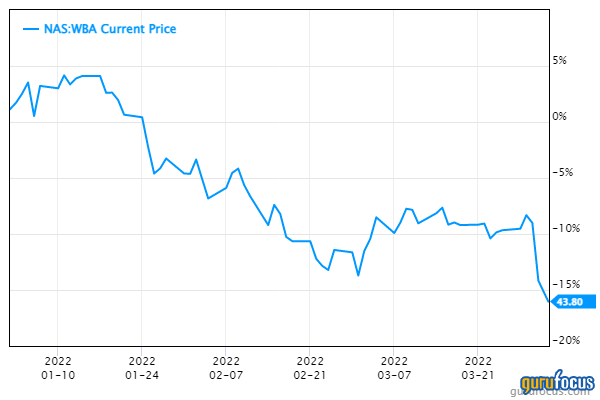

The drugstore chains shares have dropped more then 16% so far this year as the Omicron variant that buoyed its business, led by vaccinations and tests, continues thinning. Thursdays market close saw the stock trading at $44.77. Shortly before noon on Friday, shares stood at $43.57, down 2.68% or $1.20.

The retail chains continued transition into more of a health care company complete with new hiring, store remodels and the opening of hundreds of medical offices is proving to be an expensive endeavor, something that Wall Street analysts have also taken note of.

The Deerfield, Illinois-based company on Thursday announced financial results for the second quarter of fiscal 2022, which ended Feb. 28. Earnings per share from continuing operations were $1.02, a decrease compared with earnings of $1.06 per share in the year-ago quarter. Continuing operations adjusted earnings increased 25.9% to $1.59 per share, up 26.5% on a constant currency basis. Sales from continuing operations increased 3% over the year-ago quarter to $33.8 billion, up 3.8% on a constant currency basis, while operating income from continuing operations increased to $1.2 billion from $832 million.

CEO Rosalind Brewer said in a statement that second-quarter results demonstrated broad-based execution, driving strong comparable sales and robust earnings growth."

"We continue to make important strides along our strategic priorities, building a consumer-centric, technology-enabled healthcare enterprise at the center of local communities, she said. "VillageMD and Shields are delivering tremendous pro forma sales growth compared to their year-ago standalone results, and our Walgreens Health segment is on track toward long-term targets. The strategic review of our Boots business is progressing, and our transformational actions are accelerating sustainable value creation."

Sales from continuing operations in the first six months of the year were $67.7 billion, according to a release, an increase of 5.4% from the same period a year ago and an increase of 5.7% on a constant currency basis, reflecting strong comparable sales growth at Walgreens and in the international segment.

Operating income from continuing operations in the first six months of fiscal 2022 was $2.5 billion compared to $298 million in the same period a year ago. This was partly driven by a $1.5 billion charge from the company's equity earnings in AmerisourceBergen in the year-ago period, the company noted. Adjusted operating income from continuing operations in the first six months of year was $3.4 billion, an increase of 41.8% on a reported basis and up 42.1% on a constant currency basis. The increases reflect strong adjusted gross profit growth across both pharmacy and retail in the U.S. and a continued rebound in international segment sales and profitability, partly offset by growth investments in Walgreens Health.

For the first six months of fiscal 2022, net earnings from continuing operations increased $3.9 billion compared to the same period a year earlier, to $4.5 billion, reflecting a $2.5 billion after-tax gain in the first quarter due to the valuation of the company's previously held minority equity and debt investments in VillageMD and Shields, and the lapping of a $1.2 billion charge, net of tax, from the company's equity earnings in AmerisourceBergen in the year-ago period. Adjusted net earnings from continuing operations increased 39% in constant currency to $2.8 billion.

Earnings per share from continuing operations for the first six months of the year increased $4.54 to $5.15, compared to the same period a year ago, management said. Adjusted earnings from continuing operations were $3.27 per share, an increase of 38.6% on a reported basis and an increase of 38.8% on a constant currency basis.

This article first appeared on GuruFocus.