Crude Oil at Risk on US Spending Cuts, Copper Breaks Down

Crude oil is at risk despite buoyant risk appetite as US “sequester” spending cuts loom just over a week ahead. Copper has completed a bearish technical breakout.

Talking Points

Commodities Little-Changed Despite Risk-On Mood Before Wall Street Open

Looming US “Sequester” Spending Cuts May Undermine Sentiment Trends

Copper Prices Complete Multi-Month Bearish Technical Pattern, Aim Lower

Commodity prices are trading little-changed ahead of the opening bell on Wall Street despite a swell of risk appetite in Europe and increasingly supportive pre-open cues from S&P 500 futures, where prices have now pushed into meaningfully positive territory. The chipper mood seems to be following a dramatically stronger-than-expected German ZEW investor confidence reading.

Looking ahead, a quiet US economic calendar offers little that can meaningfully derail momentum. Still, with just over a week to go until the dreaded “sequester” government spending cuts in the US are triggered, the onset of risk aversion may be relatively swift. Indeed, it seems only a matter of time before speculation about the impact of fiscal retrenchment in the world’s top economy and global output at large begin to resurface.

If a broad-based reversal in risk does materialize, cycle-sensitive crude oil and copper prices are set to follow shares lower. The implications for precious metals are less clear-cut. It does seem plausible to think that a major turn in risk appetite will weigh on carry trades and force a correction in the runway USDJPY advance. This in turn could carry spill-over implications for the US Dollar at large considering the magnitude of the USDJPY rally and the implied degree of pending profit-taking. Such a scenario may offer a de-facto lift to precious metals.

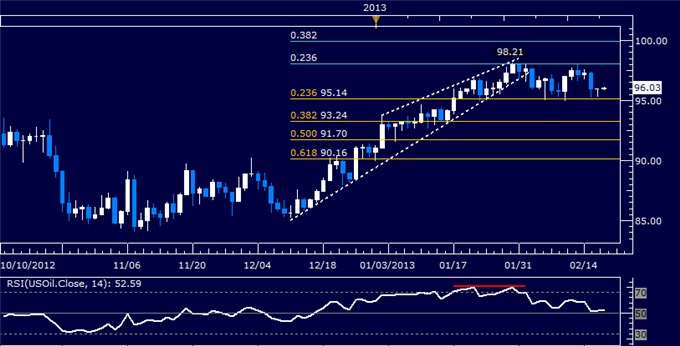

WTI Crude Oil (NY Close): $95.86 // -1.45 // -1.49%

Prices are consolidating above support at 95.14, the 23.6% Fibonacci retracement. Resistance remains in the 98.02-21 area (marked by the 23.6% Fib expansion and the January 30 high). A break higher exposes the 38.2% expansion at 99.91. Alternatively, a reversal below 95.14 initially targets the 38.2% retracement at 93.24.

Daily Chart - Created Using FXCM Marketscope 2.0

Spot Gold (NY Close): $1610.05 // -0.05 // -0.00%

Prices broke below support at 1617.84, the 61.8% Fibonacci expansion, exposing the 76.4% level at 1599.10. A further push below that targets a falling channel bottom at 1588.66. The 1617.84 level has been recast as near-term resistance, with a reversal back above that eyeing the 50% Fib at 1632.97.

Daily Chart - Created Using FXCM Marketscope 2.0

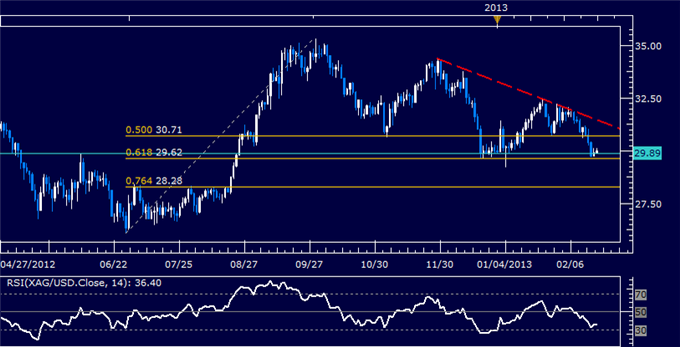

Spot Silver (NY Close): $29.94 // +0.14 // +0.47%

Prices are testing support in the 29.62-89 area, marked by the 61.8% Fibonacci retracement and the June 6 high. A bounce here sees initial resistance at 30.71, the 50% Fib, with a break above that targeting a falling trend line at 31.47. Alternatively, a move below support aims for the 76.4% level at 28.28.

Daily Chart - Created Using FXCM Marketscope 2.0

COMEX E-Mini Copper (NY Close): $3.738 // -0.004 // -0.11%

Prices completed a bearish Rising Wedge chart pattern with a break through the formation’s support. Sellers now target the 38.2% Fibonacci retracement at 3.642. A break below that aims for the 50% level at 3.596. Near term support-turned-resistance is in the 3.712-18 area.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.