Warren Buffett's Stocks Near 52-Week Lows Include Wells Fargo, Goldman Sachs

- By Holly LaFon

Earlier this year, investors had the chance to buy three Warren Buffett-approved stocks at their lowest prices in a year: The Kraft Heinz Co. (KHC), Procter & Gamble Co. (PG) and Coca-Cola Co. (KO). Price changes in Procter & Gamble and Coca-Cola stock have since moved them off the list, but four of his other holdings have since replaced them. Buffett stocks General Motors (GM), Axalta Coating Systems Ltd. (AXTA), Goldman Sachs Group Inc. (GS) and Wells Fargo & Co. (WFC) have all descended to their 52-week lows.

Warning! GuruFocus has detected 4 Warning Signs with KHC. Click here to check it out.

The intrinsic value of KHC

The stocks appear as particular bargains considering the torrid path of the S&P 500, which has pushed to record highs in September with an 8.48% gain year to date. But the index, weighted by market cap, is most heavily populated at 21% by the best-performing sector, information technology, which has risen 18.4% this year. Other pockets of the market have had a less illustrious performance. Financial stocks, including Buffett's 52-week low picks Goldman Sachs and Wells Fargo, have declined 0.79% year to date.

Buffett tends to pick stocks according to certain criteria. Most of his companies will feature consistent earnings power, a wide competitive advantage or "moat," simple business model and capable management. In short, he likes to buy "wonderful" companies at "fair" prices.

His portfolio contained 44 stocks with a value of $195.6 billion at the end of the second quarter. Some of the stocks listed may have been purchased by two of his fellow portfolio managers at Berkshire Hathaway (BRK-A)(BRK-B), Ted Weschler and Todd Combs.

Stocks near 52-week lows

General Motors Co.

Auto manufacturer General Motors trades 2.08% above its 52-week low. It declined 22% in the past year to close at $34 Wednesday.

General Motors Co. has a market cap of $47.97 billion. It has a price-earnings ratio of 0.34. The trailing 12-month dividend yield is 4.46%. The forward dividend yield is 4.56%. General Motors Co. had annual average earnings growth of 20.10% over the past five years.

The Kraft Heinz Co.

Kraft Heinz is trading 3.77% above its 52-week low. Down 29% year to date, the stock closed at $55.60 per share Wednesday.

The Kraft Heinz Co. has a market cap of $67.79 billion; its shares were traded with a price-earnings ratio of 6.40 and price-sales ratio of 2.59. The trailing 12-month dividend yield of is 4.47%. The forward dividend yield is 4.47%.

Axalta Coating Systems Ltd. (AXTA)

Axalta Coating Systems, a manufacturer of automotive coatings systems, trades 3.89% above its 52-week low. The stock is down 2% over the past year to $28.80 per share Wednesday.

Axalta Coating Systems Ltd. has a market cap of $6.94 billion; its shares were traded with a price-earnings ratio of 52.42 and price-sales ratio of 1.53. Axalta Coating Systems Ltd. had annual average earnings growth of 10.80% over the past five years.

Goldman Sachs Group Inc. (GS)

Buffett's Goldman Sachs Group Inc. trades 4.11% above its 52-week low. The investment bank's stock declined 5% over the past year to $227.80 per share Wednesday.

Goldman Sachs Group Inc. has a market cap of $86 billion; its shares were traded with a price-earnings ratio of 17.86 and price-sales ratio of 2.78. The trailing 12-month dividend yield of Goldman Sachs Group Inc. is 1.36%. The forward dividend yield is 1.42%.

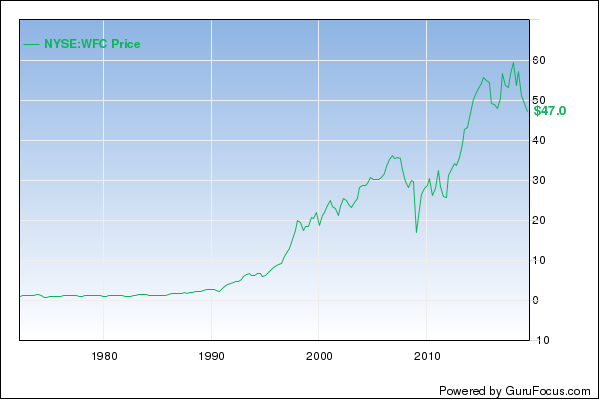

Wells Fargo & Co. (WFC)

Wells Fargo & Co., one of Buffett's larger positions at 12.8% of his portfolio, trades 4.34% above its 52-week low. After sliding 4% over the past year, the bank's stock closed at $42.60 on Wednesday.

Wells Fargo & Co. has a market cap of $253.57 billion; its shares were traded with a price-earnings ratio of 13.25 and price-sales ratio of 3.01. The trailing 12-month dividend yield is 3.06%. The forward dividend yield is 3.30%.

See Warren Buffett (Trades, Portfolio)'s portfolio here.

Read more articles about Warren Buffett (Trades, Portfolio) here:

4 Manufacturing Companies Gurus Agree On

Warren Buffett's Pension Advice Is Easy but Only If You're Committed

US Markets Start 4th Quarter Significantly Overvalued

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with KHC. Click here to check it out.

The intrinsic value of KHC