Why Alarm.com Stock Fell Nearly 18% in May

What happened

Shares of home security tech company Alarm.com (NASDAQ: ALRM) dropped 17.7% in May, according to data from S&P Global Market Intelligence.

This performance isn't as bad as it might seem at initial glance, as the S&P 500, including dividends, fell 6.4% last month.

Alarm.com stock remains an outperformer over the past year, as it's gained 19.7% over the one-year period though June 7, versus the broader market's 5.8% return.

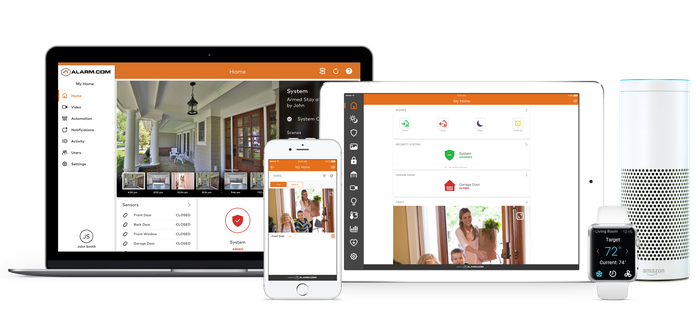

Image source: Alarm.com.

So what

We can attribute Alarm.com stock's poor performance last month to the company's May 9 release of its first-quarter results, which included a full-year 2019 outlook that alarmed some investors. Shares fell 8.2% the next day and plunged 15.4% in the two-trading day period following the release.

In Q1, the Virginia-based company's revenue grew 21% year over year to $112.3 million, while earnings per share adjusted for one-time items were flat with the year-ago period at $0.34. The bottom line did manage, however, to beat Wall Street's $0.31 consensus estimate.

Alarm.com management is taking a cautious stance on its outlook because of tariffs on Chinese goods. While the company increased its full-year 2019 revenue guidance, it left its earnings guidance unchanged. CEO Stephen Trundle addressed this topic on the earnings call:

Approximately one-third of the finished goods hardware products that we offer our service providers are imported from China. To date, the tariffs have had a modest impact on Alarm.com, but given the amount of activity in this area, we will remain diligent in watching the developments and will make appropriate adjustments if and when we have greater visibility into the outcome of the trade negotiations.

For context, hardware and other revenue accounted for about 29% of the company's total revenue in the first quarter, with software-as-a-service and license revenue bringing in the other 71%.

Now what

For the full year, Alarm.com now expects adjusted EPS between $1.37 and $1.41 on revenue of $447.3 million to $454.2 million. Previous revenue guidance was $440 million to $450 million.

In 2018, the company turned in adjusted EPS of $1.33 on revenue of $420.5 million. So, at the midpoints, its current guidance represents adjusted earnings growth of 4.5% and revenue growth of 7.2% year over year.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool recommends Alarm.com Holdings. The Motley Fool has a disclosure policy.