Why Utilities Have a Love-Hate Relationship With Hurricanes

Electric and natural gas utilities like Consolidated Edison, Inc. (NYSE: ED) and Duke Energy Corp (NYSE: DUK) have seen their systems hit hard by hurricanes in the last decade. It seems like a lose-lose situation: customers suffer from the blackouts hurricanes cause, and the utilities are left with a mess to clean up. But there's another side to these storms that actually benefits utilities. Here's what you need to understand to see the full picture.

Sandy's impact

It seems like a long time ago now, but in late 2012 hurricane Sandy pummelled the mid-Atlantic region. According to Con Ed, almost 1.4 million customers lost power. That was nearly four times as many outages as the previous worst storm in the company's history. It was, without question, a bad time for the utility that provides New York City and its surrounding areas with power, natural gas, and steam.

Image source: Getty Images

After the storm, the company made plans to spend $1 billion to protect its systems against the damage that hurricanes can cause. This is often called storm hardening. Con Ed's plan included things like fortifying overhead wires, burying power lines, protecting vital equipment from flooding, and improving networks and systems to ensure constant access to remote controlled gear. The obvious goal was to protect against future weather-related outages.

Step back for a second and think about the spending that was scheduled to take place. It was investment in infrastructure. More important, it was vital investment. If that spending didn't take place, the next big storm would cause just as much, if not more, damage. Infrastructure spending like this is one of the ways that utilities justify higher prices when they ask regulators to raise customer rates (and, thus, increase revenues and earnings for shareholders).

It would be hard for a regulator to say no to spending that would strengthen a utility's systems against power outages, particularly after a big storm has been in the headlines. Storm hardening was a key piece of Con Ed's rate plans between 2014 and 2016.

Hurricane Irma

In May of 2017, as hurricane season was set to begin, Duke Energy pre-emptively announced that it had spent $5 billion on storm hardening since 2004. That didn't stop Hurricane Irma from knocking power out throughout the southeast in September of the same year, leaving an estimated eight million customers without lights. Duke is a major power provider in this region.

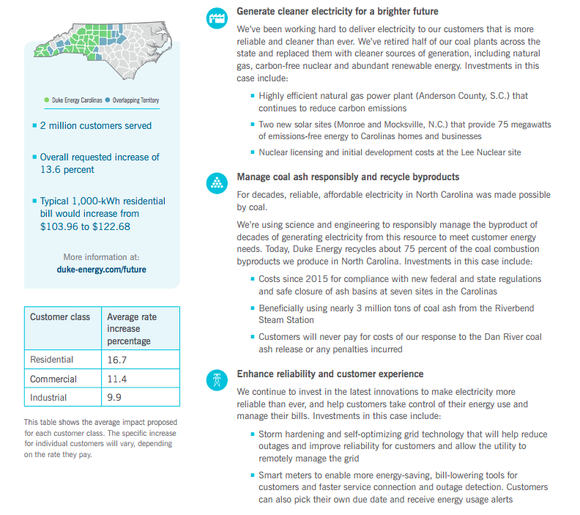

An overview of Duke's Carolinas rate case. Image source: Duke Energy Corp

Perhaps fortuitously, Duke initiated a rate case in the Carolinas in August of 2017. A key component of that case, in which the utility was looking for an overall rate increase of as much as 13.6%, was storm hardening. The results of the rate case won't be known until late 2018, and Duke probably won't get all of what it asked for. However, it's hard to believe that Duke won't be well rewarded for such spending after the devastation that Irma caused.

Slow and steady, despite some storms

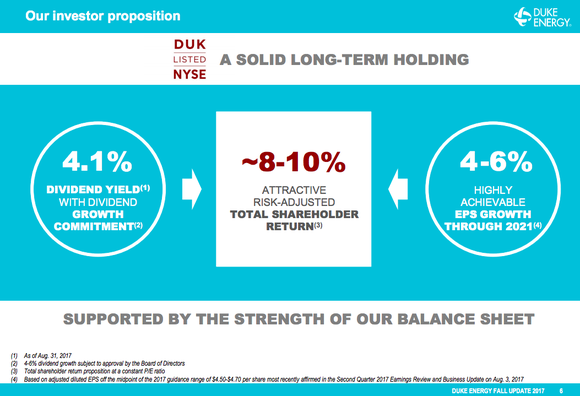

While regulated utilities like Duke and Con Ed are hampered in some ways by having to get rate hikes approved, big storms like Sandy and Irma can actually make the processes easier. For example, Duke is set to spend $36 billion on its electric and natural gas businesses between 2017 and 2021. It expects earnings to grow between 4% and 6% a year over that span. Add in a 4% dividend yield and Duke looks like a great investment option for conservative income investors.

Duke Energy earnings projections over the next few years are built on capital spending. Image source: Duke Energy Corp

But Duke will only be able to achieve those results if it is awarded solid rate hikes when it asks regulators to approve increases, like the request it has made in the Carolinas. Irma may have caused a great deal of near-term pain for Duke, which had to clean up the mess left behind. But it also makes it that much easier to convince regulators that proposed spending is, indeed, vital and worth rewarding. It's a love-hate relationship to be sure, but it should be pretty clear at this point that hurricanes aren't all bad for utilities.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.