Woodward Inc (WWD): Hedge Funds Are Snapping Up

Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won't accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

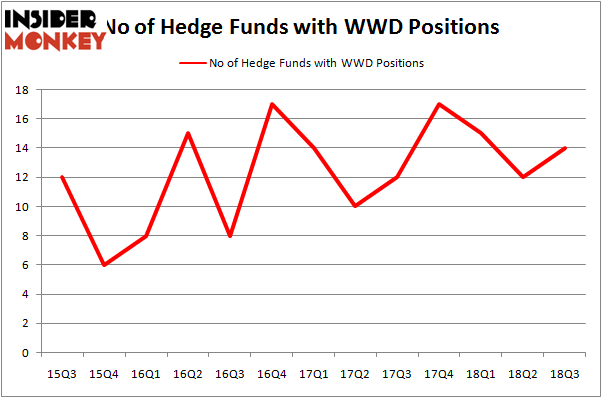

Woodward Inc (NASDAQ:WWD) has experienced an increase in hedge fund sentiment in recent months. Our calculations also showed that WWD isn't among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are seen as underperforming, old investment tools of years past. While there are more than 8,000 funds trading today, Our researchers look at the masters of this club, around 700 funds. These hedge fund managers orchestrate bulk of the hedge fund industry's total asset base, and by tailing their top equity investments, Insider Monkey has deciphered a few investment strategies that have historically outpaced the broader indices. Insider Monkey's flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let's check out the recent hedge fund action regarding Woodward Inc (NASDAQ:WWD).

How have hedgies been trading Woodward Inc (NASDAQ:WWD)?

At Q3's end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the second quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in WWD heading into this year. With hedgies' sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Royce & Associates was the largest shareholder of Woodward Inc (NASDAQ:WWD), with a stake worth $77.5 million reported as of the end of September. Trailing Royce & Associates was AQR Capital Management, which amassed a stake valued at $57.5 million. Citadel Investment Group, Hudson Bay Capital Management, and GAMCO Investors were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names have jumped into Woodward Inc (NASDAQ:WWD) headfirst. Millennium Management, managed by Israel Englander, initiated the biggest position in Woodward Inc (NASDAQ:WWD). Millennium Management had $4.5 million invested in the company at the end of the quarter. Steve Cohen's Point72 Asset Management also initiated a $1 million position during the quarter. The only other fund with a new position in the stock is Michael Platt and William Reeves's BlueCrest Capital Mgmt..

Let's check out hedge fund activity in other stocks similar to Woodward Inc (NASDAQ:WWD). We will take a look at MSC Industrial Direct Co Inc (NYSE:MSM), Nuance Communications Inc. (NASDAQ:NUAN), Quanta Services Inc (NYSE:PWR), and SINA Corp (NASDAQ:SINA). This group of stocks' market caps are similar to WWD's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position MSM,19,115118,-3 NUAN,20,398090,0 PWR,34,508552,0 SINA,24,769904,-4 Average,24.25,447916,-1.75 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $448 million. That figure was $193 million in WWD's case. Quanta Services Inc (NYSE:PWR) is the most popular stock in this table. On the other hand MSC Industrial Direct Co Inc (NYSE:MSM) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Woodward Inc (NASDAQ:WWD) is even less popular than MSM. Considering that hedge funds aren't fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn't behind this stock. This isn't necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index