Why I’m Now Bullish on Apple Stock

It has been a rotten stretch for Apple (NASDAQ:AAPL) bulls the past few weeks, but gravity may finally be losing its grip on shares. Still, investors looking to nibble should be prepared — picking up AAPL stock may be a little messy before slightly more fertile ground for a bullish cycle is found. Let me explain.

Blame it on what you will. And if you’re an Apple stock die-hard, there’s a lot to point fingers at. From broad-based market weakness to recent weak sales guidance for Q4 and more immediate bearish hints from the supply chain this week, the world’s largest company may be human after all. It has been a tough, but far from lonely, stretch for AAPL.

If misery loves company, AAPL stock’s 17% correction is even a bit more rotten than the Nasdaq 100’s 14% decline over the past several weeks. But something other than hope may be entering the technical picture, so that an Apple comes up smelling like roses for bullish investors.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

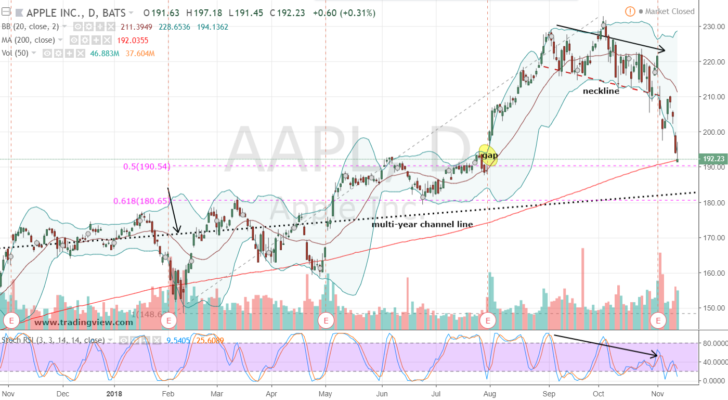

Apple Stock Daily Chart

It wasn’t long ago — in fact, just about two weeks on the calendar — that I was bearish on AAPL stock in front of earnings. The concern wasn’t the fundamentals or consumer trends, though I’ll admit I’ve yet to see one person whip out the iPhone X and that’s a bit alarming.

More to the point, the worry was technical in nature based on Apple’s price chart. Apple had formed a head and shoulders topping pattern after jumping aggressively above multiyear channel line resistance. Fast forward and gravity did take hold of Apple and shares have broken decisively lower. But now the stronger technical opportunity lays with bullish investors.

A previously discussed measured move out of the pattern is for all intents and purposes now being full-filled. The pattern completion also lines up fairly well with a key challenge of 200-day simple moving average support, a test of the 50% support level from 2018’s low to high, as well as a fill of a bullish earnings price gap from last quarter.

All told, Apple shares are looking a lot more attractive from a value perspective on the price chart than they were a short time ago. That’s not to say there’s no risk in buying AAPL stock. It would arrogant to suggest otherwise. Still, the opportunity for shares to bottom nearby look good.

If I was to put a price tag on where AAPL can bottom, I’d estimate a 7.5% wide zone from $178-$192 as a key area of longer-term support. Aside from the fore-mentioned supports this area holds the 62% retracement level, as well as Apple’s multi-year channel line.

For Apple stock investors agreeable with what’s been discussed and wish to buy shares, I’d wait for a two candle reversal bottoming pattern to emerge as stochastics aren’t entirely supportive just yet.

On the other hand, if shares do press lower and conditions become more oversold, then buying AAPL shares into weakness and deeper in the support zone with a stop-loss below $178, looks interesting.

Alternatively and for like-minded options traders, an Apple stock modified fence strategy buying the March $205/$215 bull call spread and selling the March $180/$175 put spread for a debit of $1.50 is a favored strategy to control risk while offering the potential for outsized profits in a slightly more optimistic market.

Investment accounts under Christopher Tyler’s management do not currently own positions in any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional options-based strategies, related musings or to ask a question, you can find and follow Chris on Twitter @Options_CAT and StockTwits.

More From InvestorPlace

The post Why I’m Now Bullish on Apple Stock appeared first on InvestorPlace.