Westlake (WLK) to Buy Hexion's Epoxy Business for $1.2 Billion

Westlake Chemical Corporation WLK recently formed a definitive agreement with Hexion Inc. to acquire the latter’s global epoxy business.

The deal will add a downstream portfolio of coatings and composite products to its chloro-vinyls businesses. This will enable the company to expand its integrated business. The transaction, worth around $1.2 billion, is scheduled to be completed in the first half of 2022, subject to customary closing conditions.

Westlake noted that the industries served by Hexion Epoxy are lucrative to Westlake and promise to be a synergistic addition to its existing businesses. The company is optimistic about the deal and the opportunity pool expected out of it.

Hexion Epoxy is a globally leading producer of epoxy resins, modifiers and curing agents for high-performance materials, coatings and composites. The Rotterdam-based epoxy business is a leading player in manufacturing and developing specialty resins, coatings, and composites for a wide range of industries, including high-growth and sustainability-oriented end-uses. It is noteworthy that Hexion’s epoxy business has garnered net sales of roughly $1.5 billion in the 12 months ended Sep 30, 2021.

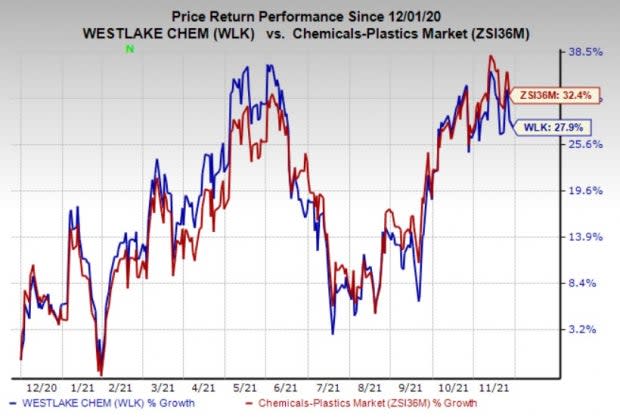

Westlake’s shares have grown 27.9% over the past year compared with the industry’s 32.4% rise. The company’s estimated earnings growth rate for the current year is pegged at around 562%.

Image Source: Zacks Investment Research

In the third quarter of 2021, Westlake reported earnings of $4.69 per share, topping the Zacks Consensus Estimate of $4.01. Revenues were $3,055 million, which jumped 61% year over year and topped the Zacks Consensus Estimate of $2,716.2 million.

In its third-quarter earnings call, the company noted that it expects the recently completed acquisitions of LASCO Fittings, Boral North America and Dimex, totaling around $2.6 billion, to initiate a stage of development and growth for its building products business. The LASCO buyout is expected to add to Westlake subsidiary NAPCO’s product portfolio focusing on new markets and products.

The Dimex acquisition adds a range of post-industrial recycled plastic consumer and building products. Westlake has also secured a leading position in the growing building products and construction markets through the Boral North America buyout. The company is optimistic that the investments will strengthen its footprint in the sustainable building product markets and open up long-term growth opportunities.

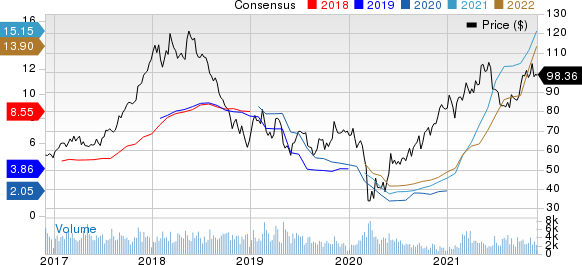

Westlake Chemical Corp. Price and Consensus

Westlake Chemical Corporation price-consensus-chart | Westlake Chemical Corporation Quote

Zacks Rank & Other Key Picks

Westlake currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks from the basic materials space include Univar Solutions Inc. UNVR and AdvanSix Inc. ASIX sporting a Zacks Rank #1, and Celanese Corp. CE carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Univar has an expected earnings growth rate of 55.2% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised 9% upward over the past 60 days.

Univar beat the Zacks Consensus Estimate for earnings in the four trailing quarters, with an earnings surprise of 24.1%, on average. UNVR’s shares have rallied 50.5% over a year.

AdvanSix has an expected earnings growth rate of 197% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised 14.1% upward over the last 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in the four trailing quarters, with an earnings surprise of 47%, on average. ASIX’s shares have also surged 157.4% over a year.

Celanese has an expected earnings growth rate of 139.7% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised 9.1% upward over the last 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in the four trailing quarters, pulling off an earnings surprise of 12.7%, on average. Shares of CE have rallied around 22.6% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Univar Solutions Inc. (UNVR) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research