Why Insiders Keep Buying SoFi Technologies

SoFi Technologies Inc. (NASDAQ:SOFI), an all-in-one fintech that got its start in the student loan business, is one of the countless tech stocks on the market that went public via special purpose acquisition company (SPAC) during the 2021 market bubble, only to plunge down to just a fraction of its initial price in the months after. As of Dec. 14, the stock was down 79% from its initial listing price and 71% year-to-date.

In the current risk-off environment, the majority of investors are no longer interested in taking a gamble on the uncertain futures of tech companies that have yet to prove they can become profitable. SoFi may promise to revolutionize financial solutions, but its still burning cash with a net margin of -27.91%, rendering the stocks value completely speculative for ordinary shareholders.

However, one bullish sign for SoFi is that company insiders appear to be taking advantage of the lower stock prices to scoop up shares on the open market. CEO Anthony Noto in particular has been an avid buyer. Lets take a closer look at SoFi to see what might be making insiders so bullish on the stock.

When have insiders been buying?

First, lets look at when the bulk of the insider buying has occurred. According to the chart below, the bulk of insider buying occurred in May and June of 2022, with smaller spikes in August 2021 and May 2022.

In total, there have been 29 insider buying instances since this data started to be tracked in March 2021. Out of these, 22 were from Noto and three were from director Harvey M. Schwartz. The rest were from insiders who have only bought shares on the open market once.

From the chart, we can see that the majority of the insider buys came during or after March 2022, when SoFi shares traded for an average price of under $10. Therefore, lower share prices could be one of the key reasons for these insider buys.

Its also worth noting that the majority of them were buys from the same person, the CEO, and that they usually occurred after a quarter ended and before said quarters results were released. Noto most recently purchased 1.13 million shares on Dec. 13.

Recent results

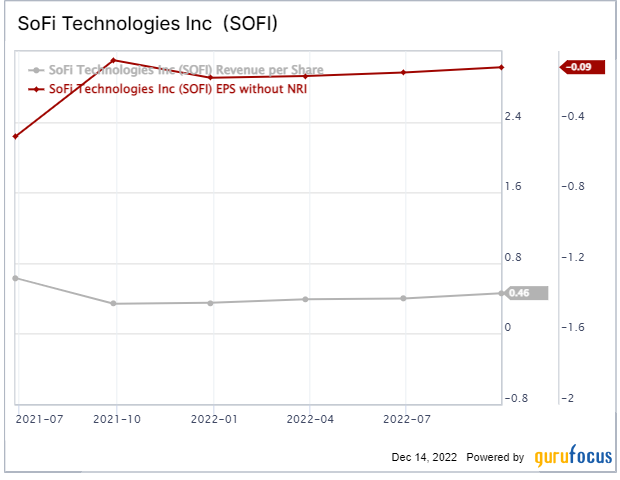

SoFis recent earnings results have been mostly positive. While earnings per share numbers have been mostly flat since the company went public and are still in negative territory, revenue has been on an uptrend.

Looking at the companys quarterly earnings reports, it has seen new member adds of over 400,000 in each of the first three quarters of 2022, with explosive growth coming from the banking segment. For the third quarter, which ended on Sept. 30, total members were up 61% year-over-year to 4.7 million.

The company has also raised its guidance for the full year. It now expects full-year 2022 adjusted net revenue of $1.517 billion to $1.522 billion and adjusted Ebitda of $115 million to $120 million. This marks the third quarter in a row of positive revisions to full-year 2022 guidance and indicates strong optimism from the management team.

Headwinds and tailwinds

SoFi got its start as a social lending platform in 2011, bringing together Stanford students, alumni and institutional investors in order to generate lower rates on student loans. From its origins in Stanford, it quickly expanded to 50 universities and kept growing from there.

The companys history has been rocky at times, but it kept growing, adding mortgage lending in 2014 and acquiring payments company Galileo and investment application 8 Securities in 2019. It acquired a bank charter in the first quarter of 2022 as the latest step in its effort to offer an all-around fintech solution.

Driving the companys growth story now is its appeal as a one-stop shop where customers can borrow, save, spend, invest and protect their money through the SoFi app or website.

Acquiring a bank charter has greatly increased SoFis flexibility and cross-selling opportunities, especially in the current macroeconomic environment that has become more favorable for traditional checking and savings accounts. In its third-quarter earnings report, SoFi claimed that the median FICO score of customers opening new direct deposit accounts was 750, and that approximately half of all newly-funded SoFi Money accounts were setting up direct deposit by day 30, up from just 37% in the second quarter.

Aside from general macroeconomic uncertainty and the potential for a recession, the main headwind that SoFi faces is the pause on student loan payments. In the third quarter, student loan origination volume was $457 million, down more than 50% from the average pre-pandemic volume. While this is an ongoing issue, personal loan origination rose to $2.8 billion, up from $1.6 billion in the year-ago quarter. In total, all lending product origination was up 2% year-over-year, with personal loan gains making up for declines in student loan and mortgage volume.

Takeaway

The growth opportunities that SoFi has unlocked by gaining a bank charter are huge. This was the main puzzle piece that the company needed to offer a true all-in-one fintech solution for customers personal finances, and the rapid user growth SoFi has experienced as a result is plain to see. While the student loan pause and the housing market slowdown are dampening growth for now, the companys lending activity is still strong thanks to personal loans.

All-in-all, its easy to see why the CEO and other insiders are so bullish on SoFi Technologies. The company has made an enormous step forward that is already accelerating its growth, and yet shares are still dropping thanks to a combination of economic troubles, a risk-off stock market environment and worries about the student loan pause.

SoFis stock might not necessarily recover soon with the cards so stacked against it, but the upcoming quarters should provide investors with more evidence on whether or not the company can become a true fintech disruptor.

This article first appeared on GuruFocus.