Weekly CEO Buys Highlight

According to GuruFocus insider data, these are the largest CEO buys from the past week.

Gannett

Gannett Co. Inc. (NYSE:GCI) CEO Michael Reed bought 285,000 shares on Nov. 21 for an average price of $6.61. The share price has decreased by 3.78% since then.

Gannett operates as a media and marketing solutions company. It offers 260 print and digital daily and non-daily publications under the USA Today Network brand name in the U.S. and Newsquest, which has a print and online publications portfolio of approximately 150 news brands and 150 magazines in the United Kingdom. It also provides commercial printing and distribution, marketing and data services.

The company has a market cap of $781.52 million. Its shares traded at $6.36 as of Nov. 29. On Nov. 19, New Media Investment Group Inc. and Gannett announced the successful completion of the acquisition of Legacy Gannett by New Media for a combination of cash and stock. The combined company adopted the name Gannett and trades on the New York Stock Exchange under the ticker GCI.

Director Maria M. Miller bought 8,000 shares on Nov. 22 for an average price of $6.59. Since then, the share price has decreased by 3.49%.

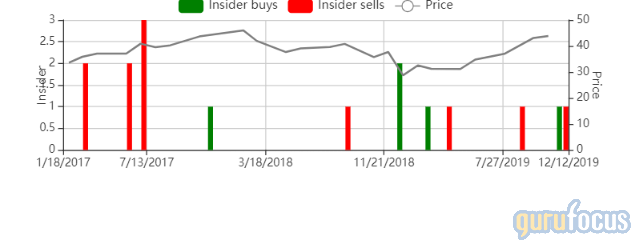

Aramark

Aramark (NYSE:ARMK) CEO John J. Zillmer bought 35,000 shares on Nov. 21 for an average price of $42.68. The stock has increased by 2.25% since then.

Aramark provides food, facilities and uniform services to a variety of clients and institutions. The majority of company revenue comes from its North American food and support services segment. Smaller but substantial segments include food and support services international and uniform and career apparel.

The company has a market cap of $10.89 billion. Its shares traded at $43.64 with a price-earnings ratio of 24.52 as of Nov. 29. Net income for the fourth quarter of 2019 was $86 million compared to the year-ago quarter, when net income was $175 million.

Executive Vice President of Human Resources Lynn McKee sold 250,000 shares on Nov. 27 at a price of $44.14. Since then, the price of the stock has decreased by 1.13%.

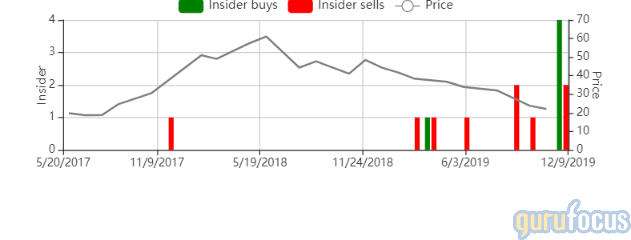

ServiceNow

ServiceNow Inc. (NYSE:NOW) President and CEO William R. McDermott bought 3,600 shares on Nov. 25 at a price of $278.93. The share price has increased by 1.47% since then.

ServiceNow is a software-as-a-service company that develops ITSM software for enterprise-level customers. Its service management solutions also reach other areas of the enterprise, including human resource, finance, legal and marketing. It is also attempting to expand beyond the service management market and into information technology operations management, or ITOM, with solutions for cloud provisioning, configuration automation and event management, among others.

The company has a market cap of $53.38 billion. Its shares traded at $283.04 with a price-earnings ratio of 1,581.23 as of Nov. 29. Net income for the third quarter of 2019 was $40.60 million compared to $8.41 million for the prior-year period.

President of Global Customer Operations David Schneider sold 5,000 shares on Nov. 25 at a price of $283.5. Since then, the share price has decreased 0.16%.

Chief Product Officer Chirantan Jitendra Desai sold 1,715 shares on Nov. 13 for an average price of $249.44 and 2,836 shares on Nov. 18 for $258 per share. The stock has climbed 9.71% since then.

Chief Talent Officer Patricia L. Wadors sold 3,956 shares on Nov. 18 at a price of $258. Since then, the share price has increased by 9.71%.

Principal Accounting Officer Fay Sien Goon sold 147 shares on Nov. 18 at a price of $259.51. The stock has increased 9.07% since then.

UroGen Pharma

UroGen Pharma Ltd. (NASDAQ:URGN) CEO Elizabeth A. Barrett bought 7,530 shares on Nov. 21 at a price of $28. Since then, the stock has gained 13%.

UroGen Pharma is a clinical-stage biopharmaceutical company focused on developing novel therapies designed to change the standard of care for urological pathologies.The company's lead product candidates, MitoGel and VesiGel, are proprietary formulations of the chemotherapy drug Mitomycin C, or MMC, a generic drug, which is used off-label for urothelial cancer treatment only in a water-based formulation as an adjuvant, or supplemental post-surgery, therapy.

The company has a market cap of $663.80 million. Its shares traded at $31.64 as of Nov. 29. Net loss for the third quarter of 2019 was $22.25 million compared to a loss of $20.53 million for the same period of 2018.

Barrett also bought 1,548 shares on Nov. 15 at a price of $26 and 7,470 shares on Nov. 20 at a price of $28. The price of the stock has increased by 13% since then.

Chief Financial Officer Peter P. Pfreundschuh sold 354 shares on Nov. 20 at a price of $28.41. Since then, the price of the stock has increased by 11.37%.

Chief Medical Officer Mark Schoenberg bought 1,960 shares on Nov. 19 at a price of $28.17. The price of the stock has increased by 12.32% since then.

Chief Operating Officer Stephen Mullennix sold 608 shares on Nov. 14 at a price of $26. The price of the stock has increased by 21.69% since then.

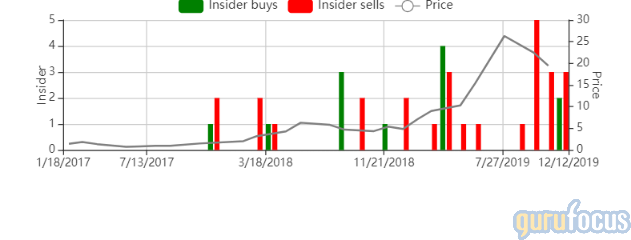

Enphase Energy

Enphase Energy Inc. (NASDAQ:ENPH) President and CEO Badrinarayanan Kothandaraman bought 10,000 shares on Nov. 21 at a price of $17.69. Since then, the share price has increased by 23.63%.

Enphase Energy delivers energy management technology for the solar industry. The company designs, develops, manufactures and sells home energy solutions that connect solar generation, energy storage and management on one intelligent platform. Its product and service portfolio consists of Enphase Microinverters, Enphase Envoy, Enphase Enlighten and Apps, Enphase Energy Services, and Enphase Storage System. The company is currently targeting the residential and commercial markets in the United States, Canada, Mexico, the United Kingdom, France, the Benelux region, Australia, New Zealand and certain other Asian markets.

The company has a market cap of $2.68 billion. Its shares traded at $21.87 with a price-earnings ratio of 58.79 as of Nov. 29. Net income for the third quarter of 2019 was $31.10 million compared to a loss of $3.47 million for the prior-year quarter.

Vice President and Chief Financial Officer Eric Branderiz bought 10,000 shares on Nov. 21 at a price of $17.7. The share price has increased by 23.56% since then.

Chief Operating Officer Jeff McNeil sold 500 shares on Nov. 18 at a price of $20 and 7,000 shares on Nov. 25 at a price of $20.02. The price of the stock has increased by 9.24% since then.

Chief Accounting Officer Mandy Yang sold 20,000 shares on Nov. 4 at a price of $18.77. Since then, the price of the stock has increased by 16.52%.

For the complete list of stocks bought by their company CEOs, go to CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.