Yacktman Asset Management Trims Procter & Gamble, Oracle

Yacktman Asset Management (Trades, Portfolio) sold shares of the following stocks during the first quarter of 2020.

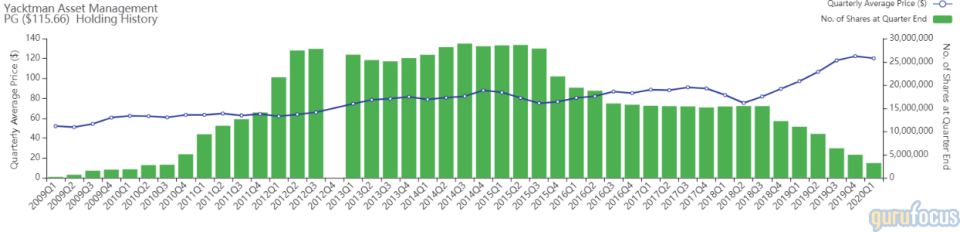

Procter & Gamble

The firm cut the Procter & Gamble Co. (PG) position by 57.71%. The portfolio was impacted by -2.27%.

The consumer product manufacturer has a market cap of $286 billion and an enterprise value of $308 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 9.85% and return on assets of 4.29% are outperforming 64% of companies in the consumer packaged goods industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.43 is above the industry median of 0.4.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.14% of outstanding shares, followed by Yacktman Asset Management (Trades, Portfolio) with 0.13% and Ken Fisher (Trades, Portfolio) with 0.06%.

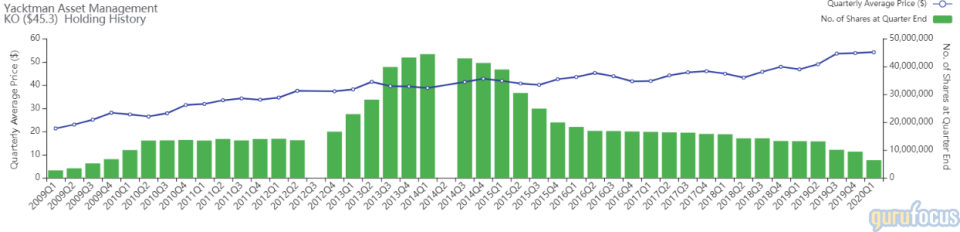

Coca-Cola

The guru's firm curbed its Coca-Cola Co. (KO) holding by 32.68%. The portfolio was impacted by -2.15%.

The producer of non-alcoholic beverages has a market cap of $194.52 billion and an enterprise value of $228.92 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 54.58% and return on assets of 11.23% are outperforming 81% of companies in the beverages, non-alcoholic industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.35 is below the industry median of 0.59.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 9.32% of outstanding shares, followed by Yacktman Asset Management (Trades, Portfolio) with 0.15% and Jeremy Grantham (Trades, Portfolio) with 0.08%.

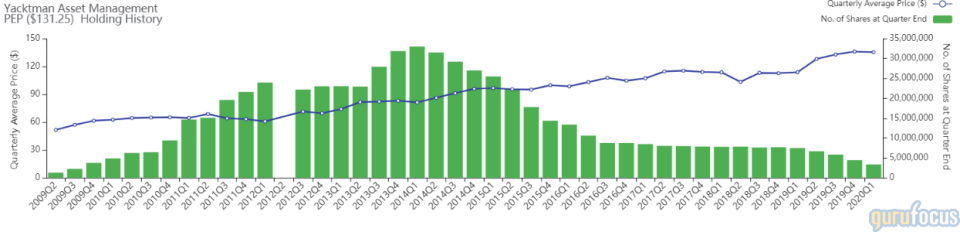

PepsiCo

The firm cut its position of PepsiCo Inc. (PEP) by 23.92%, impacting the portfolio -1.84%.

The producer of beverages has a market cap of $182.22 billion and an enterprise value of $212 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 51.32% and return on assets of 9.24% are outperforming 74% of companies in the beverages, non-alcoholic industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.27 is below the industry median of 0.59.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.49% of outstanding shares, followed by the Yacktman Asset Management (Trades, Portfolio) with 0.24% and the Yacktman Fund (Trades, Portfolio) with 0.12%.

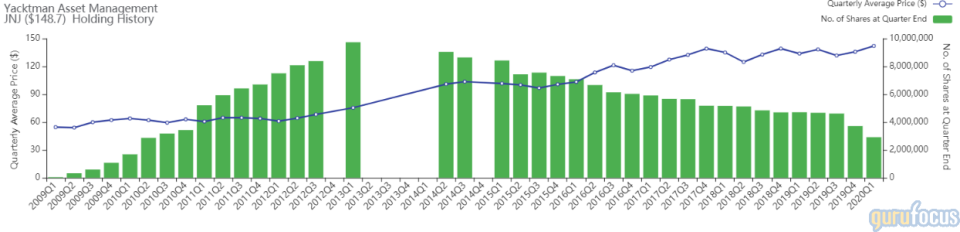

Johnson & Johnson

The investment firm cut its position in Johnson & Johnson (JNJ) by 21.47%. The trade had an impact of -1.47% on the portfolio.

The healthcare company has a market cap of $392 billion and an enterprise value of $402 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 28.88% and return on assets of 11.13% are outperforming 86% of companies in the drug manufacturers industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.7 is below the industry median of 0.94.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 0.18% of outstanding shares, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) and the Yacktman Asset Management (Trades, Portfolio), both with 0.11%.

Oracle

The firm cut its Oracle Corp. (ORCL) position by 27.78%. The trade had an impact of -1.40% on the portfolio.

The provider of applications, IT solutions, databases and hardware has a market cap of $164 billion and an enterprise value of $190 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 57% and return on assets of 10.35% are outperforming 83% of companies in the software industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.5 is underperforming 75% of competitors.

First Eagle Investment (Trades, Portfolio) is the largest guru shareholder of the company with 0.98% of outstanding shares. Other notable shareholders are HOTCHKIS & WILEY with 0.47% and Fisher with 0.42%.

Anthem

The firm reduced its holding in Anthem Inc. (ANTM) by 38.13%. The trade had an impact of -0.93% on the portfolio.

The private health insurance organization has a market cap of $69.38 billion and an enterprise value of $85 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 15.36% and return on assets of 6.16% outperform 52% of other companies in the healthcare plans industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.25 is below the industry median of 0.62.

The largest guru shareholder of the company is the Vanguard Health Care Fund (Trades, Portfolio) with 1.86% of outstanding shares, followed by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors with 1.22% and First Eagle Investment (Trades, Portfolio) with 0.79%.

Disclosure: I do not own any stocks mentioned.

Read more here:

The Smead Value Fund Sells Aflac, Exits Cummins

The Vanguard Health Care Fund Exits CVS Health, Teva Pharmaceutical

Markel Gayner Exits UnitedHealth, Unilever

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.