Why UDG Healthcare plc (LON:UDG) Has Low Debt On Its Balance Sheet?

Mid-caps stocks, like UDG Healthcare plc (LSE:UDG) with a market capitalization of £2.14B, aren’t the focus of most investors who prefer to direct their investments towards either large-cap or small-cap stocks. However, generally ignored mid-caps have historically delivered better risk-adjusted returns than the two other categories of stocks. I recommend you look at the following hurdles to assess UDG’s financial health. Check out our latest analysis for UDG Healthcare

Can UDG service its debt comfortably?

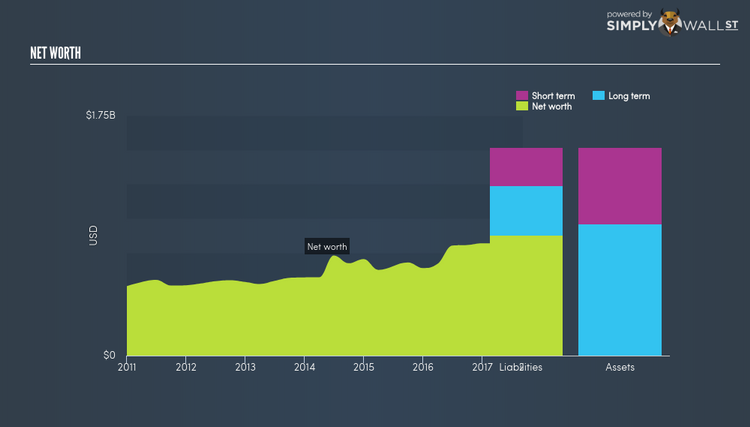

Debt-to-equity ratio tells us how much of the asset debtors could claim if the company went out of business. For UDG, the debt-to-equity ratio is 27.76%, which indicates that its debt is at an acceptable level. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings (EBIT) at least three times its interest payments is considered financially sound. UDG’s interest on debt is sufficiently covered by earnings as it sits at around 10.54x. Debtors may be willing to loan the company more money, giving UDG ample headroom to grow its debt facilities.

Can UDG meet its short-term obligations with the cash in hand?

A different measure of financial health is measured by its short-term obligations, which is known as liquidity. These include payments to suppliers, employees and other stakeholders. If an adverse event occurs, the company may be forced to pay these immediate expenses with its liquid assets. To assess this, I compare UDG’s cash and other liquid assets against its upcoming debt. Our analysis shows that UDG does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

Next Steps:

Are you a shareholder? UDG’s high cash coverage and appropriate debt levels indicate its ability to utilise its borrowings efficiently in order to generate ample cash flow. Given that UDG’s financial position may change, I suggest exploring market expectations for UDG’s future growth on our free analysis platform.

Are you a potential investor? Although investors should analyse the serviceability of debt, it shouldn’t be viewed in isolation of other factors. Ultimately, debt financing is an important source of funding for companies seeking to grow through new projects and investments. UDG’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.