Deutsche Bank Weighs In On REITs With 4 Top Picks Prior To Earnings

Given the recent strong performance of the REIT sector, how can investors best to position themselves prior to Q4 2014 earnings reports?

In a note dated January 26, Deutsche Bank analyst Vin Chao sheds some light on this question.

Deutsche Bank - Big Picture

The macroeconomic environment for 2015 continues to appear favorable for U.S. commercial real estate, highlights include:

U.S. GDP continues to accelerate.

Stable and growing U.S. job market.

Limited new supply (most sectors).

Global economic uncertainty is a downward driver for rates on U.S. 10-Year Treasury Notes, which in turn helps cash flows from U.S. commercial real estate.

All of these factors combine to help create positive tailwinds moving forward for the REIT sector.

Deutsche Bank - Valuation Concerns

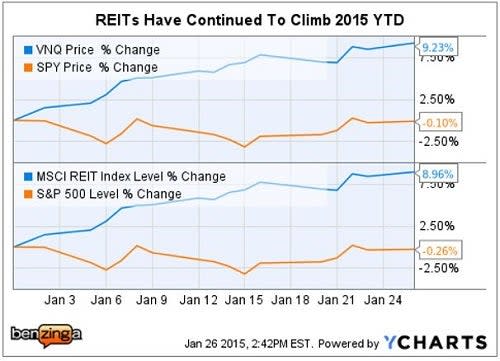

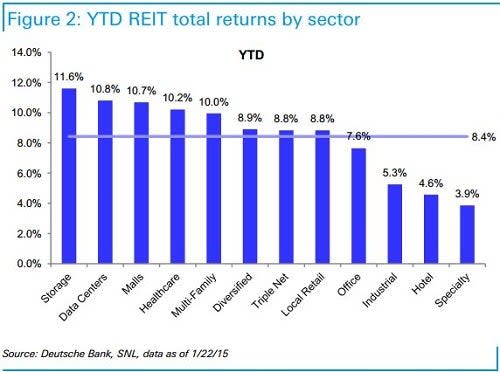

During 2014 REITs returned ~30 percent for investors, and YTD REIT shares have already jumped over 8 percent higher, while the broader market has been flat to lower.

Against this backdrop, Deutsche Bank is less bullish on the REIT sector overall.

Chao expects that there may be some profit taking as Q4 2014 earnings are reported, which may create buying selective buying opportunities for investors.

Related Link: How To 'Get Rich Slowly' In The REIT World

Deutsche Bank - 4 Top Picks

1. In the shopping center space, Brixmor Property Group Inc (NYSE: BRX) is the Deutsche Bank top pick, despite ~5 percent exposure to Houston, Texas. If lower oil prices and related job losses continue, this could become a headwind. However, energy prices should benefit power center anchors.

Deutsche Bank maintains a Buy rating and increased its PT from $28 to $29.

2. Regional mall landlord General Growth Properties Inc (NYSE: GGP) is also a retail top pick, sporting a $27.45 billion cap. The recent drop in energy prices and strong holiday season sales will help offset some reported store closures and potentially difficult Y/Y comparisons due to high mall occupancy and leasing spreads in the mid to high teens during 2014.

Deutsche Bank maintains a Buy rating and increased its PT from $31 to $33.

3. Data center REIT CyrusOne Inc (NASDAQ: CONE) is the Deutsche Bank top pick in this space, despite its ~30 percent exposure to the Houston market. Deutsche Bank noted that announced layoffs in the oil and gas services sectors are global, and that not all layoffs will be in Texas. Investors will need to pay close attention to the CONE conference call regarding this market segment.

Deutsche Bank maintains a Buy rating and increased its PT from $31 to $35.

4. Single-tenant triple-net lease landlord Spirit Realty Capital, Inc (New) (NYSE: SRC) is also a top Deutsche Bank pick. However, it is notable that this is the only REIT Deutsche Bank covers in this sector). The SRC dividend yield is the highest of the Deustche Bank top four, currently yielding 5.37 percent.

Deutsche Bank maintains a Buy rating and increased its PT from $12.50 to $13.

Related Link: Jefferies Weighs In On Best Data Center REITs For 2015

Deutsche Bank - 2 Retail Downgrades

1. Shopping center REIT Retail Properties of America Inc (NYSE: RPAI) was downgraded from Buy to Hold. Deutsche Bank noted that RPAI was "heavily exposed to our 'watchlist' of tenants..." which includes: Barnes & Noble, Best Buy, Office Depot, Staples and Rite Aid.

Deutsche Bank maintained its PT at $18.

2. Shopping center REIT Ramco-Gershenson Properties Trust (NYSE: RPT) was also downgraded by Deutsche Bank from Buy to Hold. Deutsche Bank noted that RPT was heavily geographically concentrated, with two-thirds of revenue from Michigan and Florida properties.

Deutsche Bank increased its PT from $19 to $20.

Deutsche Bank also noted that both of these REITs had executed on strategic initiatives and improved their balance sheets. The downgrades were primarily a function of valuation.

Latest Ratings for BRX

Jan 2015 | Deutsche Bank | Maintains | Buy | |

Jan 2015 | Barclays | Maintains | Overweight | |

Dec 2014 | Deutsche Bank | Maintains | Buy |

View More Analyst Ratings for BRX

View the Latest Analyst Ratings

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.