Silver & Gold Are in Trouble — Here’s My Plan: Macke

A quick update is worthwhile in light of today's drops in silver and gold.

The Federal Reserve's apparent lack of enthusiasm for further aggressive stimulus has given a bid to the U.S. dollar. You can, and likely will, argue that the Fed will continue to inject money into the system. I don't disagree, but the pace at which it will do so is likely to slow. Markets aren't about absolutes -- they are about trends and inflection points. Helicopter Ben signaled a growing concern about inflation when he removed the notion of "subdued inflation" from the Fed statement, and he didn't sign off on QE3 as he doesn't seem to believe it would help.

Inflation concerns. Stimulus cuts. These are signals that the ardor with which the Federal Reserve dumps money in the system is fading. This fact is bullish for the dollar. As I've mentioned on roughly 10,000 occasions: U.S. Dollar Strength = Weak U.S. Stocks and Commodities.

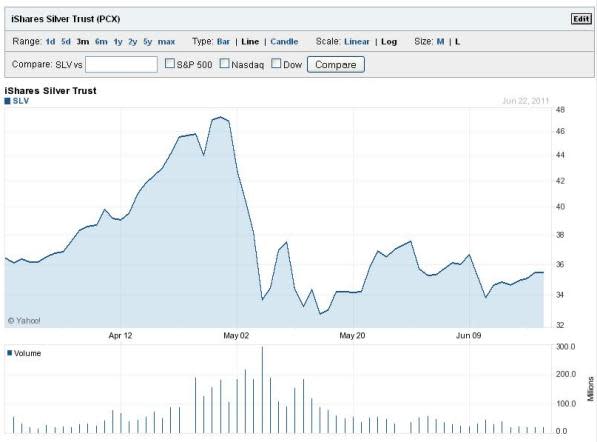

Bottom line: I'm staying long gold, which benefits from a general flight from global currencies. But remember the "tight leash" I had on my brand-new position in silver via the SLV? I'm tightening it even further. While $33.50 was my stop before, $34.50 is my stop now. The change alters my "stop-loss" to something like a "stop-even," as $34.50 is within 2-bits of my cost basis.

CLICK HERE TO ENLARGE THE CHART.

Why the update? Because some of the fundamentals have changed. To quote the almost completely discredited stimulus advocate John Maynard Keynes: "When the facts change, I change my mind. What do you do, sir?"

Buy and hold silver all you want. Complain about my hyper-trading. I'm not panicked or afraid in the least. I would simply rather have my money than the false pride of saying I'm buying dips because I believe I'm smarter than the market. Gold and silver dropping today is both right and concerning for bulls. I hope silver doesn't hit my stop, but if it does I'm selling. I wanted you all to know in advance, because that struck me as the "stand-up" thing to do.

I hope your portfolios are hanging in there today.

-- Macke