Why This Satellite Radio Company Still Has Room for Growth

Keeping up in the radio satellite industry can be very tough, especially since technological advances took over consumer habits. Pioneer System, for example, recently launched a new car radio that supports Internet radio, and additionally recognizes Pandora Media Inc. (P)'s settings from Apple Inc. (AAPL)'s iPhones or iPods, thereby customizing users' music station automatically. Furthermore, iTunes' online radio service has also become a major industry player, especially among young drivers. This increasingly fragmented scenario has caused some damage among established firms, such as SIRIUS XM Holdings Inc. (SIRI), which lost over 22,000 net subscribers in fourth quarter fiscal 2013. However, many investment gurus, like Leon Cooperman (Trades, Portfolio) and Andreas Halvorsen (Trades, Portfolio) remain confident in the company's future profitability, leading them recently to buy substantial amounts of stock.

The Time for Change Has Arrived

As a satellite radio service, SIRIUS XM operates mainly in the U.S. and Canada, and is distributed primarily through automakers, retailers and its websites. While Subscriber Revenues (subscription and activation fees) generate 86% of the company's total income - the rest derived from Advertising, Equipment Sales, and Other Sales (ancillary services) - management has been targeting the issue of a fleeing customer base via several initiatives. On the one hand, last week's new program launches of "the Perri Peltz Show," and the in-depth coverage of the Masters Tournament from April 10 to April 13 are expected to help capture a larger audience share. But the firm's more interesting changes will affect its long-term profits.

In a move to diversify its business model, SIRIUS completed its acquisition of Agero Inc. for $530 million in cash. The connected vehicle unit will allow the firm to provide several telematics services via satellite and wireless, ranging from driver alerts and nearby gas stations, to navigation help and voice texting services. However, this is only one of many telematics partnerships, as the company is currently engaged in contracts with Honda Motor Co Ltd (ADR) (HMC) and Toyota Motor Corp (ADR) (TM), among others. In fact, the firm just recently extended its contract with Nissan until 2018, and entered into a partnership with AT&T Inc. (T), by which SIRIUS XM will offer emergency support and roadside assistance to all connected Nissan cars. The telematics market, which offers a $4.2 billion opportunity for the firm and will double its current broadcasting reach (24% of all cars) in a few years, will also contribute significantly to offset competitive headwinds in the future.

A Sirius Investment Choice?

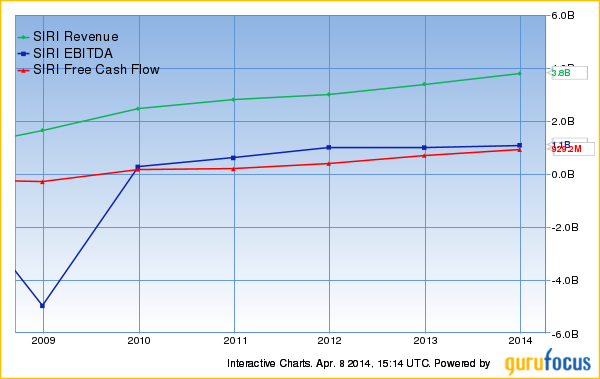

As new cars sold with satellite radio continue to increase, reaching 11 million for 2014 and expected to double by 2018, SIRIUS XM will reap major profits, as evidenced by its record penetration rate of 71% in new cars for 2013. With quarterly subscriber and advertising revenues up by 10.1% and 13.4%, respectively, management is expecting total revenue to break the $4 billion mark in 2014, in line with the 10.9% annual growth rate. Furthermore, the firm's solid 19.3% annual EBITDA growth will continue at this pace going forward, bringing 2013's $1.18 billion up to $1.38 for fiscal 2014. On another note, SIRIUS XM has announced it will resume its share repurchase plan, with $2.2 billion shares to be repurchased for this year, thereby boosting shareholders profits.

Given the company's extensive satellite network with 170 channels, it should be difficult for new market entrants to replicate this scale, putting the radio broadcaster at an advantage. Furthermore, the company benefits from a wide operating margin of 27.49% and solid free cash flow increments, which is expected to reach $1.1 billion for this fiscal year. However, investors should consider that the stock's trading price of 51.10x trailing earnings is sporting a strong price premium relative to the industry average of 18.9x, and may therefore be an expensive investment. Nonetheless, I feel bullish about SIRIUS XM's long-term future and believe the company still has room to grow.

Disclosure: Patricio Kehoe holds no position in any stocks mentioned.

This article first appeared on GuruFocus.